Federal Reserve's Rate Cut Outlook Impacts US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Federal Reserve's Rate Cut Outlook Sends US Treasury Yields on a Rollercoaster Ride

The Federal Reserve's increasingly dovish stance on interest rates has sent shockwaves through the US Treasury market, causing significant volatility in Treasury yields. Recent comments from Fed officials hinting at potential rate cuts have triggered a dramatic shift in investor sentiment, leaving many wondering what the future holds for this crucial segment of the US economy.

This article delves into the intricacies of the relationship between the Federal Reserve's monetary policy decisions and the performance of US Treasury yields, analyzing the current market dynamics and exploring potential future scenarios.

Understanding the Connection: Fed Policy and Treasury Yields

The Federal Reserve's actions significantly impact US Treasury yields. When the Fed lowers interest rates (a rate cut), it generally becomes less attractive to hold Treasury bonds, as their yields become less competitive compared to other investment options. This increased competition leads to a decrease in demand for Treasuries, subsequently pushing their yields down. Conversely, a rate hike increases the attractiveness of Treasury bonds, driving up demand and yields.

The Current Market Landscape: A Shift Towards Lower Yields

The recent shift in the Federal Reserve's outlook towards potential rate cuts has directly impacted investor expectations. Market participants are now pricing in a higher probability of rate reductions in the coming months, leading to a decline in Treasury yields across the maturity spectrum. This is particularly evident in the shorter-term Treasury yields, which are more sensitive to immediate changes in Fed policy.

Impact on Investors and the Broader Economy:

The fluctuation in Treasury yields has significant implications for various sectors:

- Bond Investors: Lower yields mean lower returns for bond investors. This forces many to reassess their portfolio strategies, potentially shifting towards higher-yielding assets or alternative investments.

- Corporate Borrowing Costs: Decreased Treasury yields often translate to lower borrowing costs for corporations, potentially stimulating economic activity through increased investment and expansion.

- Mortgage Rates: Changes in Treasury yields influence mortgage rates, impacting the housing market's affordability and overall activity. Lower yields generally lead to lower mortgage rates.

- The Dollar: Fluctuations in US Treasury yields can also affect the value of the US dollar relative to other currencies. Lower yields might weaken the dollar, impacting international trade and investment flows.

What Lies Ahead: Predicting Future Trends

Predicting the future direction of Treasury yields remains challenging. Several factors will play a crucial role, including:

- Inflation Data: The Fed's decisions heavily depend on inflation data. Persistent inflation could force the Fed to maintain or even raise interest rates, potentially pushing Treasury yields higher.

- Economic Growth: The pace of economic growth will influence the Fed's policy decisions. Slowing growth might encourage rate cuts, while robust growth could support higher rates.

- Geopolitical Events: Global uncertainties and geopolitical events can significantly impact investor sentiment and Treasury yields.

Conclusion: Navigating the Volatility

The Federal Reserve's rate cut outlook has created significant volatility in the US Treasury market. While lower yields might offer advantages for certain sectors, it also presents challenges for bond investors and necessitates careful portfolio management. Staying informed about economic indicators, Fed pronouncements, and geopolitical developments is crucial for investors navigating this dynamic environment. Consult with a financial advisor to develop a strategy tailored to your specific risk tolerance and investment goals.

Keywords: Federal Reserve, interest rates, rate cut, US Treasury yields, Treasury bonds, monetary policy, bond market, inflation, economic growth, investment strategy, financial advisor, mortgage rates, dollar, geopolitical risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Federal Reserve's Rate Cut Outlook Impacts US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New York Attorney General Under Fbi Investigation Directors Confirmation

May 21, 2025

New York Attorney General Under Fbi Investigation Directors Confirmation

May 21, 2025 -

Climate Change And Reproductive Health Understanding The Link Between A Warming Planet And Pregnancy Complications

May 21, 2025

Climate Change And Reproductive Health Understanding The Link Between A Warming Planet And Pregnancy Complications

May 21, 2025 -

Bitcoin Etf Investment Soars Past 5 Billion Market Trends And Analysis

May 21, 2025

Bitcoin Etf Investment Soars Past 5 Billion Market Trends And Analysis

May 21, 2025 -

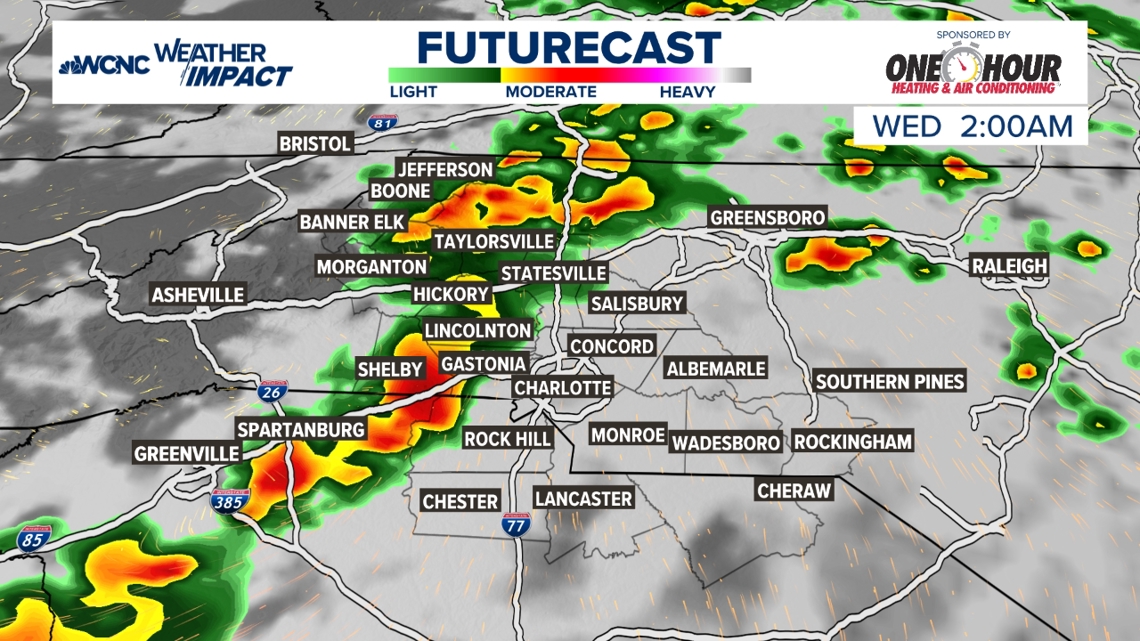

Rain Likely Throughout The Week With Falling Temperatures

May 21, 2025

Rain Likely Throughout The Week With Falling Temperatures

May 21, 2025 -

Limited Severe Weather Risk Tuesday Night Localized Storm Outlook

May 21, 2025

Limited Severe Weather Risk Tuesday Night Localized Storm Outlook

May 21, 2025