Analyzing The Clean Energy Tax Debate And Its Impact On The US Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Clean Energy Tax Debate and its Impact on the US Economy

The debate surrounding clean energy tax credits and incentives is heating up in the US, with significant implications for the nation's economic future. Proponents argue these policies are crucial for driving innovation, creating jobs, and combating climate change, while opponents raise concerns about costs, competitiveness, and potential market distortions. Understanding the nuances of this debate is vital for navigating the complex interplay between environmental policy and economic growth.

The Current Landscape of Clean Energy Tax Incentives:

The US currently offers a variety of tax credits and incentives aimed at boosting clean energy adoption. These include:

- Production Tax Credits (PTCs): These credits incentivize the production of renewable energy, such as wind and solar power. The amount of the credit varies depending on the technology and is often phased out over time.

- Investment Tax Credits (ITCs): These credits encourage investment in renewable energy infrastructure, including solar panels, wind turbines, and energy storage systems. Like PTCs, the ITC rates can change based on technology and project size.

- Clean Vehicle Tax Credits: These credits incentivize the purchase of electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs), aiming to accelerate the transition to cleaner transportation.

These incentives are often debated regarding their effectiveness and long-term sustainability. Some argue that they artificially inflate the clean energy sector, while others contend they are necessary to level the playing field with fossil fuels which historically have benefited from substantial government subsidies.

Arguments For Clean Energy Tax Incentives:

Supporters emphasize the multifaceted economic benefits:

- Job Creation: The clean energy sector is a significant job creator, offering opportunities in manufacturing, installation, maintenance, and research. Tax incentives accelerate this job growth.

- Economic Diversification: Investing in clean energy reduces reliance on volatile fossil fuel markets, promoting economic stability and resilience.

- Technological Innovation: Government support fosters innovation and the development of more efficient and cost-effective clean energy technologies.

- Environmental Benefits: The transition to clean energy is crucial for mitigating climate change and improving air quality, leading to long-term health and economic benefits.

Arguments Against Clean Energy Tax Incentives:

Critics raise several counterarguments:

- Cost to Taxpayers: Providing tax credits and incentives represents a significant cost to taxpayers, raising questions about efficiency and alternative uses of these funds.

- Market Distortions: Some argue that these incentives create an uneven playing field, potentially disadvantaging conventional energy sources and hindering competition.

- Inefficiency and "Picking Winners": Concerns exist about government intervention potentially supporting less efficient technologies or companies, leading to wasted resources.

- Impact on Energy Prices: The impact of clean energy incentives on overall energy prices is a subject of ongoing debate. While some argue they could increase prices in the short term, others believe they lead to long-term price reductions through technological advancements and market competition.

The Economic Impact: A Complex Picture:

The economic impact of clean energy tax policies is complex and multifaceted. Studies have yielded varying results, depending on the assumptions used and the specific policies analyzed. Some research suggests significant economic benefits, while others highlight potential drawbacks. Furthermore, the long-term economic effects are difficult to predict accurately due to technological advancements and evolving market dynamics.

Moving Forward: The Need for Data-Driven Policy:

To effectively inform the debate, a comprehensive and transparent evaluation of existing and proposed clean energy tax policies is crucial. This requires:

- Robust Data Collection: Accurate data on job creation, investment, technological progress, and environmental impacts is vital.

- Independent Economic Analysis: Rigorous and unbiased economic analysis can help policymakers understand the true costs and benefits of different policies.

- Adaptive Policymaking: Policies should be regularly reviewed and adjusted based on new data and evolving economic circumstances.

The clean energy tax debate is central to the future of the US economy and its environmental sustainability. By focusing on data-driven policymaking and fostering open dialogue, policymakers can strive to create a balanced approach that maximizes economic benefits while addressing environmental concerns effectively. Further research and public discourse are needed to ensure the long-term success of this crucial transition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Clean Energy Tax Debate And Its Impact On The US Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Treasury Yields Fall As Fed Hints At One Rate Cut In 2025

