America's Economic Future Hangs In The Balance: The Clean Energy Tax Debate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

America's Economic Future Hangs in the Balance: The Clean Energy Tax Debate

America stands at a crossroads. The nation's economic future is inextricably linked to its approach to climate change, and the ongoing debate surrounding clean energy tax credits is a pivotal battleground. The stakes are high: massive job creation potential versus economic uncertainty, technological innovation versus entrenched interests, and a sustainable future versus a path of environmental degradation. This article delves into the complexities of this crucial debate.

The Current Landscape: A Tug-of-War Between Progress and Resistance

The Inflation Reduction Act (IRA), signed into law in 2022, included substantial investments in clean energy through tax credits and incentives. This legislation represents a significant step towards decarbonizing the American economy, aiming to boost domestic manufacturing, create high-paying jobs in renewable energy sectors, and reduce reliance on fossil fuels. Supporters argue this is a vital investment in America's future, fostering economic growth while mitigating climate risks.

However, the IRA's clean energy provisions have faced significant opposition. Critics raise concerns about the cost to taxpayers, arguing the subsidies are excessive and inefficient. Some also express worries about the potential negative impacts on traditional energy industries and the overall competitiveness of American businesses. The debate is further fueled by partisan divisions, with differing perspectives on the role of government intervention in the economy and the urgency of addressing climate change.

Analyzing the Key Arguments:

-

Proponents of Clean Energy Tax Credits: These advocates emphasize the long-term economic benefits of transitioning to a clean energy economy. They highlight the potential for millions of high-skilled jobs in manufacturing, installation, and maintenance of renewable energy technologies, citing studies from organizations like the Environmental Defense Fund. Furthermore, they argue that investing in clean energy infrastructure will improve energy independence and national security. They point to the success of similar policies in other countries, such as Germany's Energiewende, as evidence of the potential for economic growth and environmental sustainability to coexist.

-

Opponents of Clean Energy Tax Credits: Opponents frequently cite concerns about the financial burden on taxpayers. They question the effectiveness and efficiency of government subsidies, suggesting that the market should drive the transition to clean energy without significant government intervention. Concerns about the potential displacement of workers in traditional energy sectors are also frequently raised. Some argue that the IRA unfairly favors certain technologies or regions, leading to uneven economic development. Groups like the American Petroleum Institute have actively lobbied against the expansion of clean energy tax credits.

The International Context: A Global Race for Clean Energy Dominance

The clean energy tax debate is not isolated to the United States. Globally, nations are competing to become leaders in the renewable energy sector. China, for example, is a major player in manufacturing solar panels and wind turbines. The IRA aims to bolster American competitiveness in this global race, ensuring that the U.S. captures a larger share of the burgeoning clean energy market. This aspect adds a layer of strategic importance to the debate, extending beyond purely economic considerations.

The Road Ahead: Navigating Uncertainty and Finding Common Ground

The future of America's economy is deeply intertwined with its success in transitioning to a clean energy future. The debate over clean energy tax credits will continue to shape this transition. Finding a balance between fostering innovation, supporting workers, and managing taxpayer costs is crucial. Open dialogue, data-driven analysis, and a willingness to compromise are essential to navigating this complex challenge and securing a prosperous and sustainable future for the United States.

Further Reading:

- [Link to a relevant report from the Brookings Institution]

- [Link to a relevant article from the New York Times]

- [Link to the official White House website information on the IRA]

Call to Action: Stay informed about the ongoing debate and engage in constructive conversations about the future of American energy policy. Your voice matters.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on America's Economic Future Hangs In The Balance: The Clean Energy Tax Debate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Strip The Duck The Latest On Jon Jones And Tom Aspinalls Heated Exchange

