$5B+ Poured Into Bitcoin ETFs: Understanding The Directional Bets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Decoding the Directional Bets on Crypto's Future

The cryptocurrency market is buzzing. Over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) since the SEC's approval of the first spot Bitcoin ETF, sparking intense speculation about the future direction of Bitcoin's price and the broader crypto market. This unprecedented influx of capital represents a significant vote of confidence in Bitcoin's long-term potential, but understanding the implications requires a closer look at the underlying dynamics.

This surge isn't just about retail investors; institutional money is pouring in, signaling a shift in how mainstream finance views the leading cryptocurrency. This article dives deep into the reasons behind this massive investment, explores the implications for Bitcoin's price, and examines the potential risks and rewards involved.

The SEC Approval: A Catalyst for Institutional Investment

The Securities and Exchange Commission's (SEC) approval of the first spot Bitcoin ETF marked a watershed moment. For years, the SEC had resisted approving such ETFs, citing concerns about market manipulation and investor protection. The approval, however, opened the floodgates for institutional investors who previously faced significant hurdles to accessing Bitcoin directly. This decision legitimized Bitcoin in the eyes of many, attracting a wave of capital previously hesitant to enter the crypto space. [Link to relevant SEC announcement]

Why the Massive Influx? Understanding the Directional Bets

Several factors contribute to this monumental investment in Bitcoin ETFs:

-

Increased Institutional Adoption: Major financial institutions, including BlackRock, Invesco, and Fidelity, are now offering Bitcoin ETFs, making it easier for institutional investors to gain exposure to Bitcoin without navigating the complexities of direct cryptocurrency exchanges. This signifies a move towards mainstream acceptance.

-

Reduced Regulatory Uncertainty: The SEC's approval significantly reduces regulatory uncertainty surrounding Bitcoin ETFs, encouraging more conservative investors to participate. This clarity is a major driver of the current investment surge.

-

Hedge Against Inflation: Many see Bitcoin as a hedge against inflation, especially in times of economic uncertainty. The current macroeconomic climate, marked by persistent inflation in many countries, is likely driving demand for Bitcoin as a store of value.

-

Diversification: Bitcoin's low correlation with traditional asset classes makes it an attractive addition to diversified investment portfolios. Investors are increasingly seeking alternative assets to enhance returns and mitigate risk.

Bitcoin's Price: Riding the Wave of Institutional Capital

The influx of capital into Bitcoin ETFs has undoubtedly had a significant impact on Bitcoin's price. While correlation doesn't equal causation, the price has generally seen upward pressure since the approvals. However, it's crucial to remember that the crypto market is highly volatile. While institutional investment provides a strong foundation for growth, short-term price fluctuations are still expected.

The Risks and Rewards

Investing in Bitcoin ETFs, while potentially lucrative, carries inherent risks. These include:

-

Market Volatility: The cryptocurrency market is known for its extreme volatility. Bitcoin's price can fluctuate dramatically in short periods, leading to significant losses.

-

Regulatory Changes: Future regulatory changes could negatively impact the Bitcoin ETF market.

-

Security Risks: While ETFs mitigate some security risks associated with holding Bitcoin directly, platform security remains a concern.

Despite these risks, the potential rewards are substantial. Many investors believe in Bitcoin's long-term growth potential, viewing the current investment surge as a step towards broader adoption and increased value.

The Future of Bitcoin ETFs

The future looks bright for Bitcoin ETFs. With more approvals expected and further institutional adoption anticipated, the market is poised for significant growth. However, careful consideration of the risks and rewards is crucial before investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Poured Into Bitcoin ETFs: Understanding The Directional Bets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Climate Changes Effect On Pregnancy Infertility Miscarriage And Birth Outcomes

May 20, 2025

Climate Changes Effect On Pregnancy Infertility Miscarriage And Birth Outcomes

May 20, 2025 -

Rba Cuts Rates To Two Year Low Amidst Cooling Inflation

May 20, 2025

Rba Cuts Rates To Two Year Low Amidst Cooling Inflation

May 20, 2025 -

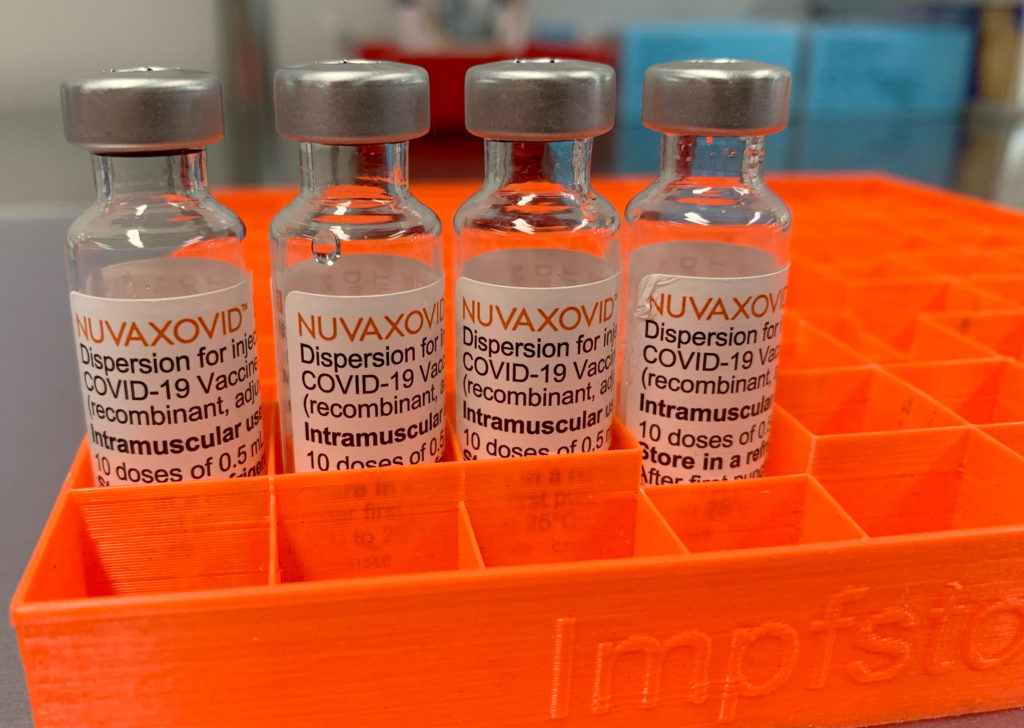

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Constraints

May 20, 2025

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Constraints

May 20, 2025 -

Jamie Lee Curtis And Lindsay Lohan A Mother Daughter Bond Like No Other

May 20, 2025

Jamie Lee Curtis And Lindsay Lohan A Mother Daughter Bond Like No Other

May 20, 2025 -

Expert Mlb Betting Picks Based On Splits May 19th

May 20, 2025

Expert Mlb Betting Picks Based On Splits May 19th

May 20, 2025