$200 Million Influx: Investors Bet Big On Ethereum After Pectra Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$200 Million Influx: Investors Bet Big on Ethereum After Shanghai Upgrade

Ethereum's price surged following the highly anticipated Shanghai upgrade, prompting a significant influx of investment. The crypto market witnessed a renewed wave of optimism as over $200 million poured into Ethereum in the days following the successful implementation of the upgrade. This substantial investment signifies a strong vote of confidence in Ethereum's future and its potential for continued growth. The upgrade, a major milestone for the Ethereum network, unlocked staked ETH, a pivotal moment for the cryptocurrency's evolution.

This article delves into the reasons behind this substantial investment surge, exploring the impact of the Shanghai upgrade and analyzing the implications for the future of Ethereum.

The Shanghai Upgrade: A Game Changer for Staked ETH

The Shanghai upgrade, also known as the "Shapella" upgrade, was a critical moment for Ethereum. For months, millions of ETH were locked in staking contracts, unable to be withdrawn. This upgrade finally enabled stakers to withdraw their staked ETH and accumulated rewards. This unlocking of previously illiquid assets injected significant liquidity into the market, contributing directly to the price increase and attracting considerable investment.

What this means for investors: The ability to unstake ETH significantly reduces the risk associated with staking, making it a more attractive proposition for both institutional and retail investors. Previously, the lengthy unstaking period and potential for validator slashing presented considerable hurdles. The Shanghai upgrade effectively mitigates these risks, bolstering investor confidence.

Beyond the Staking Unlocks: Other Factors Driving Investment

While the Shanghai upgrade was undeniably the catalyst, other factors contributed to the $200 million influx into Ethereum. These include:

- Increased Network Activity: The upgrade has led to a noticeable increase in Ethereum network activity, demonstrating the network's continued relevance and robustness. Higher transaction volumes often correlate with increased price.

- Positive Market Sentiment: The successful and timely completion of the Shanghai upgrade boosted overall market sentiment, creating a positive feedback loop that encouraged further investment.

- Growing DeFi Ecosystem: Ethereum remains the dominant platform for decentralized finance (DeFi), and the upgrade only strengthens its position. The thriving DeFi ecosystem continues to attract investment and drive demand for ETH.

- Institutional Adoption: Institutional investors are increasingly recognizing the value and potential of Ethereum, further contributing to the price surge.

What the Future Holds for Ethereum

The $200 million influx is a strong indication of the market's belief in Ethereum's long-term prospects. However, it’s important to remember that the cryptocurrency market remains volatile. While the Shanghai upgrade is a major positive development, several factors could influence Ethereum's future price.

These factors include:

- Regulatory Landscape: The evolving regulatory environment for cryptocurrencies could impact Ethereum's price.

- Competition from Other Blockchains: Competition from other layer-1 blockchains continues to be a factor.

- Overall Market Conditions: The broader cryptocurrency market's performance will undoubtedly affect Ethereum's price.

Conclusion:

The $200 million investment surge following the Shanghai upgrade underscores Ethereum's continued strength and attractiveness as a leading cryptocurrency. While uncertainty remains within the broader crypto market, the successful upgrade and subsequent price increase paint a positive picture for Ethereum's future, suggesting that the network's long-term potential remains significant for investors. The removal of staking liquidity lock-ups opens doors for a new wave of participation and innovation within the Ethereum ecosystem. Further developments and positive market sentiment will be key factors determining Ethereum's trajectory in the coming months and years. Stay tuned for further updates on this exciting development in the crypto space.

Keywords: Ethereum, Shanghai Upgrade, Shapella, Staked ETH, Cryptocurrency, Investment, DeFi, Blockchain, Crypto Market, Price Surge, $200 Million, Crypto News, ETH

(Optional CTA): Follow us for more insightful crypto news and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $200 Million Influx: Investors Bet Big On Ethereum After Pectra Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

