Will Clean Energy Taxes Boost Or Break America's Economy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Taxes Boost or Break America's Economy? A Complex Question with No Easy Answers

The debate surrounding clean energy taxes in America is heating up, and with good reason. Proponents argue these taxes are crucial for driving the transition to a sustainable future, while opponents fear economic repercussions. But will these taxes ultimately boost or break the American economy? The answer, unfortunately, isn't simple and depends on a multitude of factors.

This article delves into the complexities of this crucial issue, examining the potential economic benefits and drawbacks of implementing clean energy taxes in the United States. We'll explore the arguments from both sides, analyze the potential impact on various sectors, and consider the long-term implications for economic growth and job creation.

The Arguments for Clean Energy Taxes: A Green Stimulus?

Advocates for clean energy taxes often frame them as a necessary investment in the future. These taxes, typically in the form of carbon taxes or fees on fossil fuel emissions, aim to:

- Internalize externalities: Fossil fuels impose significant environmental costs (pollution, climate change) not reflected in their market price. Taxes help internalize these costs, making cleaner energy sources more competitive.

- Stimulate green innovation: By making fossil fuels more expensive, clean energy taxes incentivize research, development, and deployment of renewable energy technologies like solar, wind, and geothermal. This fosters innovation and creates new job opportunities in the burgeoning green sector.

- Reduce healthcare costs: Air pollution from fossil fuels contributes significantly to respiratory illnesses and other health problems. Reducing emissions through clean energy taxes can lead to substantial healthcare cost savings.

- Enhance global competitiveness: Early adoption of clean technologies can give the US a competitive edge in the global green economy, attracting investment and creating high-skilled jobs.

The Counterarguments: Economic Concerns and Potential Downsides

Opponents of clean energy taxes raise several concerns, primarily focusing on potential negative impacts on the economy:

- Increased energy costs: Higher taxes on fossil fuels can lead to increased energy prices for consumers and businesses, potentially slowing economic growth and impacting low-income households disproportionately.

- Job losses in fossil fuel industries: The transition to clean energy could lead to job losses in traditional fossil fuel industries, although proponents argue that these losses will be offset by job creation in the renewable energy sector. .

- Impact on manufacturing and industry: Energy-intensive industries could face higher production costs, potentially reducing competitiveness and leading to job losses or relocation.

- Potential for regressive taxation: If not designed carefully, clean energy taxes could disproportionately affect low-income households who spend a larger percentage of their income on energy.

Finding the Right Balance: Policy Design and Mitigation Strategies

The key to maximizing the benefits and minimizing the drawbacks of clean energy taxes lies in careful policy design. This includes:

- Revenue recycling: Using the revenue generated from clean energy taxes to fund investments in renewable energy infrastructure, energy efficiency programs, or tax cuts for low-income households can mitigate the regressive effects.

- Phased implementation: A gradual increase in taxes over time allows businesses and consumers to adapt, minimizing the immediate economic shock.

- Targeted support for affected industries: Providing assistance to workers and communities impacted by the transition to clean energy can help ease the adjustment process. .

Conclusion: A Long-Term Investment with Uncertainties

The impact of clean energy taxes on the American economy is a complex issue with no easy answers. While potential economic drawbacks exist, ignoring the long-term costs of climate change and the opportunities presented by the green economy would be a grave mistake. Careful policy design, coupled with a commitment to a just transition for workers and communities, is crucial for maximizing the benefits and minimizing the risks of this critical policy decision. The debate continues, but one thing is certain: the future of the American economy is inextricably linked to its approach to clean energy. What are your thoughts? Share your opinion in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Taxes Boost Or Break America's Economy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Refinance Your Mortgage Rates Fall On May 19 2025

