Will Clean Energy Tax Incentives Deliver Economic Prosperity? A US Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Clean Energy Tax Incentives Deliver Economic Prosperity? A US Perspective

The Inflation Reduction Act (IRA), signed into law in 2022, represents the most significant investment in clean energy in US history. At its core lie substantial tax incentives aimed at accelerating the transition to a greener economy. But will these incentives truly deliver the promised economic prosperity? This question is central to ongoing debates about the Act's effectiveness and long-term impact.

While proponents argue the IRA will create millions of jobs and stimulate economic growth, skeptics raise concerns about potential costs, market distortions, and the overall feasibility of achieving the ambitious targets set forth. Let's delve into both sides of this critical discussion.

The Promise of Green Jobs and Economic Growth

The IRA offers a plethora of tax credits and incentives designed to boost investment in renewable energy sources like solar, wind, and geothermal power. These include:

- Production Tax Credits (PTC): Incentivizing the production of clean electricity.

- Investment Tax Credits (ITC): Encouraging investment in renewable energy infrastructure.

- Clean Vehicle Tax Credits: Boosting demand for electric vehicles (EVs) and associated charging infrastructure.

- Energy Efficiency Tax Credits: Incentivizing homeowners and businesses to improve energy efficiency.

The argument for economic prosperity hinges on the creation of numerous jobs across the clean energy sector – from manufacturing and installation to research and development. Supporters point to the potential for revitalizing economically depressed areas by attracting investment and fostering new industries. Furthermore, a robust clean energy sector is anticipated to enhance US global competitiveness in a rapidly evolving market. [Link to a relevant government report on job creation in the clean energy sector].

Potential Challenges and Concerns

Despite the optimism, several challenges could hinder the IRA's ability to deliver on its economic promises:

- Supply Chain Constraints: The rapid expansion of the clean energy sector might face challenges due to limited availability of critical materials and skilled labor. [Link to an article discussing supply chain issues in renewable energy].

- Inflationary Pressures: Increased demand for certain materials could contribute to inflation, negating some of the intended economic benefits.

- Geographic Disparities: The benefits of the IRA may not be evenly distributed across the country, potentially exacerbating existing regional economic inequalities.

- Market Distortion: Some critics argue that the substantial tax incentives could distort the energy market, leading to inefficiencies and unintended consequences.

The Long-Term Outlook: A Balancing Act

The ultimate success of the IRA's tax incentives in fostering economic prosperity will depend on a complex interplay of factors. Careful planning, efficient implementation, and ongoing monitoring are crucial to address potential challenges and maximize the positive economic impacts. Transparency and accountability will be key to ensuring the incentives are used effectively and efficiently.

Further research is needed to fully understand the long-term consequences of these policies. Economists are closely monitoring job growth, investment levels, and the overall impact on the US economy. The next few years will be crucial in determining whether the ambitious goals of the IRA can be realized.

Call to Action: Stay Informed

The economic future of the US, in part, rests on the success of the IRA's clean energy initiatives. Staying informed about the ongoing developments, research findings, and policy debates surrounding the Act is crucial for citizens and policymakers alike. Engage with credible sources of information and participate in the conversation to ensure a sustainable and prosperous future for all.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Clean Energy Tax Incentives Deliver Economic Prosperity? A US Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ufc Accused Of Concealing Aspinalls Condition Jon Jones Speaks Out

May 20, 2025

Ufc Accused Of Concealing Aspinalls Condition Jon Jones Speaks Out

May 20, 2025 -

Eagles Head Coach Nick Sirianni Secures Long Term Deal Following Super Bowl Lvii Win

May 20, 2025

Eagles Head Coach Nick Sirianni Secures Long Term Deal Following Super Bowl Lvii Win

May 20, 2025 -

Joel And Ellies Evolving Dynamic Analyzing The Key Differences Between The Last Of Us Game And Season 2

May 20, 2025

Joel And Ellies Evolving Dynamic Analyzing The Key Differences Between The Last Of Us Game And Season 2

