Refinance Your Mortgage: Rates Fall On May 19, 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Refinance Your Mortgage: Rates Fall on May 19, 2025 – Is Now the Time?

Mortgage rates took a dip on May 19th, 2025, presenting a potentially lucrative opportunity for homeowners considering refinancing. This unexpected shift in the market has many asking: Should I refinance my mortgage? Let's delve into the details and explore whether this rate drop benefits you.

The recent decline in mortgage rates follows [mention specific market event or economic indicator that influenced the drop, e.g., a surprise announcement from the Federal Reserve, a change in inflation projections, etc.]. This unexpected movement has created a window of opportunity for those seeking lower monthly payments, shorter loan terms, or access to cash through a cash-out refinance.

Understanding the Current Mortgage Rate Landscape

As of May 19th, 2025, average mortgage rates are [insert specific data on average rates for different loan types, e.g., 30-year fixed, 15-year fixed, ARM]. This represents a [percentage] decrease compared to [mention previous rate period for comparison, e.g., the average rates in April 2025]. However, it's crucial to remember that these are average rates, and your individual rate will depend on several factors, including:

- Credit score: A higher credit score typically qualifies you for a lower interest rate.

- Down payment: A larger down payment often translates to better terms.

- Loan type: Different loan types (e.g., FHA, VA, conventional) carry varying interest rates.

- Debt-to-income ratio (DTI): A lower DTI shows lenders you can comfortably manage your debt.

Is Refinancing Right for You?

Before diving into the refinance process, carefully consider these points:

- How much will you save? Calculate the potential savings in monthly payments and total interest paid over the life of the loan. Use an online mortgage refinance calculator to estimate your potential savings. [Link to a reputable mortgage calculator].

- Closing costs: Refinancing involves closing costs, which can eat into your savings. Factor these costs into your calculations to determine the overall net benefit.

- Your current loan terms: How much time remains on your current mortgage? A shorter remaining term might make refinancing less worthwhile.

- Interest rate difference: A significant difference between your current rate and the new rate is essential to justify the refinancing costs.

- Your long-term financial goals: Consider if refinancing aligns with your broader financial plan.

Types of Refinancing Options:

Several refinance options exist, each catering to different needs:

- Rate-and-term refinance: Lower your interest rate and/or shorten your loan term.

- Cash-out refinance: Borrow against your home's equity to access cash for renovations, debt consolidation, or other expenses.

- Cash-in refinance: Pay down your principal balance to reduce your loan amount and monthly payments.

Taking the Next Steps:

If you believe refinancing is beneficial, shop around for the best rates from multiple lenders. Compare not just interest rates but also closing costs and fees. Consider working with a mortgage broker who can help you navigate the process and find the most suitable option. Remember to thoroughly review all loan documents before signing.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any major financial decisions.

Keywords: Refinance mortgage, mortgage rates, May 19 2025, mortgage refinancing, lower mortgage rates, refinance calculator, cash-out refinance, rate and term refinance, home equity, mortgage lenders.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Refinance Your Mortgage: Rates Fall On May 19, 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Peaky Blinders Future Confirmed Creator Reveals Major Creative Shift

