Slight Decline In U.S. Treasury Yields Following Fed's Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Decline in U.S. Treasury Yields Following Fed's Rate Cut Outlook

U.S. Treasury yields experienced a modest dip following the Federal Reserve's recent indication of a potential interest rate cut. This shift reflects investor sentiment regarding the central bank's evolving stance on inflation and economic growth. The subtle movement in yields underscores the delicate balance the Fed is navigating as it attempts to manage inflation without triggering a recession.

The Federal Reserve's comments hinted at a possible easing of monetary policy, a move interpreted by many market analysts as a response to slowing economic growth and easing inflationary pressures. This outlook, however, remains tentative, contingent upon incoming economic data and the ongoing assessment of the inflation landscape.

Understanding the Connection Between Fed Policy and Treasury Yields

Treasury yields, essentially the return an investor receives on U.S. government debt, are inversely correlated with bond prices. When investors anticipate lower interest rates, they often buy bonds, driving up their prices and subsequently lowering the yields. This inverse relationship is a cornerstone of understanding the bond market's reaction to central bank policy. The recent decline in yields suggests increased investor confidence in the Fed's ability to manage the economy, albeit cautiously.

The current situation presents a complex scenario for investors. While lower yields might seem attractive to some, they also indicate lower returns. The anticipated rate cuts, while aiming to stimulate the economy, also carry the risk of increased inflation in the long run. This uncertainty creates a challenging environment for both short-term and long-term investment strategies.

What Does This Mean for Investors?

The slight decline in Treasury yields shouldn't be interpreted as a definitive sign of future market trends. The economic landscape remains fluid, and the Fed's decisions are susceptible to changes based on new data and evolving circumstances.

Key takeaways for investors:

- Diversification remains crucial: A well-diversified portfolio can help mitigate risks associated with fluctuating Treasury yields.

- Monitor economic indicators: Stay informed about key economic data releases, such as inflation reports and GDP growth figures, to anticipate potential market shifts.

- Consult financial advisors: Seeking professional guidance is recommended, especially during periods of economic uncertainty.

Looking Ahead: Uncertainty Remains

The future direction of Treasury yields hinges on several factors, including:

- Inflation data: The persistence or abatement of inflation will significantly influence the Fed's future policy decisions.

- Economic growth: The pace of economic growth will play a crucial role in shaping the central bank's approach to monetary policy.

- Geopolitical events: Global events can significantly impact investor sentiment and consequently, Treasury yields.

The recent slight decline in yields provides a snapshot of current market sentiment, but it's essential to approach this development with caution. The ongoing interplay between inflation, economic growth, and central bank policy will continue to shape the trajectory of Treasury yields in the coming months. Investors are advised to remain vigilant and adapt their strategies accordingly. For further analysis on the current economic climate, consider exploring resources from the Federal Reserve [link to Federal Reserve website] and reputable financial news outlets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Decline In U.S. Treasury Yields Following Fed's Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

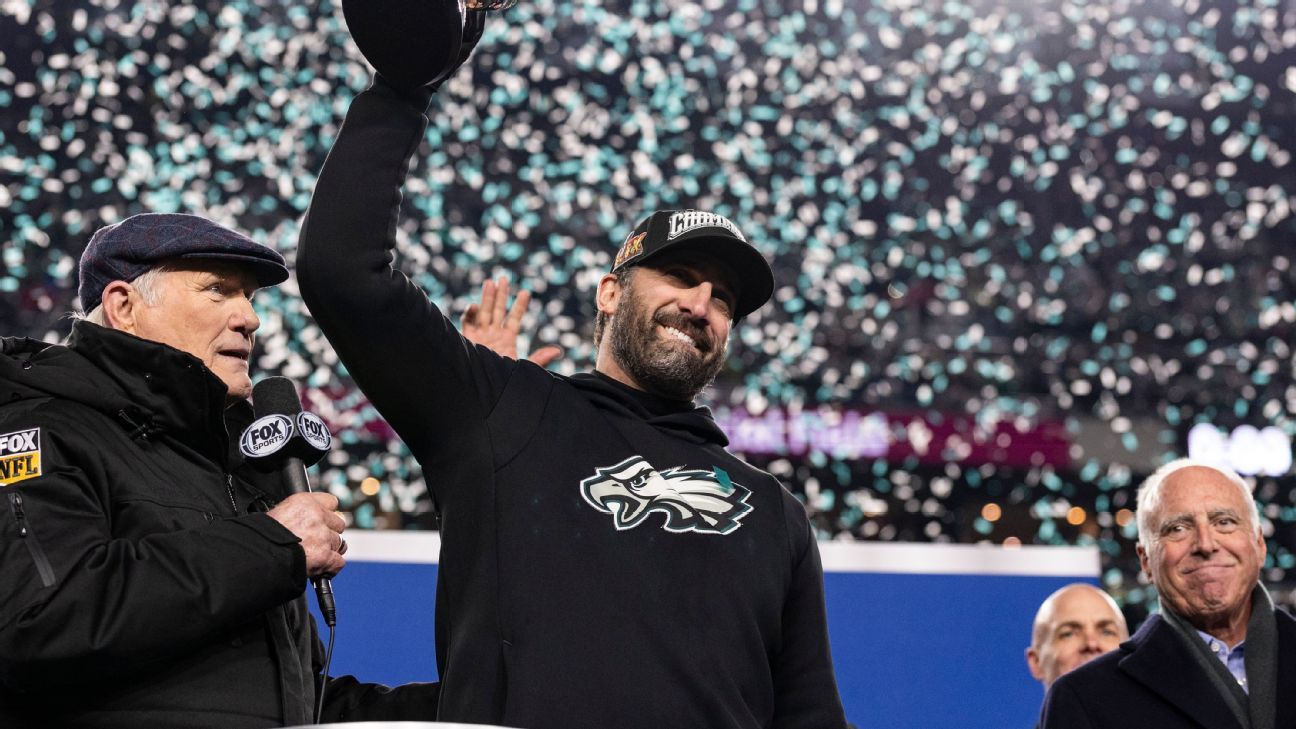

Nick Sirianni Gets Multi Year Contract Extension From Eagles

May 20, 2025

Nick Sirianni Gets Multi Year Contract Extension From Eagles

May 20, 2025 -

Big Changes Coming New Peaky Blinders Series Officially Announced

May 20, 2025

Big Changes Coming New Peaky Blinders Series Officially Announced

May 20, 2025 -

Daniel Craig Cillian Murphy And Tom Hardy Star In New Ww 1 Film Streaming Now

May 20, 2025

Daniel Craig Cillian Murphy And Tom Hardy Star In New Ww 1 Film Streaming Now

May 20, 2025 -

Climate Changes Devastating Effect On Pregnancy Outcomes A Global Health Concern

May 20, 2025

Climate Changes Devastating Effect On Pregnancy Outcomes A Global Health Concern

May 20, 2025 -

Eagles Lock Up Sirianni With Long Term Contract Deal

May 20, 2025

Eagles Lock Up Sirianni With Long Term Contract Deal

May 20, 2025