May 20, 2025

Strip The Duck The Latest On Jon Jones And Tom Aspinalls Heated Exchange

May 20, 2025 -

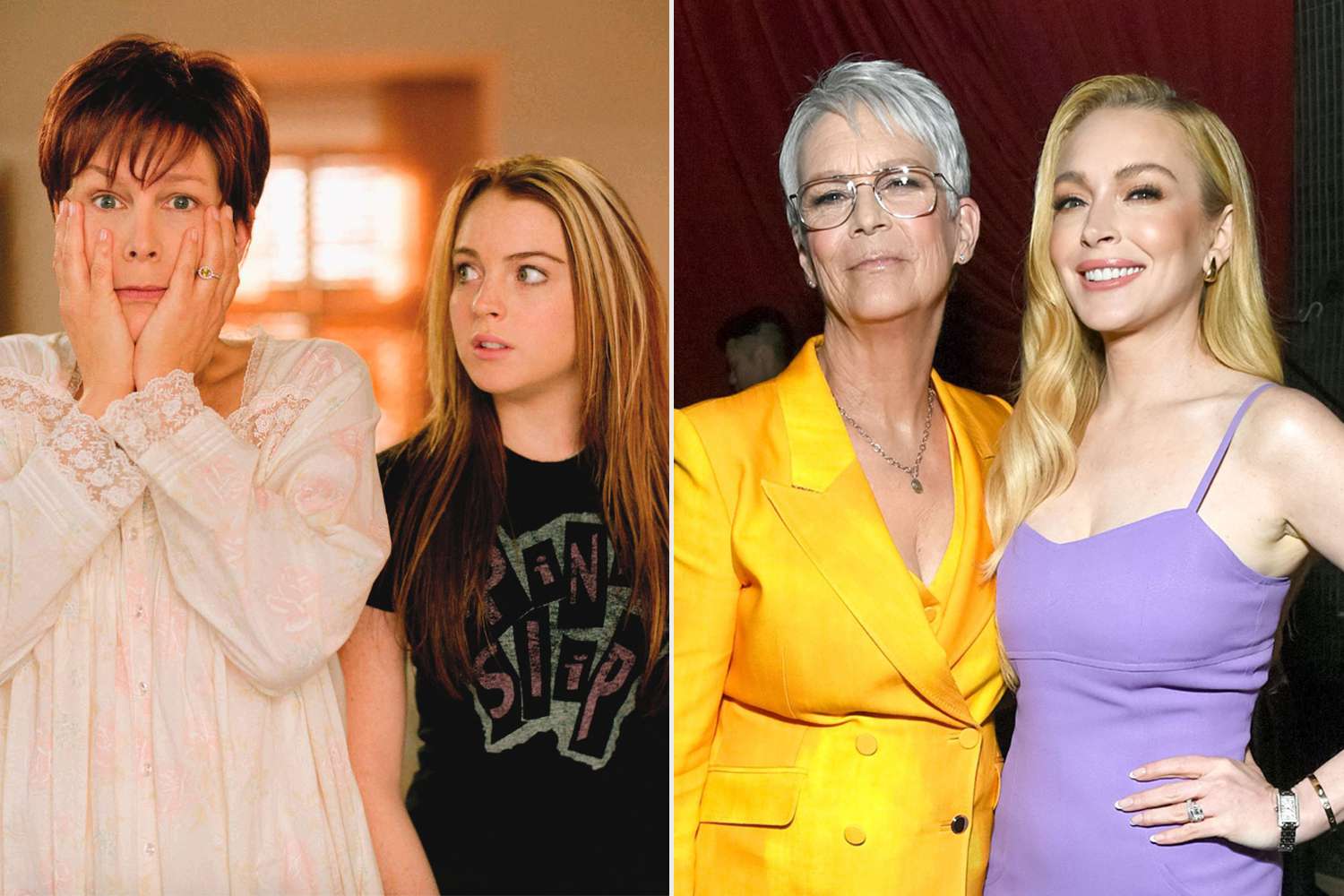

Exclusive Jamie Lee Curtis On Maintaining Her Bond With Lindsay Lohan After Freaky Friday

May 20, 2025

Exclusive Jamie Lee Curtis On Maintaining Her Bond With Lindsay Lohan After Freaky Friday

May 20, 2025 -

Jon Jones Future In Ufc Questioned Following I M Done Remark Aspinall Talks Falter

May 20, 2025

Jon Jones Future In Ufc Questioned Following I M Done Remark Aspinall Talks Falter