May 20, 2025

Us Treasury Yields Fall As Fed Hints At One Rate Cut In 2025

May 20, 2025 -

Economic Fallout Or Green Growth Analyzing The Clean Energy Tax Plan

May 20, 2025

Economic Fallout Or Green Growth Analyzing The Clean Energy Tax Plan

May 20, 2025 -

Bali Cracks Down On Bad Tourist Behavior New Guidelines Unveiled

May 20, 2025

Bali Cracks Down On Bad Tourist Behavior New Guidelines Unveiled

May 20, 2025 -

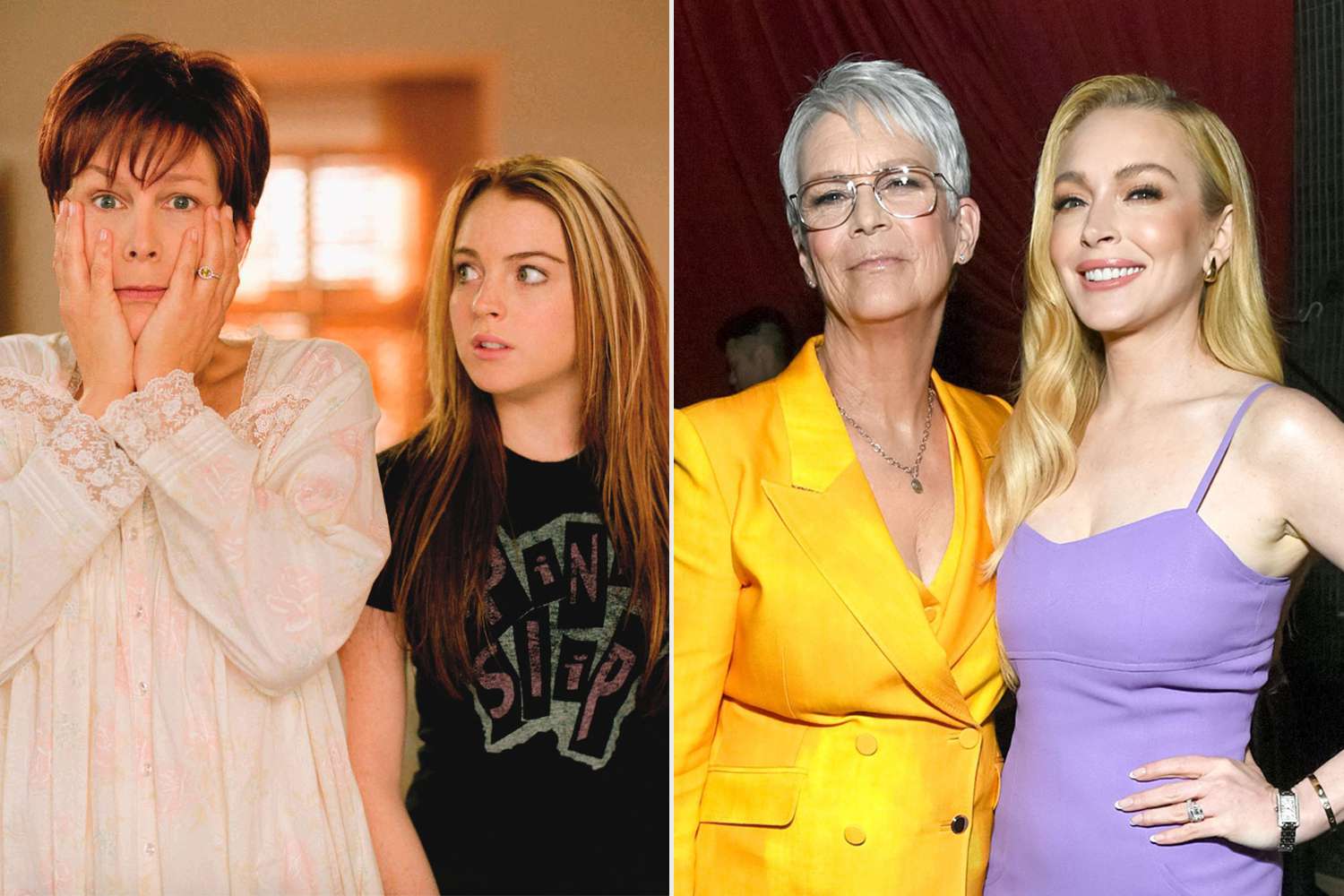

Jamie Lee Curtis On Her Lasting Friendship With Lindsay Lohan A Candid Conversation

May 20, 2025

Jamie Lee Curtis On Her Lasting Friendship With Lindsay Lohan A Candid Conversation

May 20, 2025 -

Stock Market Rally Continues S And P 500s Six Day Winning Streak Fuels Market Optimism

May 20, 2025

Stock Market Rally Continues S And P 500s Six Day Winning Streak Fuels Market Optimism

May 20, 2025