Record Bitcoin ETF Investments: $5B+ Inflow Signals Market Confidence

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Bitcoin ETF Investments: $5 Billion+ Inflow Signals Market Confidence

Bitcoin ETF investments have surged past the $5 billion mark, signaling a significant vote of confidence in the cryptocurrency from institutional investors. This record inflow represents a monumental shift in the perception of Bitcoin, moving beyond the volatile asset class it was once considered to be and into the mainstream investment sphere. The implications for Bitcoin's future price and broader market adoption are significant.

This unprecedented influx of capital into Bitcoin exchange-traded funds (ETFs) marks a turning point for the digital currency. For years, institutional investors remained hesitant due to concerns about regulation, volatility, and security. However, the recent approvals of several Bitcoin ETFs in major markets, coupled with increased regulatory clarity in some jurisdictions, have significantly eased these concerns.

What's Driving the Record Investment?

Several factors are contributing to this massive investment surge:

- Regulatory Approvals: The approval of Bitcoin ETFs by key regulatory bodies like the SEC (in the US, albeit limited approvals for spot Bitcoin ETFs) has legitimized Bitcoin in the eyes of many institutional investors. This approval signals a degree of regulatory oversight and acceptance, reducing perceived risk.

- Institutional Adoption: Large financial institutions are increasingly recognizing Bitcoin as a potential asset class diversification tool. This is evident in the growing number of institutional investors allocating a portion of their portfolios to Bitcoin ETFs.

- Inflation Hedge: With persistent inflation in many parts of the world, Bitcoin is seen by some as a potential hedge against inflation, offering an alternative investment option to traditional assets.

- Increased Market Maturity: The Bitcoin market has matured significantly since its inception, with improved infrastructure, increased security measures, and a more robust ecosystem.

The Implications of the $5 Billion+ Inflow

This record inflow carries several significant implications:

- Price Volatility: While not a direct causation, this influx of capital could lead to increased price stability in the long term, as a more significant and diverse investor base can absorb market fluctuations more effectively. However, short-term volatility remains a possibility.

- Increased Market Liquidity: The increased volume of trading in Bitcoin ETFs will contribute to improved market liquidity, making it easier for investors to buy and sell Bitcoin without significantly impacting the price.

- Mainstream Adoption: The growing adoption of Bitcoin ETFs represents a key step towards mainstream acceptance of Bitcoin as a legitimate investment asset. This could lead to increased accessibility and broader adoption in the future.

Looking Ahead: What Does the Future Hold for Bitcoin ETFs?

The future looks bright for Bitcoin ETFs. As regulatory clarity improves and institutional adoption continues to grow, we can expect to see further increases in investment. However, challenges remain, including potential regulatory hurdles in different jurisdictions and the inherent volatility of the cryptocurrency market. The ongoing evolution of the regulatory landscape will play a crucial role in shaping the future of Bitcoin ETFs and their impact on the broader cryptocurrency market.

It's crucial to remember that investing in Bitcoin, or any cryptocurrency, carries significant risk. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions. Consult with a qualified financial advisor before investing in Bitcoin ETFs or any other cryptocurrency-related investments.

Keywords: Bitcoin ETF, Bitcoin investment, cryptocurrency investment, institutional investors, ETF inflow, Bitcoin price, cryptocurrency regulation, SEC, Bitcoin ETF approval, market liquidity, inflation hedge, Bitcoin adoption.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Bitcoin ETF Investments: $5B+ Inflow Signals Market Confidence. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

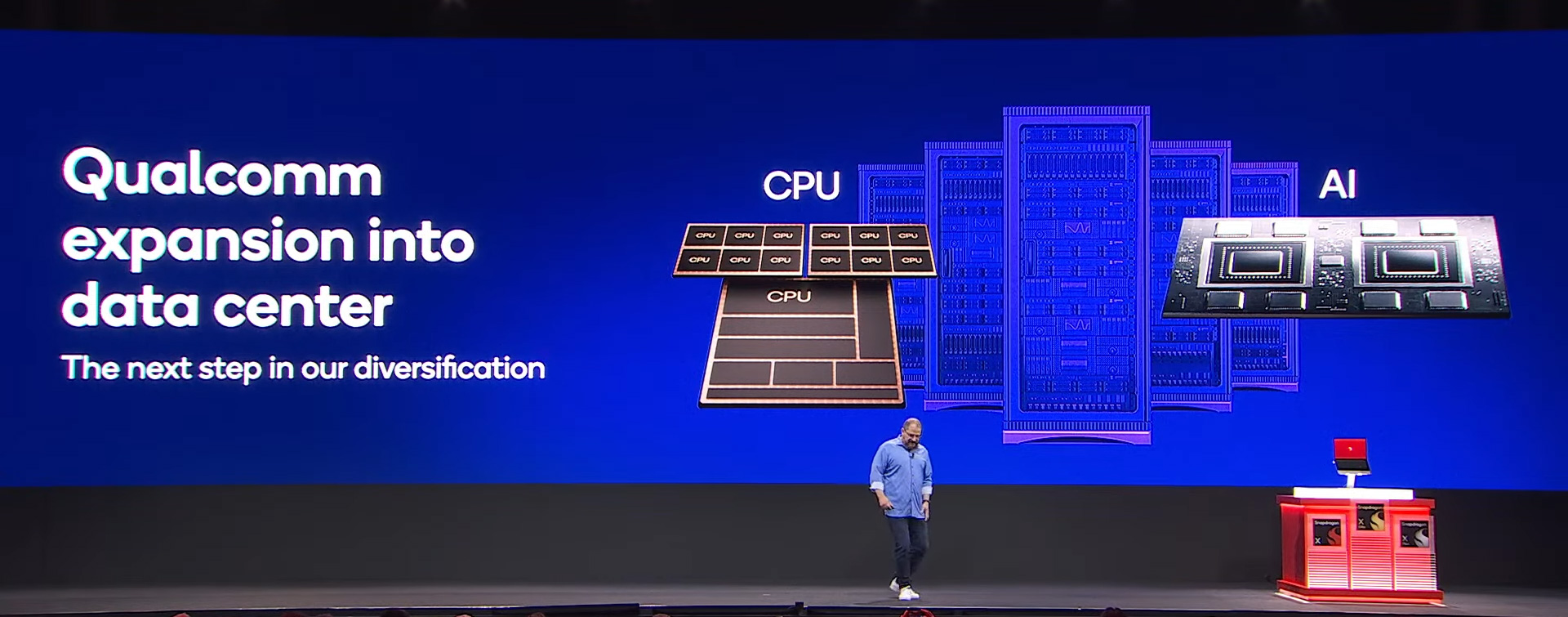

Qualcomm Unveils Plans For Powerful New Data Center Cpus And Ai Inference Accelerators

May 20, 2025

Qualcomm Unveils Plans For Powerful New Data Center Cpus And Ai Inference Accelerators

May 20, 2025 -

World War I Epic Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Details

May 20, 2025

World War I Epic Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Details

May 20, 2025 -

Tariff Tensions Escalate Trump Vs Walmart On Price Increases

May 20, 2025

Tariff Tensions Escalate Trump Vs Walmart On Price Increases

May 20, 2025 -

Rba Interest Rate Decision 3 85 Implications For Borrowers

May 20, 2025

Rba Interest Rate Decision 3 85 Implications For Borrowers

May 20, 2025 -

Jones Vs Ufc Controversy Erupts Over Aspinalls Injury Disclosure

May 20, 2025

Jones Vs Ufc Controversy Erupts Over Aspinalls Injury Disclosure

May 20, 2025