NIO Q1 Earnings Preview: Can Delivery Growth Offset Tariff Worries?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Preview: Can Delivery Growth Offset Tariff Worries?

Chinese electric vehicle (EV) maker NIO is set to release its first-quarter 2024 earnings on [Insert Date Here], and investors are holding their breath. While the company has shown impressive delivery growth in recent quarters, looming tariff concerns and a challenging macroeconomic environment cast a shadow over the anticipated results. Can NIO's robust sales figures outweigh these headwinds? Let's delve into the key factors to watch.

NIO's Recent Performance: A Mixed Bag

NIO has consistently exceeded delivery expectations in recent quarters, showcasing the growing demand for its premium EVs in the competitive Chinese market. The company's innovative battery-as-a-service (BaaS) model has also proven popular, attracting customers with lower upfront costs. However, increased competition from established players like BYD and new entrants, coupled with rising raw material prices, present significant challenges. The recent imposition of tariffs on certain imported goods also adds another layer of complexity to the company's financial outlook.

Key Factors to Watch in the Q1 Earnings Report:

- Delivery Numbers: Analysts will be keenly focused on the total number of vehicles delivered during Q1 2024. A strong showing here would be a powerful indicator of sustained demand, bolstering investor confidence. Any significant deviation from expectations will likely trigger market reactions.

- Gross Margin: Maintaining healthy gross margins in the face of rising input costs is crucial for NIO's profitability. Investors will scrutinize this metric to gauge the company's ability to manage its pricing strategy and operational efficiency. Pressure on margins due to tariffs will be a key area of concern.

- Guidance for Q2 2024: Forward-looking guidance will be another crucial element of the earnings report. NIO's projections for Q2 deliveries and financial performance will provide valuable insight into the company's outlook for the remainder of the year. Conservative guidance amidst tariff uncertainty wouldn't be surprising.

- Impact of Tariffs: The extent to which tariffs have impacted NIO's operations and profitability will be a key focus for investors. Transparency in addressing the tariff issue and the company's mitigation strategies will be essential in shaping market sentiment. This could include discussions about potential price adjustments or supply chain diversification.

- BaaS Subscription Growth: The success of the BaaS model is vital for NIO's long-term strategy. Tracking the growth in BaaS subscriptions will provide insights into the program's effectiveness and its contribution to overall revenue.

The Tariff Tightrope: Navigating Uncertainty

The impact of tariffs on NIO's bottom line remains a significant uncertainty. The company's ability to absorb these costs or pass them onto consumers without significantly impacting demand will be a crucial factor determining its Q1 performance and future prospects. Strategies for mitigating the impact of tariffs, such as exploring alternative supply chains or negotiating favorable trade agreements, will be closely examined.

Conclusion: A Critical Juncture for NIO

NIO's Q1 2024 earnings report is poised to be a pivotal moment for the company. While strong delivery numbers could paint a positive picture, the impact of tariffs and the broader macroeconomic environment cannot be ignored. Investors will carefully analyze the reported figures, guidance, and management commentary to assess NIO's ability to navigate the current challenges and maintain its growth trajectory in the increasingly competitive EV market. The results will undoubtedly shape the company's valuation and its future trajectory in the electric vehicle race.

Further Reading:

- [Link to NIO Investor Relations Website]

- [Link to a reputable article on the impact of tariffs on the Chinese EV market]

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Preview: Can Delivery Growth Offset Tariff Worries?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trump Judicial Nominee Vetting Bondi Reduces Aba Involvement

Jun 03, 2025

Trump Judicial Nominee Vetting Bondi Reduces Aba Involvement

Jun 03, 2025 -

Crimean Bridge Under Attack Ukraine Claims Underwater Sabotage Operation

Jun 03, 2025

Crimean Bridge Under Attack Ukraine Claims Underwater Sabotage Operation

Jun 03, 2025 -

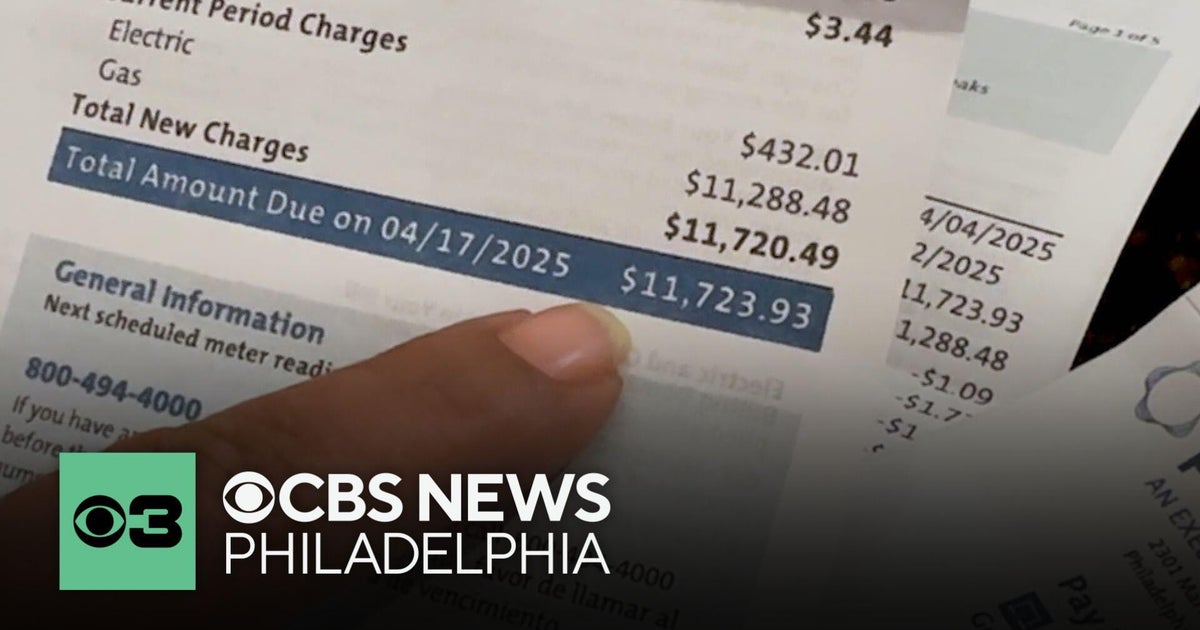

Philadelphia Peco Customer Faces 12 000 Bill Following Billing Error

Jun 03, 2025

Philadelphia Peco Customer Faces 12 000 Bill Following Billing Error

Jun 03, 2025 -

After 16 Years Marc Marons Wtf Podcast Is Conclude

Jun 03, 2025

After 16 Years Marc Marons Wtf Podcast Is Conclude

Jun 03, 2025 -

Crimean Bridge Targeted Again Ukraine Reports New Underwater Bombing

Jun 03, 2025

Crimean Bridge Targeted Again Ukraine Reports New Underwater Bombing

Jun 03, 2025