Clean Energy Taxes And The US Economy: Analyzing The Potential Outcomes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Taxes and the US Economy: Analyzing the Potential Outcomes

The debate surrounding clean energy taxes and their impact on the US economy is heating up. Proposed policies aimed at accelerating the transition to renewable energy sources often involve various tax incentives, credits, and potentially, even carbon taxes. Understanding the potential economic outcomes of these policies is crucial for policymakers, businesses, and citizens alike. This article delves into the complexities of this issue, examining both the potential benefits and drawbacks.

The Promise of a Green Economy: Job Creation and Innovation

Proponents of clean energy taxes argue that these policies are essential for driving economic growth and creating high-paying jobs. Investing in renewable energy technologies like solar, wind, and geothermal power stimulates innovation, leading to the development of new industries and manufacturing capabilities. The transition to a cleaner energy sector is predicted to generate millions of jobs across various sectors, from manufacturing and installation to research and development. Furthermore, a shift towards renewable energy sources reduces reliance on volatile fossil fuel markets, enhancing energy security and price stability in the long run. This stability can translate to significant savings for businesses and consumers.

Tax Incentives: A Catalyst for Investment

Tax credits and other financial incentives play a pivotal role in making clean energy investments more attractive. The Investment Tax Credit (ITC) for solar energy, for instance, has been instrumental in driving the growth of the solar industry. By reducing the upfront cost of renewable energy projects, these incentives encourage private sector investment, fostering competition and accelerating technological advancements. This ripple effect boosts economic activity throughout the supply chain, creating jobs and stimulating economic growth in related industries. [Link to a relevant government report on ITC effectiveness].

Potential Economic Challenges: Transition Costs and Industry Shifts

While the long-term economic benefits of clean energy are widely acknowledged, the transition itself presents challenges. The shift away from fossil fuels could lead to job losses in traditional energy sectors, requiring significant retraining and workforce adaptation programs. [Link to a report on job displacement in the fossil fuel industry]. Additionally, the initial investment costs associated with building renewable energy infrastructure can be substantial, potentially impacting government budgets and potentially leading to increased energy costs in the short term. However, the long-term cost savings associated with reduced reliance on fossil fuels and improved energy efficiency are expected to outweigh these initial expenses.

Carbon Taxes: A Controversial Approach

The implementation of a carbon tax, a levy on carbon emissions, is a highly debated policy tool. While proponents argue that it effectively incentivizes emissions reductions and generates revenue for investments in clean energy, critics express concerns about potential regressive effects on lower-income households and negative impacts on certain industries. The design of a carbon tax is crucial to mitigate these potential downsides. Mechanisms such as revenue recycling (returning tax revenue to citizens through rebates or tax cuts) can help offset the burden on low-income families. [Link to an article discussing different carbon tax models].

Conclusion: Navigating the Path to a Sustainable Future

The economic consequences of clean energy taxes are complex and multifaceted. While the transition to a cleaner energy economy presents significant challenges, the potential long-term benefits – including job creation, economic growth, and enhanced energy security – are substantial. Careful policy design, strategic investment in workforce development, and effective mechanisms to address potential negative impacts are crucial for navigating this transition successfully and building a sustainable and prosperous future for the US economy. Further research and ongoing analysis are essential to fully understand the evolving dynamics of this important issue. This requires collaboration between policymakers, economists, and the private sector to ensure a smooth and equitable transition to a cleaner energy future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Taxes And The US Economy: Analyzing The Potential Outcomes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Will Clean Energy Taxes Boost Or Break Americas Economy

May 20, 2025

Will Clean Energy Taxes Boost Or Break Americas Economy

May 20, 2025 -

War 2 Teaser Released Hrithik Roshan Jr Ntr And Kiara Advani Star

May 20, 2025

War 2 Teaser Released Hrithik Roshan Jr Ntr And Kiara Advani Star

May 20, 2025 -

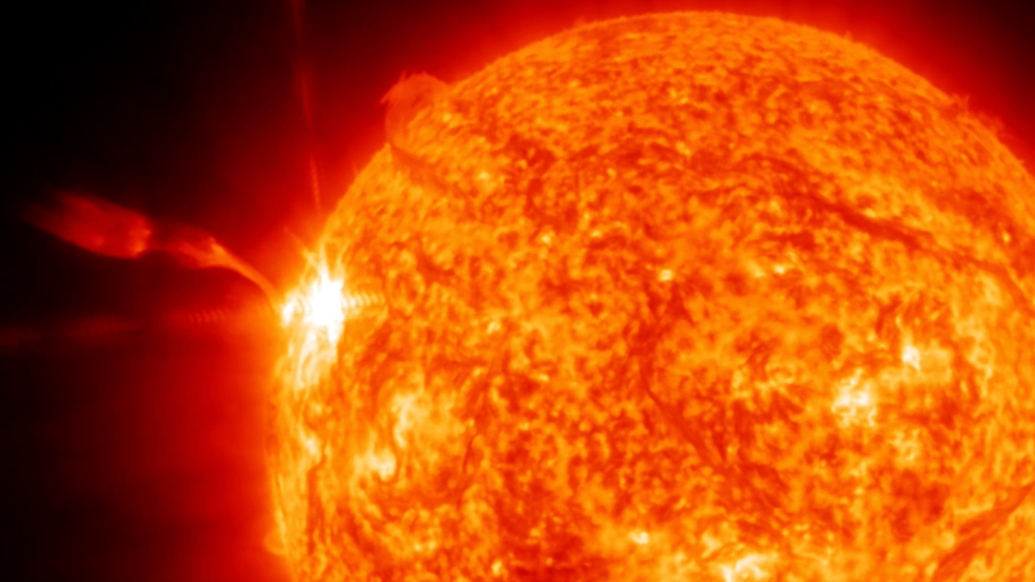

Intense Solar Flare Radio Outage Impacts Europe Asia And The Middle East Video

May 20, 2025

Intense Solar Flare Radio Outage Impacts Europe Asia And The Middle East Video

May 20, 2025 -

Jamie Lee Curtis On Lindsay Lohan A Candid Look At Their Unique Bond

May 20, 2025

Jamie Lee Curtis On Lindsay Lohan A Candid Look At Their Unique Bond

May 20, 2025 -

Spains Regulatory Clampdown Airbnbs 66 000 Listing Purge

May 20, 2025

Spains Regulatory Clampdown Airbnbs 66 000 Listing Purge

May 20, 2025