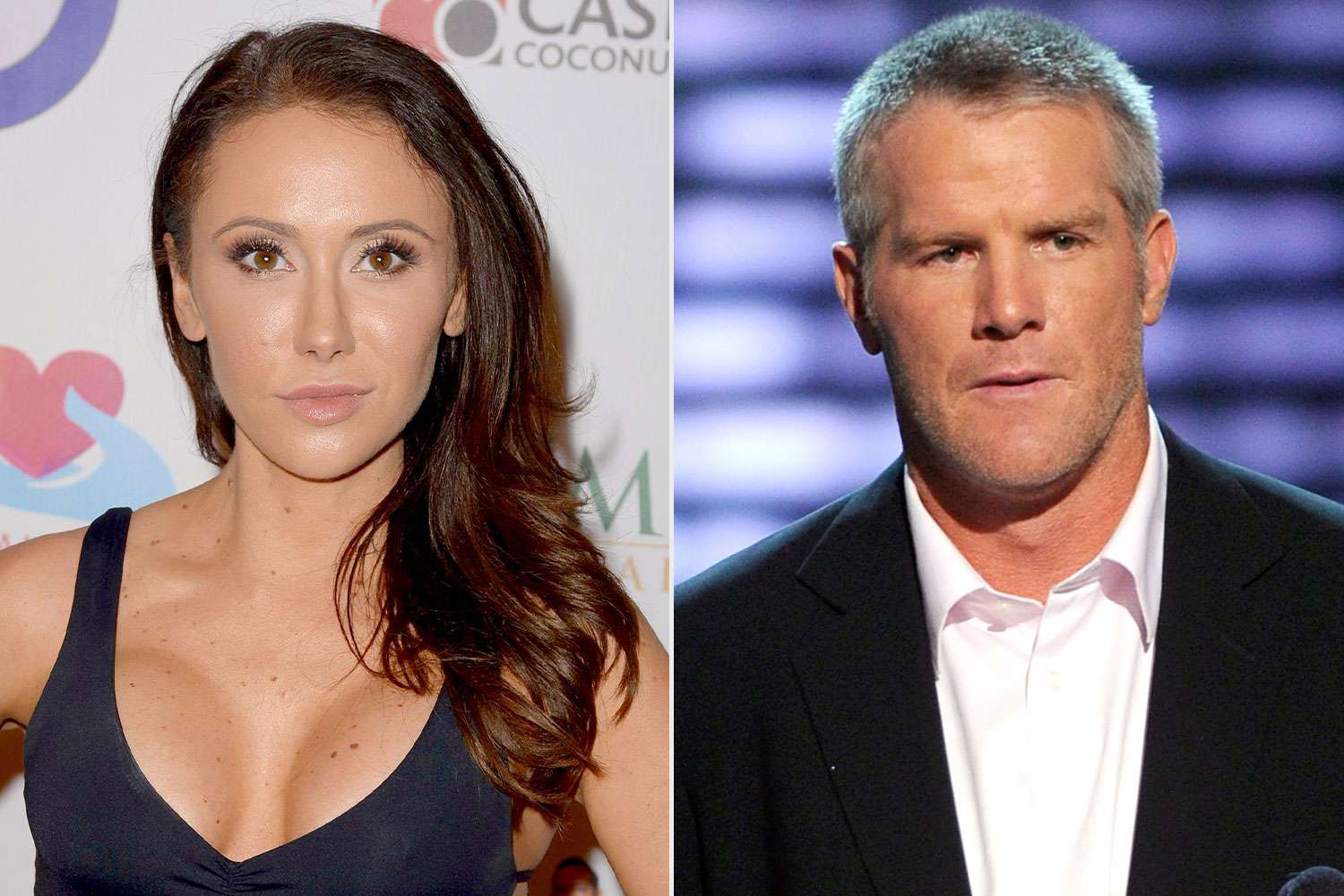

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On The Aftermath

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On The Aftermath

May 20, 2025 -

Analyzing The Clean Energy Tax Debate And Its Impact On The Us Economy

May 20, 2025

Analyzing The Clean Energy Tax Debate And Its Impact On The Us Economy

May 20, 2025 -

Novavax Covid 19 Vaccine Fda Grants Approval Under Specific Circumstances

May 20, 2025

Novavax Covid 19 Vaccine Fda Grants Approval Under Specific Circumstances

May 20, 2025 -

From Debut Novel To Bestseller Analyzing Taylor Jenkins Reids Publishing Triumph

May 20, 2025

From Debut Novel To Bestseller Analyzing Taylor Jenkins Reids Publishing Triumph

May 20, 2025 -

Philadelphia Eagles Sirianni Signs Contract Extension Following Super Bowl Lvii Victory

May 20, 2025

Philadelphia Eagles Sirianni Signs Contract Extension Following Super Bowl Lvii Victory

May 20, 2025