Billions Flow Into Bitcoin ETFs: A Look At The Bold Investment Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow into Bitcoin ETFs: A Look at the Bold Investment Strategies

The world of finance is buzzing. Billions of dollars are pouring into Bitcoin exchange-traded funds (ETFs), marking a significant shift in how institutional and individual investors approach the cryptocurrency market. This surge isn't just a fleeting trend; it reflects a growing acceptance of Bitcoin as a legitimate asset class and a strategic investment opportunity. But what bold investment strategies are driving this massive influx of capital? Let's delve into the details.

The Rise of Bitcoin ETFs: A Game Changer

The approval of the first Bitcoin futures ETF in the US in 2021 paved the way for a wave of similar products. These ETFs offer investors a relatively straightforward and regulated way to gain exposure to Bitcoin's price movements without the complexities and risks of directly holding the cryptocurrency. This accessibility is a key factor in attracting both seasoned investors and newcomers to the market. The ease of buying and selling through brokerage accounts familiar to most investors is a major draw compared to navigating the often-confusing world of cryptocurrency exchanges.

Why the Billions are Flowing In:

Several factors contribute to the billions flowing into Bitcoin ETFs:

-

Increased Institutional Adoption: Large institutional investors, including pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin, seeing it as a potential hedge against inflation and a diversification tool. The regulated nature of ETFs makes them an attractive option for these institutions, who often have strict guidelines on investment vehicles.

-

Regulatory Clarity (Slowly Emerging): While regulatory uncertainty still surrounds the cryptocurrency market, the approval of Bitcoin ETFs signifies a step towards greater clarity and acceptance by regulatory bodies. This increased regulatory scrutiny, while potentially daunting, ultimately increases investor confidence.

-

Growing Retail Investor Interest: Individual investors are also embracing Bitcoin ETFs as a simpler and safer alternative to direct cryptocurrency trading. The familiarity of the ETF structure makes it easier for them to participate in the Bitcoin market without needing to understand the intricacies of blockchain technology or digital wallets.

-

Bitcoin's Perceived Value Proposition: Many investors see Bitcoin as a store of value, similar to gold, and a potential hedge against inflation. This perception, combined with Bitcoin's limited supply, fuels the demand for exposure to the cryptocurrency.

Bold Investment Strategies at Play:

The investment strategies employed by those pouring billions into Bitcoin ETFs are diverse, but a few key themes emerge:

-

Diversification: Many investors are using Bitcoin ETFs to diversify their portfolios, reducing their overall risk by spreading investments across different asset classes.

-

Inflation Hedging: With inflation concerns remaining prominent globally, Bitcoin's limited supply and its historical performance during inflationary periods are drawing investors seeking to protect their purchasing power.

-

Long-Term Growth Potential: A significant portion of investors see Bitcoin as a long-term investment with substantial growth potential, driven by increasing adoption and technological advancements in the cryptocurrency space.

The Future of Bitcoin ETFs:

The future looks bright for Bitcoin ETFs. We can expect to see more products launched, potentially including spot Bitcoin ETFs (which track the actual price of Bitcoin, rather than futures contracts), further fueling the growth of this market. However, investors should always conduct thorough research and understand the risks involved before investing in any cryptocurrency-related product.

Call to Action: While we don't endorse specific investments, staying informed about the evolving landscape of cryptocurrency and financial markets is crucial for making sound investment decisions. Consider consulting a financial advisor before making any major investment choices. Further research into Bitcoin and its underlying technology can provide a more comprehensive understanding of this rapidly evolving asset class.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Bitcoin ETFs: A Look At The Bold Investment Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

