RBA Cuts Rates To Two-Year Low Amidst Cooling Inflation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RBA Cuts Rates to Two-Year Low Amidst Cooling Inflation

Australia's central bank, the Reserve Bank of Australia (RBA), has slashed interest rates to a two-year low, signaling a proactive response to slowing inflation and a softening economy. This move, announced on [Date of announcement], marks a significant shift in monetary policy and has sent ripples through the Australian financial markets. The cut, from [Previous rate]% to [New rate]%, is expected to stimulate economic activity and boost consumer spending.

This decision comes as inflation continues its downward trajectory, falling to [Current inflation rate]% – a figure below the RBA's target range of 2-3%. While this lower inflation is generally positive, it also indicates a potential cooling of the economy, prompting the RBA to intervene.

Why the Rate Cut? Understanding the RBA's Rationale

The RBA's statement accompanying the rate cut cited several key factors driving the decision:

- Cooling Inflation: The persistent decline in inflation, driven by factors such as lower energy prices and a softening housing market, suggests a need for stimulative monetary policy.

- Softening Economic Growth: Concerns about slowing global economic growth, coupled with weaker-than-expected domestic economic data, prompted the RBA to act preemptively.

- Unemployment Concerns: While the unemployment rate remains relatively low, there are concerns about the potential for further job losses if economic growth continues to decelerate. The RBA aims to prevent this through lower interest rates.

- Global Economic Uncertainty: Geopolitical instability and trade tensions continue to cast a shadow over the global economy, adding to the RBA's cautious approach.

The RBA Governor, Philip Lowe, emphasized the bank's commitment to maintaining price stability while supporting sustainable economic growth. He highlighted the need for a flexible and data-driven approach to monetary policy, suggesting further rate cuts remain a possibility depending on future economic indicators.

Impact on the Australian Economy

The rate cut is expected to have several significant impacts on the Australian economy:

- Increased Borrowing: Lower interest rates will make borrowing cheaper for businesses and consumers, potentially encouraging investment and spending.

- Stimulated Housing Market: The reduction in mortgage rates could provide a boost to the housing market, which has shown signs of cooling in recent months. This could, however, also lead to concerns about asset bubbles if not carefully managed.

- Currency Depreciation: The rate cut could lead to a depreciation of the Australian dollar, potentially benefiting export-oriented industries. However, this could also increase the cost of imported goods.

- Increased Consumer Confidence: Lower interest rates may improve consumer confidence, encouraging greater spending and economic activity.

What's Next for the Australian Economy?

The RBA's decision marks a significant turning point in Australia's economic outlook. The effectiveness of the rate cut will depend on several factors, including consumer and business confidence, global economic conditions, and the overall trajectory of inflation. Analysts are closely monitoring key economic indicators to gauge the impact of this policy shift. Further rate cuts cannot be ruled out if economic data continues to disappoint. The RBA's next meeting is scheduled for [Date of next meeting], where further decisions regarding monetary policy will be announced. Staying informed about economic news and RBA announcements is crucial for navigating this dynamic period.

Keywords: RBA, Reserve Bank of Australia, interest rates, rate cut, inflation, Australian economy, monetary policy, economic growth, unemployment, housing market, Australian dollar, Philip Lowe, economic indicators

Related Articles: [Link to relevant article 1], [Link to relevant article 2]

Disclaimer: This article provides general information and should not be considered financial advice. Consult a financial professional for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RBA Cuts Rates To Two-Year Low Amidst Cooling Inflation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Game To Screen Analyzing The Evolved Relationship Between Joel And Ellie In The Last Of Us Season 2

May 20, 2025

From Game To Screen Analyzing The Evolved Relationship Between Joel And Ellie In The Last Of Us Season 2

