Hims & Hers (HIMS): Riding The Wave Or Facing A Crash? Investor Concerns.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers (HIMS): Riding the Wave or Facing a Crash? Investor Concerns Mount

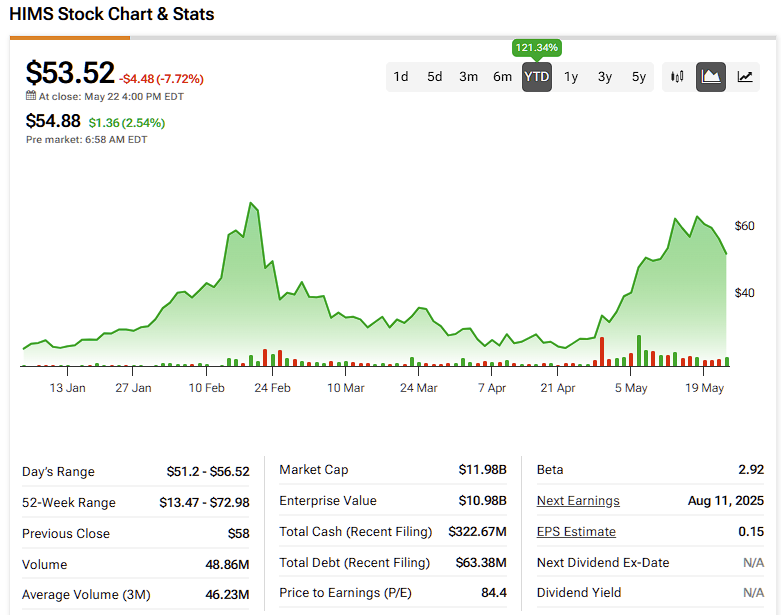

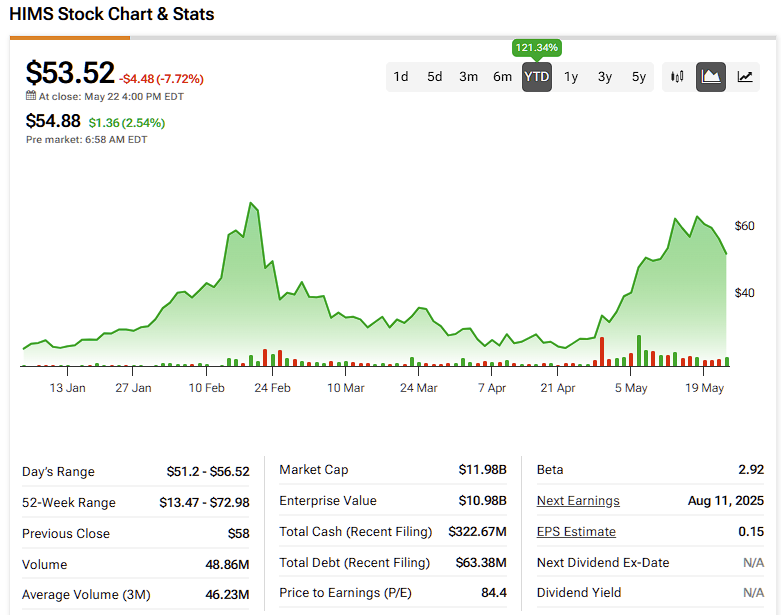

Hims & Hers Health (HIMS), the telehealth company offering a range of convenient health and wellness products, has seen its stock price fluctuate wildly in recent months, leaving investors questioning its long-term viability. While the company boasts a strong brand and a seemingly vast market, significant concerns are emerging that could threaten its future success. This article delves into the key investor anxieties surrounding Hims & Hers, exploring both the potential for continued growth and the risks that could lead to a significant downturn.

The Allure of Convenience: Hims & Hers' Initial Success

Hims & Hers' initial success stemmed from its disruptive approach to healthcare. By offering easy online access to treatments for conditions like hair loss, erectile dysfunction, and acne, the company tapped into a market underserved by traditional healthcare providers. This convenient, discreet model resonated with a tech-savvy demographic, fueling impressive early growth. The company's direct-to-consumer (DTC) model, bypassing the complexities of insurance and traditional doctor visits, was a key differentiator.

The Shifting Landscape: Growing Competition and Regulatory Scrutiny

However, the landscape is changing. Increased competition from established pharmaceutical companies and emerging telehealth startups is putting pressure on Hims & Hers' market share. Furthermore, regulatory scrutiny is intensifying, with concerns raised regarding the company's marketing practices and the potential for over-prescription of certain medications. This heightened regulatory environment adds significant uncertainty to the company's future prospects.

H2: Key Investor Concerns:

-

Profitability: Despite impressive revenue growth, Hims & Hers has struggled to achieve consistent profitability. High marketing costs and operational expenses have hampered the company's bottom line, raising concerns about its long-term financial sustainability. Investors are increasingly scrutinizing the company's ability to control costs and achieve sustainable profitability.

-

Customer Acquisition Cost (CAC): The cost of acquiring new customers remains a significant challenge for Hims & Hers. The company's reliance on digital marketing strategies often translates to high CAC, potentially impacting its overall profitability. Strategies to optimize customer acquisition and reduce CAC are crucial for future success.

-

Market Saturation: The market for telehealth services is rapidly expanding, leading to concerns about market saturation. As more players enter the field, competition will likely intensify, putting downward pressure on prices and margins for Hims & Hers.

-

Dependence on a Few Key Products: While offering a diverse range of products, Hims & Hers' revenue is still heavily reliant on a few key offerings. Diversification of its product portfolio and revenue streams is essential to mitigate risk.

H2: Potential for Future Growth:

Despite these concerns, Hims & Hers still possesses considerable potential. The company's strong brand recognition and established customer base provide a solid foundation for future growth. Expanding into new therapeutic areas and geographical markets could unlock significant opportunities. Furthermore, strategic partnerships with insurance providers and healthcare systems could enhance its market reach and potentially reduce its dependence on DTC marketing.

H2: Conclusion: Navigating the Uncertain Waters

The future of Hims & Hers remains uncertain. While the company's convenient model and strong brand offer significant potential, investors must carefully weigh the risks associated with increased competition, regulatory pressures, and profitability challenges. Only time will tell if Hims & Hers can successfully navigate these turbulent waters and maintain its position as a leading player in the telehealth industry. Investors should closely monitor the company's financial performance, regulatory developments, and strategic initiatives before making any investment decisions. Further research into the company's financial reports and industry analysis is strongly recommended.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS): Riding The Wave Or Facing A Crash? Investor Concerns.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jamie Dimon On Trumps Priorities Navigating Global Geopolitical Change

Jun 03, 2025

Jamie Dimon On Trumps Priorities Navigating Global Geopolitical Change

Jun 03, 2025 -

The Wire Actors Sons Dramatic Rescue Following Henry County Tornado

Jun 03, 2025

The Wire Actors Sons Dramatic Rescue Following Henry County Tornado

Jun 03, 2025 -

Tray Chaneys Son Fighting For Life After Tornado In Georgia

Jun 03, 2025

Tray Chaneys Son Fighting For Life After Tornado In Georgia

Jun 03, 2025 -

North Texas Police Conclude Manhunt Arresting Capital Murder Fugitive

Jun 03, 2025

North Texas Police Conclude Manhunt Arresting Capital Murder Fugitive

Jun 03, 2025 -

Nio Q1 Earnings Report Assessing Delivery Growth Amidst Rising Tariff Concerns

Jun 03, 2025

Nio Q1 Earnings Report Assessing Delivery Growth Amidst Rising Tariff Concerns

Jun 03, 2025