May 20, 2025

Peaky Blinders Future Confirmed Creator Reveals Major Creative Shift

May 20, 2025 -

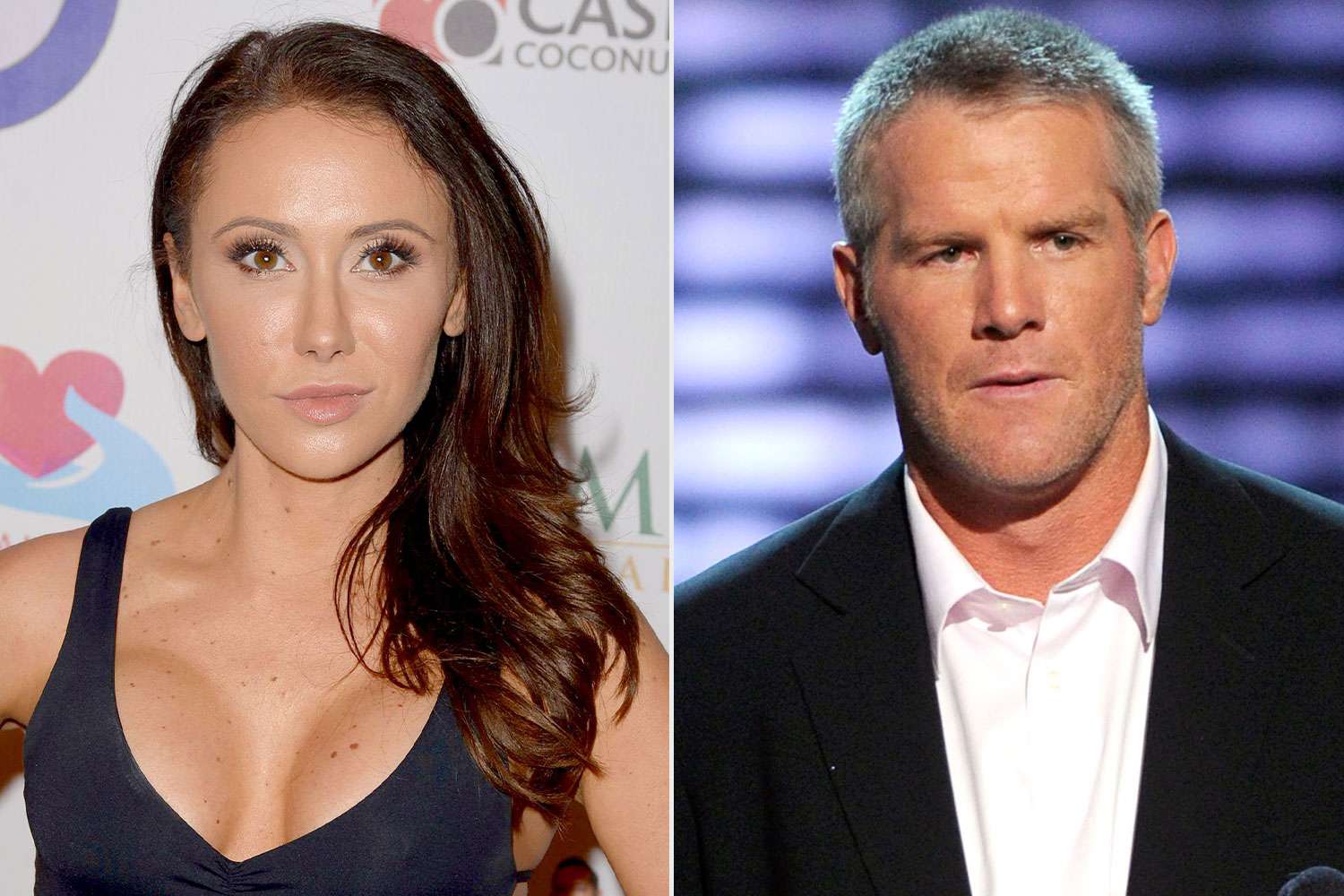

Brett Favres Legacy Under Scrutiny Netflix Documentary To Reveal All

May 20, 2025

Brett Favres Legacy Under Scrutiny Netflix Documentary To Reveal All

May 20, 2025 -

Ntrs Globetrotting Spree Details Emerge From Recent Trips

May 20, 2025

Ntrs Globetrotting Spree Details Emerge From Recent Trips

May 20, 2025 -

Wall Street Defies Moody S Six Day Winning Streak For S And P 500

May 20, 2025

Wall Street Defies Moody S Six Day Winning Streak For S And P 500

May 20, 2025 -

Jenn Sterger Revisits The Brett Favre Scandal A Story Of Exploitation And Neglect

May 20, 2025

Jenn Sterger Revisits The Brett Favre Scandal A Story Of Exploitation And Neglect

May 20, 2025