Are Mortgage Refinance Rates Down? May 19, 2025 Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are Mortgage Refinance Rates Down? May 19, 2025 Analysis

Introduction: The rollercoaster ride of mortgage rates continues! Are we finally seeing a dip that could benefit homeowners considering refinancing? Our analysis of May 19, 2025, data explores current refinance rates, potential savings, and factors influencing this fluctuating market. Let's dive into the details to see if refinancing makes sense for you.

Current Mortgage Refinance Rate Landscape (May 19, 2025)

As of May 19, 2025, the mortgage refinance rate landscape presents a mixed picture. While a definitive "yes" or "no" on whether rates are universally down is impossible without specifying loan type and individual borrower circumstances, several indicators suggest a potential softening compared to the peaks of late 2024.

Several major lenders are reporting slight decreases in average refinance rates for certain loan types. For example, [insert a credible source, e.g., a major financial news outlet or mortgage rate aggregator] shows a decrease of approximately 0.25% on average for 30-year fixed-rate refinances compared to the average rates seen in April 2025. However, this decrease is not uniform across all lenders or loan programs.

Factors Affecting Refinance Rates:

Several factors intricately influence mortgage refinance rates:

- The Federal Reserve's Monetary Policy: The Federal Reserve's decisions on interest rates significantly impact the broader mortgage market. A pause or slowdown in rate hikes can lead to lower refinance rates.

- Inflation: High inflation generally leads to higher interest rates as lenders try to protect themselves against the erosion of their returns. Conversely, easing inflation may contribute to lower rates.

- Economic Growth: Strong economic growth can sometimes push rates upward due to increased demand for borrowing. Conversely, slower growth might lead to lower rates.

- Investor Demand: The demand for mortgage-backed securities affects rates. High demand can push rates down, while low demand can drive them up.

- Your Credit Score and Debt-to-Income Ratio: Your individual financial health plays a crucial role. A higher credit score and lower debt-to-income ratio generally qualify you for better rates.

Should You Refinance Your Mortgage?

Determining if refinancing is advantageous requires careful consideration:

- Calculate Potential Savings: Use an online mortgage refinance calculator [link to a reputable calculator] to estimate your potential monthly savings based on your current loan and the prevailing rates.

- Assess Closing Costs: Don't forget closing costs! These fees can eat into your savings, so factor them into your calculations. A longer loan term might offset higher closing costs with lower monthly payments.

- Consider Your Financial Goals: Refinance only if it aligns with your long-term financial goals. A lower interest rate may not be worth it if you plan to move soon.

Conclusion:

While some positive indicators suggest a potential softening of mortgage refinance rates as of May 19, 2025, it's crucial to remember that the market remains dynamic. The decision to refinance should be based on a thorough analysis of your individual circumstances, including your current interest rate, potential savings, and closing costs. Always consult with a qualified financial advisor and mortgage professional before making any decisions.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Consult with a financial professional for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are Mortgage Refinance Rates Down? May 19, 2025 Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Treasury Yields Fall As Fed Hints At One 2025 Rate Reduction

