Clean Energy Tax Policy: Shaping Economic Growth And Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Policy: Shaping Economic Growth and Investment

The global shift towards renewable energy is accelerating, driven by climate concerns and technological advancements. Central to this transition is the role of government policy, particularly tax policies designed to incentivize clean energy investment and deployment. This article explores how clean energy tax policies are shaping economic growth and investment, examining both the benefits and potential drawbacks.

The Power of Incentives: Driving Clean Energy Adoption

Clean energy technologies, while rapidly improving, often carry higher upfront costs compared to traditional fossil fuel-based energy sources. This is where targeted tax policies play a crucial role. Several key mechanisms are employed:

-

Tax Credits: These offer direct reductions in tax liability for investments in renewable energy infrastructure, such as solar panels, wind turbines, and energy storage systems. The Investment Tax Credit (ITC) in the United States, for example, has significantly boosted solar energy adoption. Similar schemes operate globally, often varying by country and technology.

-

Tax Deductions: These allow businesses and individuals to deduct expenses related to clean energy investments from their taxable income, effectively lowering their overall tax burden. This can be particularly effective for research and development in emerging clean energy technologies.

-

Accelerated Depreciation: This allows businesses to write off the cost of clean energy assets more quickly, providing immediate financial benefits and encouraging faster deployment.

-

Feed-in Tariffs: While not strictly a tax policy, feed-in tariffs guarantee a fixed price for electricity generated from renewable sources, making investment more predictable and attractive.

Economic Growth and Job Creation: A Green Stimulus

The impact of these policies extends beyond environmental benefits. Investment in clean energy creates significant economic opportunities:

-

Job Creation: The renewable energy sector is a major job creator, encompassing manufacturing, installation, maintenance, and research. Government incentives amplify this effect, stimulating growth in related industries.

-

Technological Innovation: Tax policies that support research and development foster innovation, leading to cost reductions and improved efficiency in clean energy technologies. This ultimately makes clean energy more competitive.

-

Infrastructure Development: The deployment of renewable energy infrastructure requires significant investment in grid modernization, energy storage, and transmission lines. This creates jobs and improves national infrastructure.

-

Foreign Direct Investment: Countries with attractive clean energy tax policies can attract significant foreign direct investment, boosting economic growth and strengthening international partnerships.

Challenges and Considerations: Navigating the Policy Landscape

While the benefits are substantial, implementing effective clean energy tax policies requires careful consideration:

-

Policy Stability: Frequent changes to tax policies can create uncertainty, discouraging long-term investments. Consistent and predictable policies are crucial.

-

Equity and Accessibility: Tax incentives should be designed to ensure equitable access and avoid disproportionately benefiting wealthy individuals or corporations.

-

Environmental Impact Assessment: It's crucial to ensure that incentivized technologies genuinely contribute to emissions reductions and avoid unintended environmental consequences.

-

International Coordination: Global cooperation is vital to avoid carbon leakage, where industries relocate to countries with less stringent environmental regulations.

Conclusion: A Path Towards Sustainable Growth

Well-designed clean energy tax policies are essential for driving the transition to a sustainable energy future. By incentivizing investment, fostering innovation, and creating jobs, these policies can contribute significantly to economic growth and prosperity. However, careful consideration of equity, stability, and environmental impacts is crucial to maximize the benefits and minimize potential drawbacks. Continued research and policy refinement are necessary to ensure that tax policies effectively support the global shift towards a cleaner, more sustainable energy system. Learn more about the specifics of clean energy tax policies in your region by visiting your country's relevant government websites.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Policy: Shaping Economic Growth And Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Spanish Government Halts 65 000 Tourist Accommodation Bookings