May 20, 2025 -

Ukraine War Trumps Planned Monday Conversation With Putin

May 20, 2025

Ukraine War Trumps Planned Monday Conversation With Putin

May 20, 2025 -

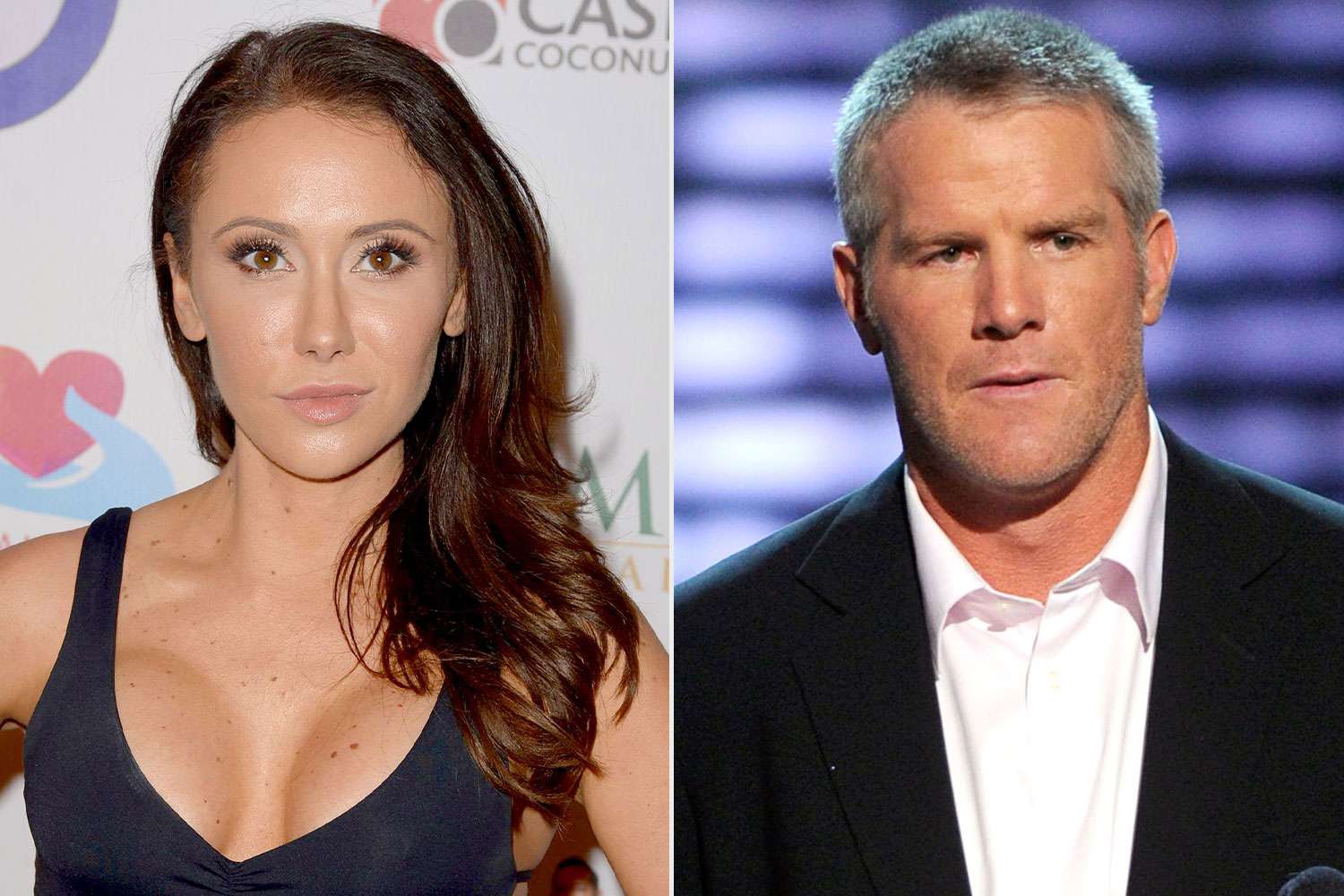

Jenn Sterger Recounts Emotional Toll Of Brett Favre Sext Scandal A Story Of Neglect

May 20, 2025

Jenn Sterger Recounts Emotional Toll Of Brett Favre Sext Scandal A Story Of Neglect

May 20, 2025