RBA Interest Rate Decision: 3.85% - Implications For Borrowers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RBA Interest Rate Decision: 3.85% – What it Means for Australian Borrowers

The Reserve Bank of Australia (RBA) has delivered another blow to borrowers, hiking the cash rate by 25 basis points to 3.85%. This marks the 12th consecutive rate increase since May 2022, bringing the official cash rate to its highest level since February 2012. While the RBA hinted at a potential pause, the persistent inflation remains a key concern, pushing them to continue tightening monetary policy. This decision has significant implications for homeowners, businesses, and the broader Australian economy.

What does this mean for borrowers?

The immediate impact is a further increase in mortgage repayments. For those with a variable-rate home loan, this translates to higher monthly expenses. The extent of the increase will depend on the size of the loan, the remaining loan term, and the individual lender's pricing structure. Borrowers should expect to see their monthly payments rise, potentially putting a strain on household budgets.

- Increased Monthly Payments: Even a 0.25% increase can add hundreds of dollars to monthly mortgage repayments, depending on the loan amount. Many borrowers are already feeling the pinch from previous rate rises.

- Budgetary Strain: The cumulative effect of consecutive rate hikes is placing significant pressure on household finances. This is particularly challenging for those with tight budgets or those who took out loans at historically low rates.

- Potential for Refinancing: With rates continuing to climb, some borrowers might consider refinancing their home loan to secure a more favorable interest rate or a different loan structure. However, it's crucial to compare offers carefully and consider any associated fees.

The Bigger Picture: Inflation and Economic Growth

The RBA's decision underscores its ongoing battle against inflation. While recent data suggests a slowing of inflation, it remains stubbornly above the target range. The central bank believes further rate increases are necessary to bring inflation back down to its 2-3% target. This strategy, however, carries the risk of slowing economic growth and potentially triggering a recession.

What to do if you're a borrower:

- Review your budget: Carefully assess your household income and expenses to determine how the rate increase will impact your financial situation.

- Contact your lender: Discuss your options with your lender, including potential hardship programs or refinancing opportunities. Many lenders offer support for borrowers facing financial difficulties.

- Seek financial advice: Consider seeking advice from a financial advisor to explore strategies for managing your debt and navigating the current economic climate. They can help you create a personalized plan.

- Explore potential savings: Look for areas where you can cut back on expenses to offset the increased mortgage repayments.

Looking Ahead: Further Rate Hikes?

While the RBA has signaled a potential pause in future meetings, the path forward remains uncertain. The future direction of interest rates will depend heavily on upcoming inflation data and the overall economic outlook. Many economists are closely watching indicators like wage growth and consumer spending to gauge the effectiveness of the RBA's monetary policy.

This period of rising interest rates presents significant challenges for Australian borrowers. Proactive planning, open communication with your lender, and potentially seeking professional financial advice are crucial steps to navigate this challenging economic environment. Stay informed about upcoming RBA announcements and economic data to better understand the implications for your financial future. For further information on financial support and resources, visit the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RBA Interest Rate Decision: 3.85% - Implications For Borrowers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Diminishing Role In Putins Calculations

May 20, 2025

Trumps Diminishing Role In Putins Calculations

May 20, 2025 -

Post Pectra Upgrade Ethereum Attracts 200 Million In Investor Funds

May 20, 2025

Post Pectra Upgrade Ethereum Attracts 200 Million In Investor Funds

May 20, 2025 -

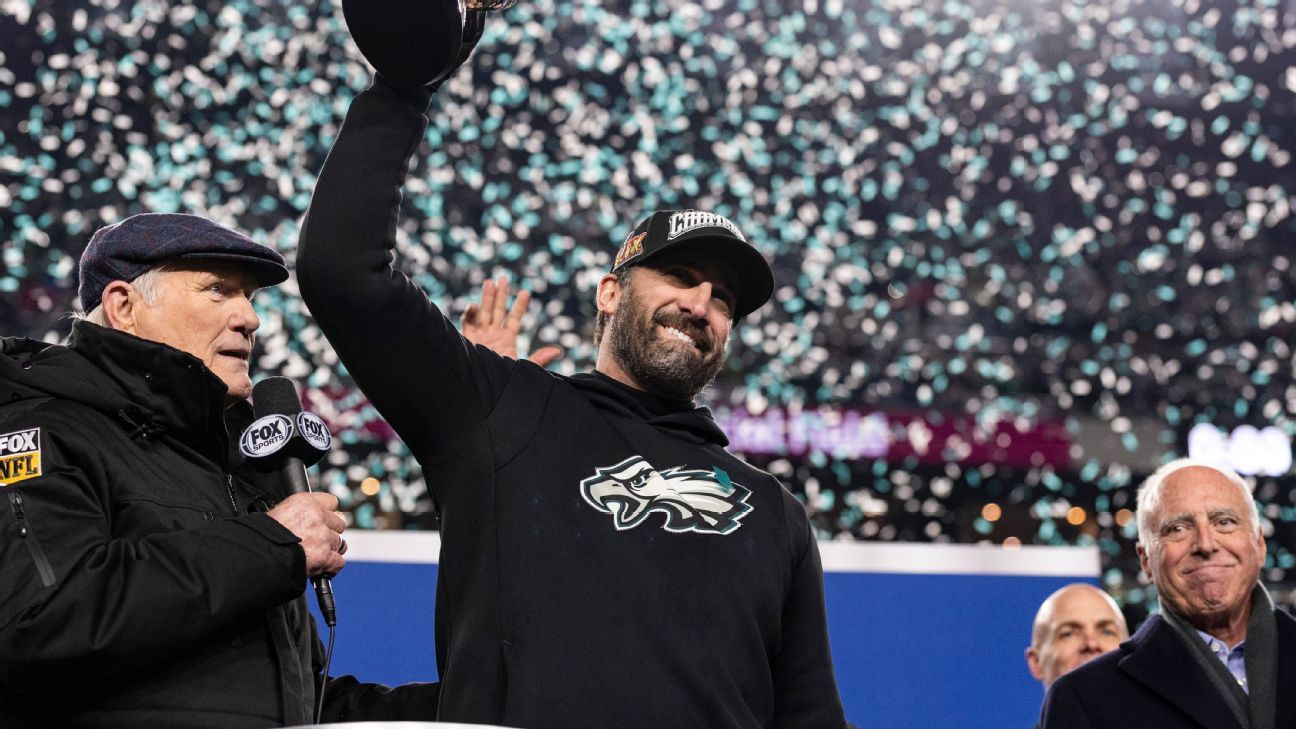

Philadelphia Eagles Coach Sirianni Receives Well Earned Contract Extension

May 20, 2025

Philadelphia Eagles Coach Sirianni Receives Well Earned Contract Extension

May 20, 2025 -

Daniel Craig Cillian Murphy And Tom Hardy Star In New Ww 1 Film Streaming Now

May 20, 2025

Daniel Craig Cillian Murphy And Tom Hardy Star In New Ww 1 Film Streaming Now

May 20, 2025 -

World Peace Appeal Key Moments From Pope Leos Inauguration Ceremony

May 20, 2025

World Peace Appeal Key Moments From Pope Leos Inauguration Ceremony

May 20, 2025