May 20, 2025 -

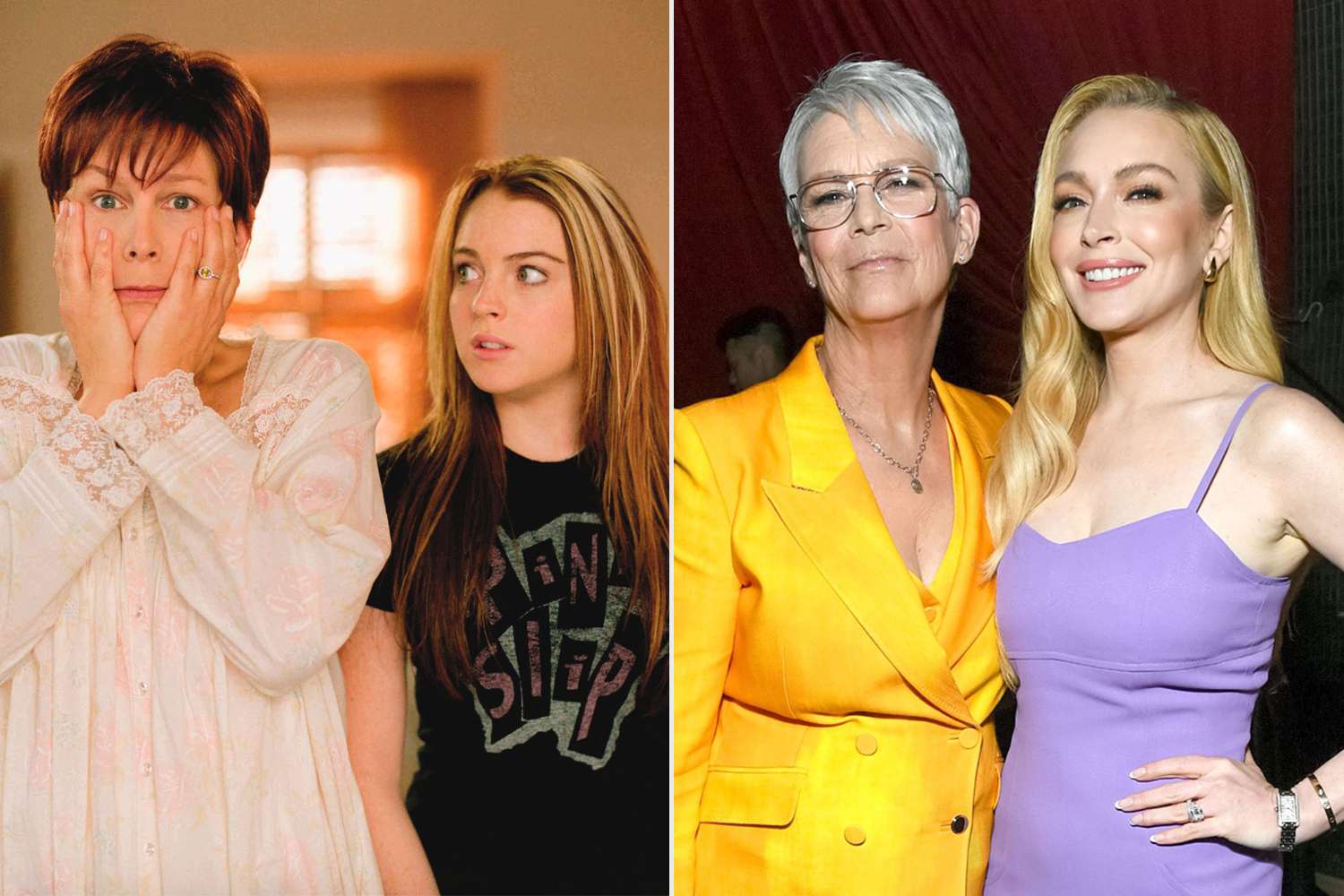

Jamie Lee Curtis Reveals How She Stays Connected With Lindsay Lohan Following Their Freaky Friday Success

May 20, 2025

Jamie Lee Curtis Reveals How She Stays Connected With Lindsay Lohan Following Their Freaky Friday Success

May 20, 2025 -

Trumps Diminished Role Putins Actions Speak Volumes

May 20, 2025

Trumps Diminished Role Putins Actions Speak Volumes

May 20, 2025 -

Ufc News Jon Jones Cryptic Message And Aspinall Contract Standoff

May 20, 2025

Ufc News Jon Jones Cryptic Message And Aspinall Contract Standoff

May 20, 2025 -

Clean Energy Taxes Analyzing The Economic Pros And Cons For America

May 20, 2025

Clean Energy Taxes Analyzing The Economic Pros And Cons For America

May 20, 2025