May 20, 2025

Us Treasury Yields Fall As Fed Hints At One 2025 Rate Reduction

May 20, 2025 -

Brett Favres Fall Espns A J Perez Discusses Intimidation And The Untold Series

May 20, 2025

Brett Favres Fall Espns A J Perez Discusses Intimidation And The Untold Series

May 20, 2025 -

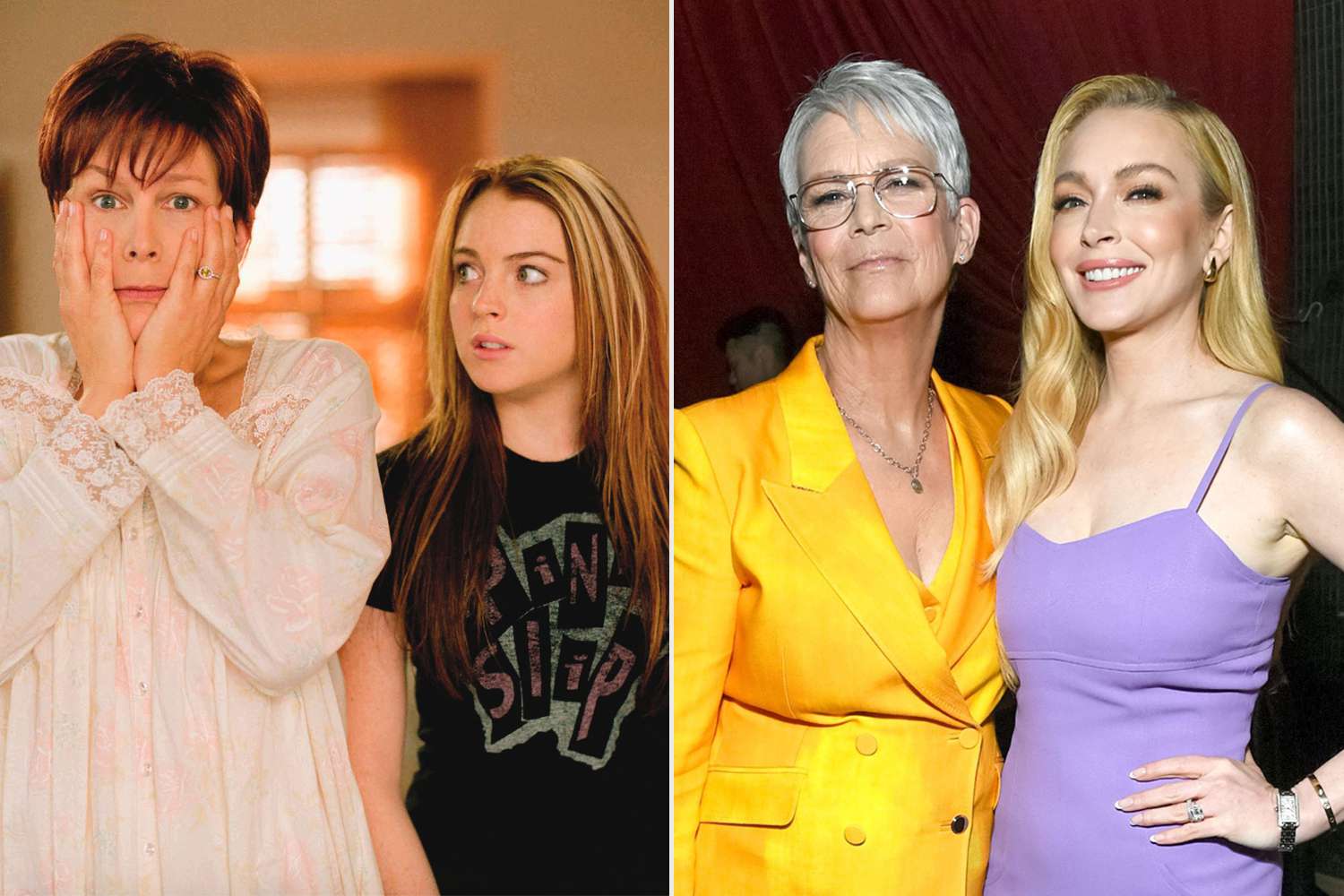

Beyond Freaky Friday Jamie Lee Curtis Discusses Her Bond With Lindsay Lohan

May 20, 2025

Beyond Freaky Friday Jamie Lee Curtis Discusses Her Bond With Lindsay Lohan

May 20, 2025 -

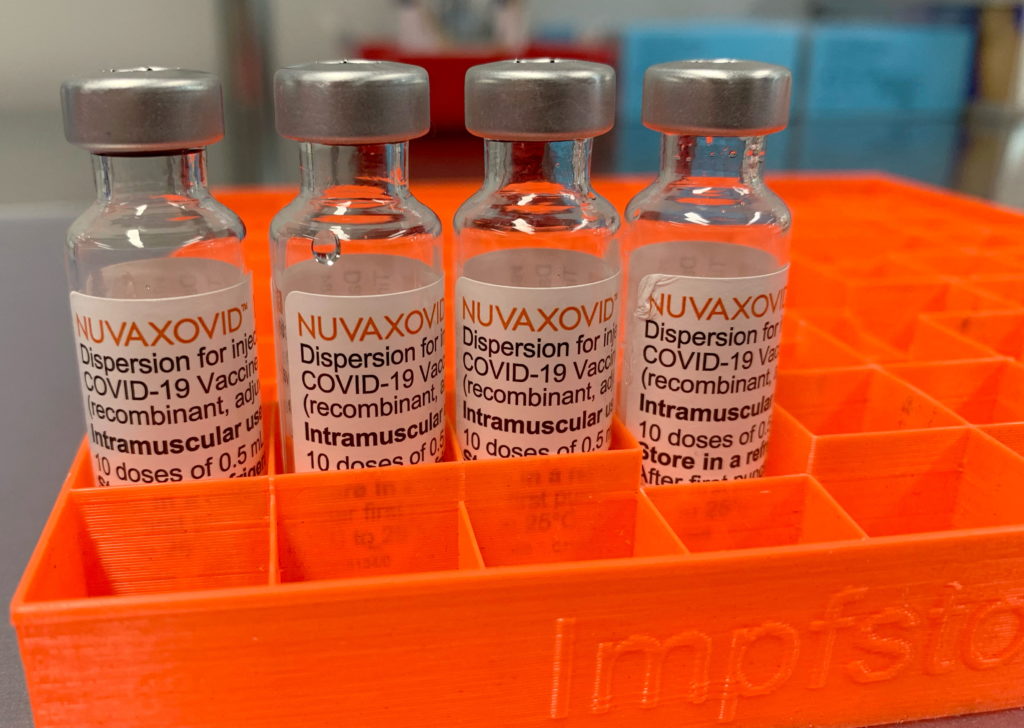

Novavax Covid 19 Vaccine Gets Fda Nod Use Significantly Curtailed

May 20, 2025

Novavax Covid 19 Vaccine Gets Fda Nod Use Significantly Curtailed

May 20, 2025 -

Jamie Lee Curtis And Lindsay Lohan A Candid Look At Their Honest Relationship

May 20, 2025

Jamie Lee Curtis And Lindsay Lohan A Candid Look At Their Honest Relationship

May 20, 2025