China Tariffs: JPMorgan's Dimon Sounds The Alarm On US Economic Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

China Tariffs: JPMorgan's Dimon Sounds the Alarm on US Economic Strategy

JPMorgan Chase CEO Jamie Dimon has issued a stark warning about the long-term economic consequences of the ongoing trade war with China, urging a reassessment of the US's approach to tariffs. Dimon's comments, made during a recent earnings call, highlight growing concerns within the business community about the detrimental impact of protectionist policies. The escalating trade tensions, he argues, are jeopardizing American businesses and potentially slowing overall economic growth.

This isn't just another Wall Street executive voicing concern; Dimon's warning carries significant weight given JPMorgan Chase's global reach and influence. His statement underscores a broader narrative questioning the efficacy of the current US economic strategy concerning China.

The Impact of Tariffs: More Than Just Trade Disputes

The effects of the US-China trade war, fueled by tariffs imposed on billions of dollars worth of goods, extend far beyond simple trade imbalances. Dimon pointed to several key areas impacted:

- Increased Costs for Consumers: Tariffs ultimately translate to higher prices for consumers, squeezing household budgets and potentially dampening consumer spending, a critical driver of US economic growth.

- Supply Chain Disruptions: The complex global supply chains that underpin modern manufacturing have been significantly disrupted, leading to production delays, increased costs, and uncertainty for businesses.

- Damage to US Businesses: American companies, particularly those heavily reliant on imports from China, have faced significant challenges, including reduced profitability and competitive disadvantages.

- Geopolitical Instability: The escalating trade war has added to global geopolitical uncertainty, creating a climate of risk aversion that can stifle investment and economic growth.

Dimon's Call for a Strategic Rethink

Dimon didn't simply express concern; he explicitly called for a strategic shift in the US approach. He argued that a more nuanced and collaborative approach is needed, focusing on addressing underlying concerns while avoiding overly aggressive protectionist measures. This sentiment reflects a growing consensus among many economists and business leaders who believe that escalating tariffs are counterproductive in the long run.

Beyond Tariffs: Addressing Underlying Issues

The issue goes beyond tariffs. The underlying tensions between the US and China encompass intellectual property rights, technology transfer, and market access. Dimon's comments suggest a need for a broader diplomatic effort focusing on these fundamental issues rather than solely relying on tariffs as a primary tool.

The Long-Term Economic Outlook:

The long-term economic consequences of the current trade strategy remain uncertain. However, Dimon's warning serves as a crucial reminder of the potential risks involved. A prolonged trade war could stifle economic growth, harm American businesses, and ultimately hurt consumers. The need for a more sustainable and collaborative approach is becoming increasingly urgent.

What's Next? A Call for Dialogue and Cooperation

Dimon’s statement emphasizes the urgent need for dialogue and cooperation between the US and China. While addressing legitimate concerns about trade practices is crucial, a path forward needs to prioritize long-term economic stability and global cooperation. The future economic health of both nations, and indeed the global economy, may well depend on it. This situation warrants continued close monitoring and analysis by economists and policymakers alike. We will continue to update you on any significant developments in this evolving trade dispute.

(Keywords: China Tariffs, US-China Trade War, Jamie Dimon, JPMorgan Chase, Economic Strategy, Trade Dispute, Global Economy, Protectionism, Supply Chain, Consumer Prices)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on China Tariffs: JPMorgan's Dimon Sounds The Alarm On US Economic Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nio Q1 Earnings Preview Can Delivery Growth Offset Tariff Worries

Jun 03, 2025

Nio Q1 Earnings Preview Can Delivery Growth Offset Tariff Worries

Jun 03, 2025 -

Adulting 101 Miley Cyrus Reaction To Dads Romance With Elizabeth Hurley

Jun 03, 2025

Adulting 101 Miley Cyrus Reaction To Dads Romance With Elizabeth Hurley

Jun 03, 2025 -

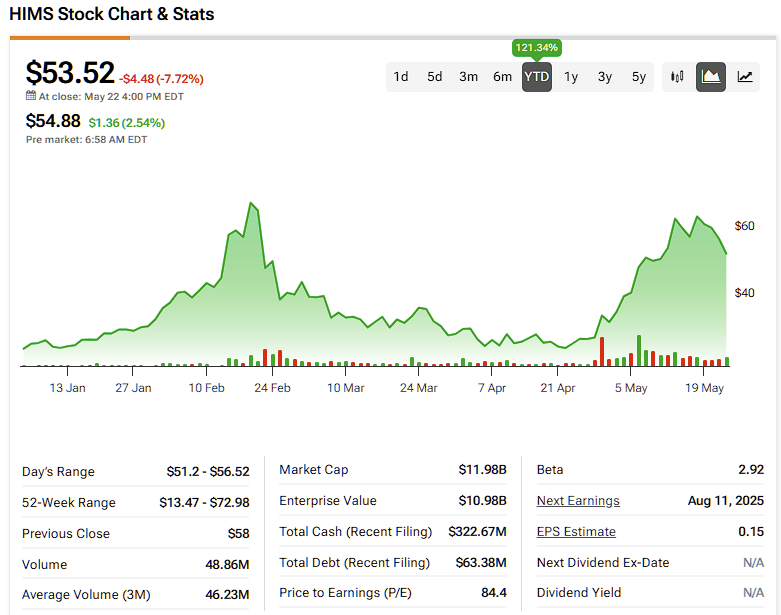

Evaluating Hims And Hers Health Hims Should You Buy Sell Or Hold

Jun 03, 2025

Evaluating Hims And Hers Health Hims Should You Buy Sell Or Hold

Jun 03, 2025 -

Major Incident Crimea Bridge Hit By Powerful Blast

Jun 03, 2025

Major Incident Crimea Bridge Hit By Powerful Blast

Jun 03, 2025 -

Hims And Hers Hims Riding The Wave Or Facing A Crash Investor Concerns

Jun 03, 2025

Hims And Hers Hims Riding The Wave Or Facing A Crash Investor Concerns

Jun 03, 2025