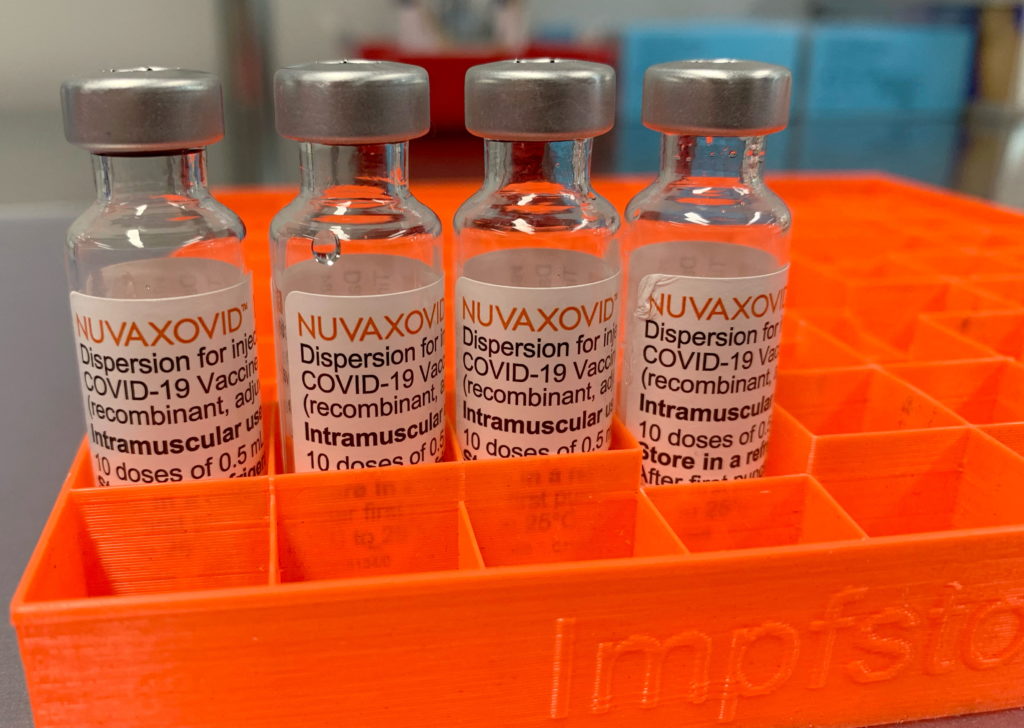

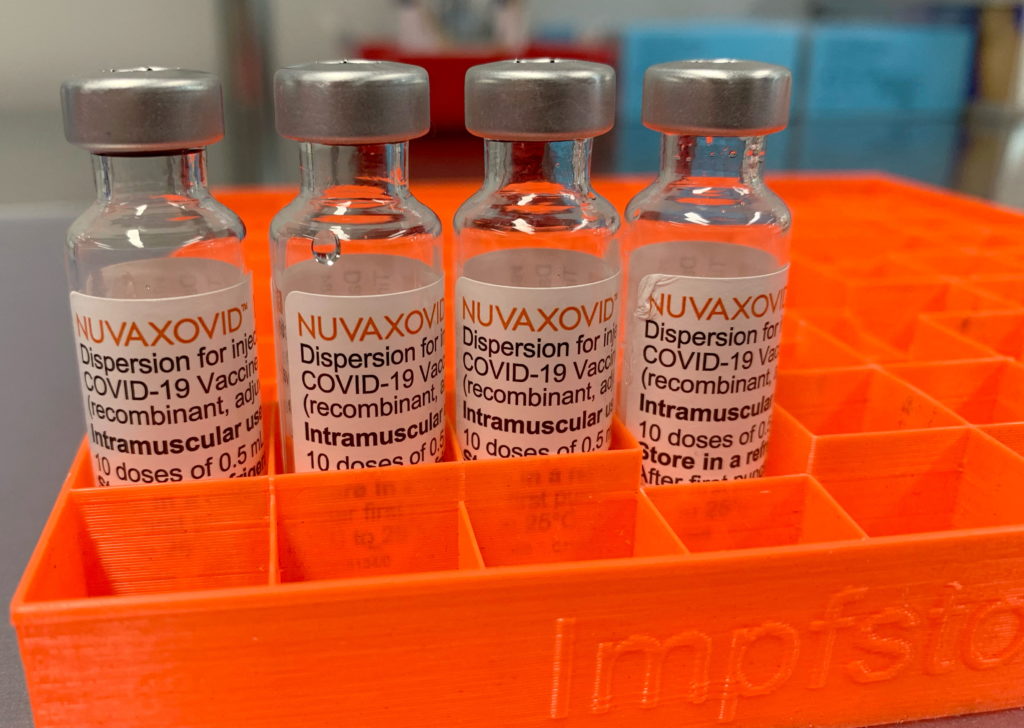

Limited Fda Approval Novavax Covid 19 Vaccines Restricted Use

May 20, 2025

Limited Fda Approval Novavax Covid 19 Vaccines Restricted Use

May 20, 2025 -

Prostate Cancer And Gleason Score 9 What It Means For Patients

May 20, 2025

Prostate Cancer And Gleason Score 9 What It Means For Patients

May 20, 2025 -

May 19 2025 Should You Refinance Your Mortgage Now

May 20, 2025