May 20, 2025

Refinance Your Mortgage Rates Fall On May 19 2025

May 20, 2025 -

May 15th Helldivers 2 Masters Of Ceremony Warbond Drop Begins

May 20, 2025

May 15th Helldivers 2 Masters Of Ceremony Warbond Drop Begins

May 20, 2025 -

Bitcoin Etf Investments Surge Past 5 Billion Analyzing The Market Trend

May 20, 2025

Bitcoin Etf Investments Surge Past 5 Billion Analyzing The Market Trend

May 20, 2025 -

Joel And Ellies Evolving Dynamic A Comparative Analysis Of The Last Of Us Game And Season 2

May 20, 2025

Joel And Ellies Evolving Dynamic A Comparative Analysis Of The Last Of Us Game And Season 2

May 20, 2025 -

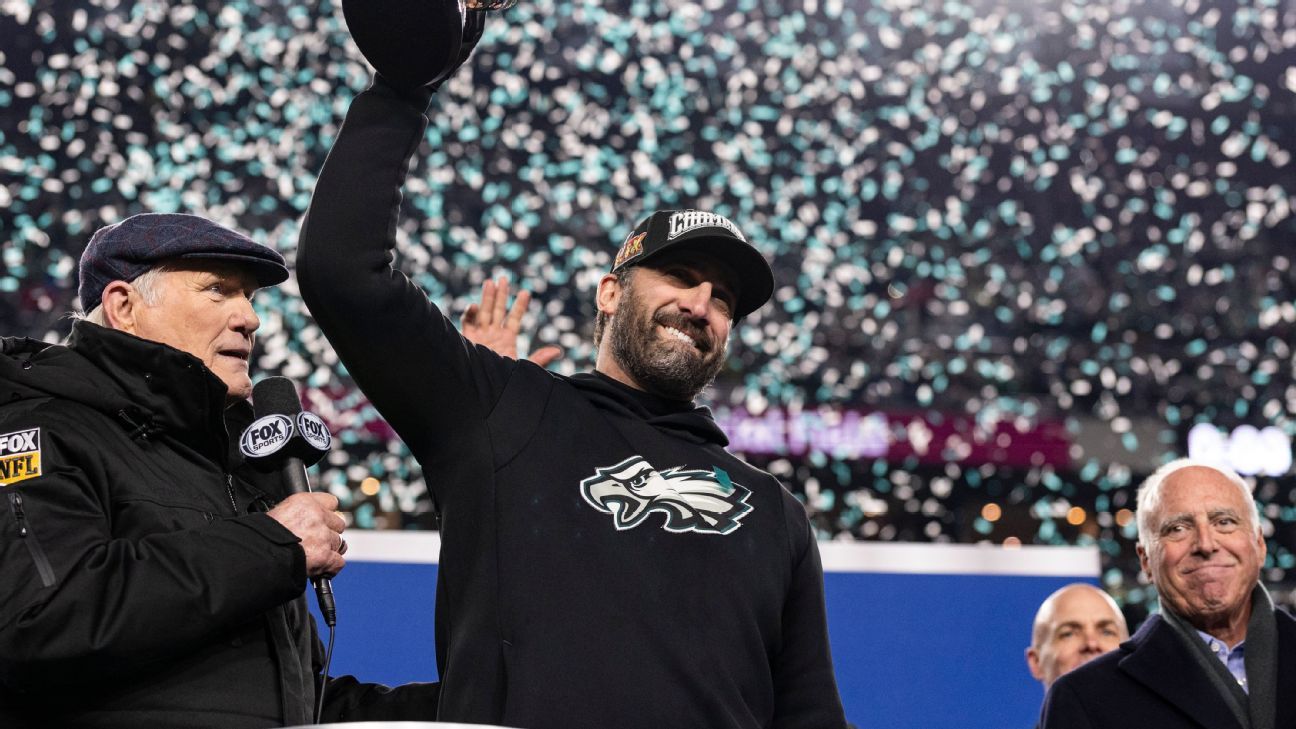

Nfl News Philadelphia Eagles Reward Sirianni With Contract Extension

May 20, 2025

Nfl News Philadelphia Eagles Reward Sirianni With Contract Extension

May 20, 2025