May 20, 2025

Spanish Government Halts 65 000 Tourist Accommodation Bookings

May 20, 2025 -

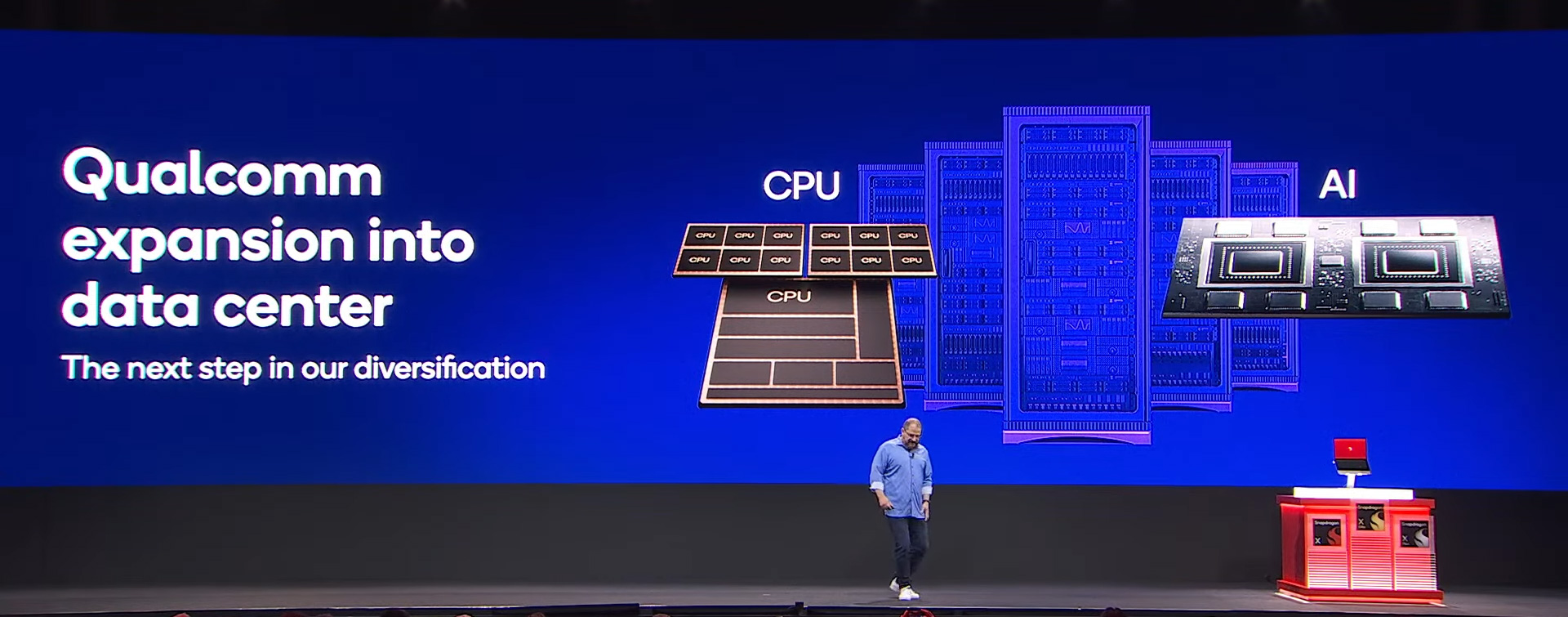

Ai And Data Center Processing Qualcomms Latest Innovations

May 20, 2025

Ai And Data Center Processing Qualcomms Latest Innovations

May 20, 2025 -

Always Kept It Real Jamie Lee Curtis On Her Friendship With Lindsay Lohan

May 20, 2025

Always Kept It Real Jamie Lee Curtis On Her Friendship With Lindsay Lohan

May 20, 2025 -

Major Crackdown 65 000 Airbnb Rentals In Spain Face Suspension

May 20, 2025

Major Crackdown 65 000 Airbnb Rentals In Spain Face Suspension

May 20, 2025 -

Fall Of Favre Director Interview Legacy Scandals And The Netflix Documentary

May 20, 2025

Fall Of Favre Director Interview Legacy Scandals And The Netflix Documentary

May 20, 2025