May 19 2025 Should You Refinance Your Mortgage Now

May 20, 2025 -

Conditional Fda Approval Novavax Covid 19 Vaccine Faces Usage Limits

May 20, 2025

Conditional Fda Approval Novavax Covid 19 Vaccine Faces Usage Limits

May 20, 2025 -

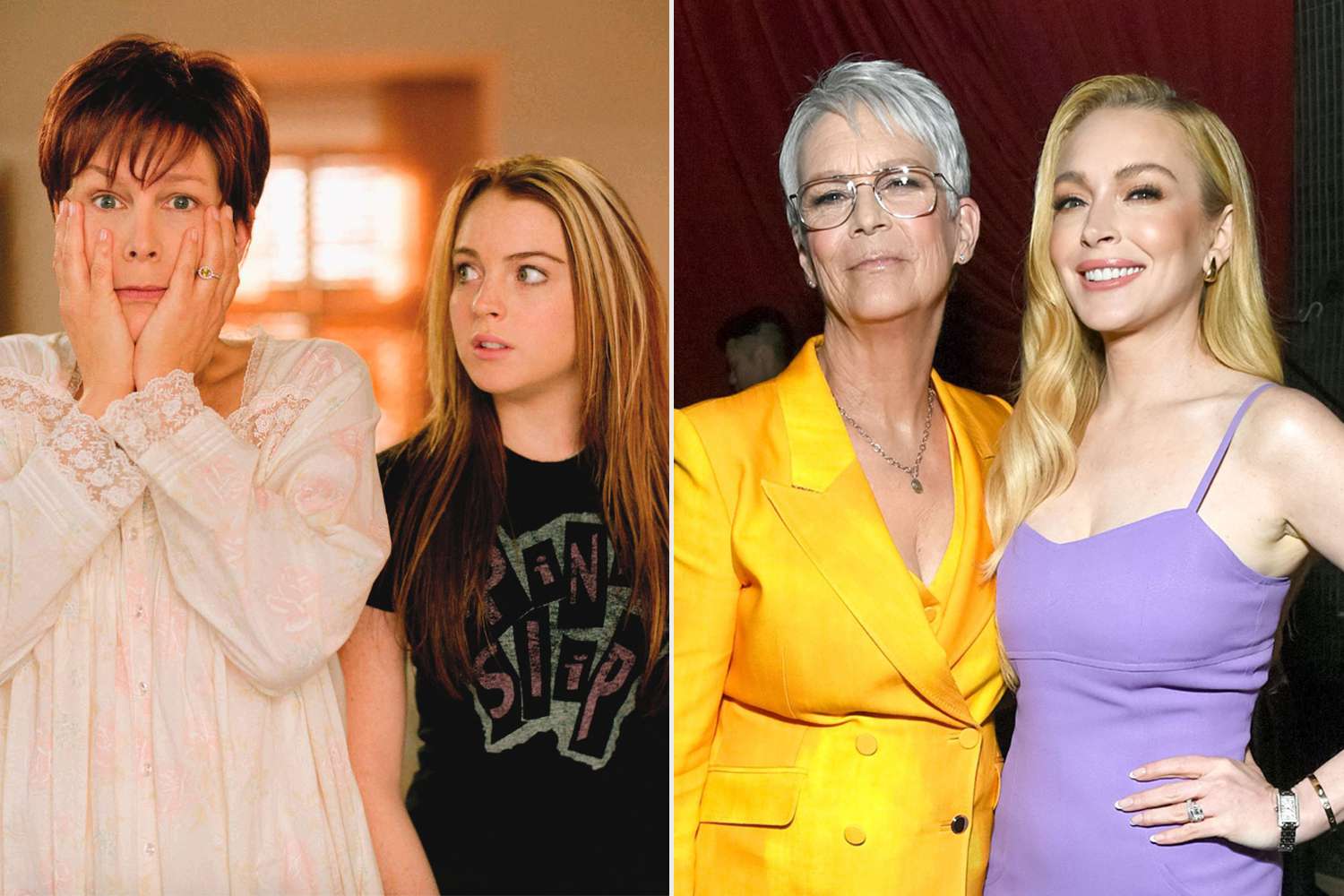

Exclusive Jamie Lee Curtis On Maintaining Her Bond With Lindsay Lohan After Freaky Friday

May 20, 2025

Exclusive Jamie Lee Curtis On Maintaining Her Bond With Lindsay Lohan After Freaky Friday

May 20, 2025