May 20, 2025 -

Walmart Warns Of Price Hikes After Trumps Tariff Stance

May 20, 2025

Walmart Warns Of Price Hikes After Trumps Tariff Stance

May 20, 2025 -

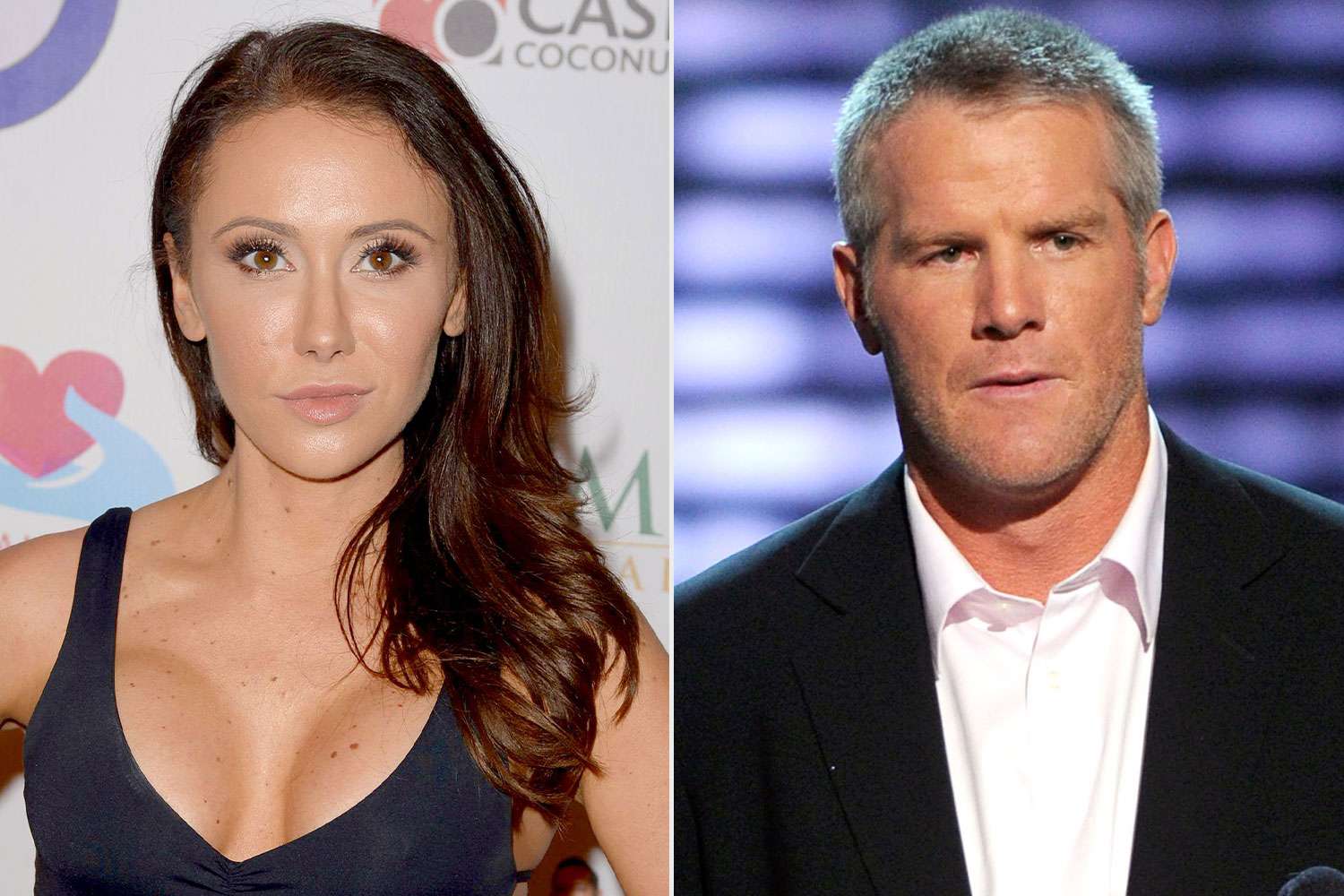

Dehumanized Jenn Sterger Details Lasting Impact Of Brett Favre Scandal

May 20, 2025

Dehumanized Jenn Sterger Details Lasting Impact Of Brett Favre Scandal

May 20, 2025