Over $5 Billion Pours Into Bitcoin ETFs: A Look At The Bold Investment Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Pours into Bitcoin ETFs: A Look at the Bold Investment Strategies

The cryptocurrency market is buzzing. More than $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) since the SEC's approval of the first spot Bitcoin ETF, sparking a wave of institutional and retail investor interest. This unprecedented influx represents a significant shift in how traditional investors are approaching the volatile yet potentially lucrative world of Bitcoin. But what bold investment strategies are driving this massive investment? Let's delve into the details.

The SEC Approval: A Game Changer

The approval of the BlackRock Bitcoin ETF marked a pivotal moment. For years, the Securities and Exchange Commission (SEC) had resisted approving spot Bitcoin ETFs, citing concerns about market manipulation and investor protection. This approval signaled a change in regulatory sentiment and opened the floodgates for other asset managers to launch their own Bitcoin ETFs. This is a major milestone for Bitcoin's legitimacy and mainstream adoption. [Link to SEC announcement]

Why the Sudden Surge in Investment?

Several factors contribute to this massive investment surge:

-

Increased Institutional Adoption: The availability of ETFs makes it easier for institutional investors like pension funds and hedge funds to gain exposure to Bitcoin. ETFs offer a familiar and regulated investment vehicle, reducing the complexities and risks associated with directly purchasing and storing Bitcoin.

-

Regulatory Clarity (or at least, more of it): The SEC approval provides a degree of regulatory certainty, alleviating concerns about the legal landscape surrounding Bitcoin investments. This encourages more risk-averse investors to enter the market.

-

Diversification Strategies: Many investors view Bitcoin as a potential hedge against inflation and a diversifying asset in their portfolios. ETFs provide a convenient way to achieve this diversification without the complexities of directly managing cryptocurrency holdings.

-

Accessibility for Retail Investors: ETFs lower the barrier to entry for retail investors. They can now access Bitcoin through their brokerage accounts, simplifying the investment process and making it more accessible to a wider audience.

Bold Investment Strategies Unveiled

The significant investment in Bitcoin ETFs reflects a range of bold investment strategies:

-

Dollar-Cost Averaging (DCA): Many investors are employing DCA, regularly investing a fixed amount of money into Bitcoin ETFs regardless of price fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak.

-

Strategic Allocation: Institutional investors are strategically allocating a portion of their portfolios to Bitcoin ETFs, viewing it as a long-term growth asset with the potential to outperform traditional investments.

-

Hedging Against Inflation: With persistent inflation concerns, many investors see Bitcoin as a potential inflation hedge, storing value outside of traditional fiat currencies.

-

Technological Advancement Betting: The underlying belief in Bitcoin's long-term value and the potential of blockchain technology fuels many investments.

The Future of Bitcoin ETFs

The future looks bright for Bitcoin ETFs. More ETF applications are currently pending with the SEC, and we can expect a continued influx of investment as more products are approved. However, it's crucial to remember that Bitcoin remains a highly volatile asset, and investors should proceed with caution and conduct thorough research before investing.

Call to Action: Stay informed about the latest developments in the Bitcoin ETF market by subscribing to our newsletter [link to newsletter signup] and following us on social media [links to social media]. Remember to always consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Pours Into Bitcoin ETFs: A Look At The Bold Investment Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reserve Bank Of Australia Lowers Rates To Two Year Low Amid Easing Inflation

May 20, 2025

Reserve Bank Of Australia Lowers Rates To Two Year Low Amid Easing Inflation

May 20, 2025 -

Analysis Putin Demonstrates Trumps Reduced Leverage On The World Stage

May 20, 2025

Analysis Putin Demonstrates Trumps Reduced Leverage On The World Stage

May 20, 2025 -

From Debut Novel To Bestseller Analyzing Taylor Jenkins Reids Publishing Triumph

May 20, 2025

From Debut Novel To Bestseller Analyzing Taylor Jenkins Reids Publishing Triumph

May 20, 2025 -

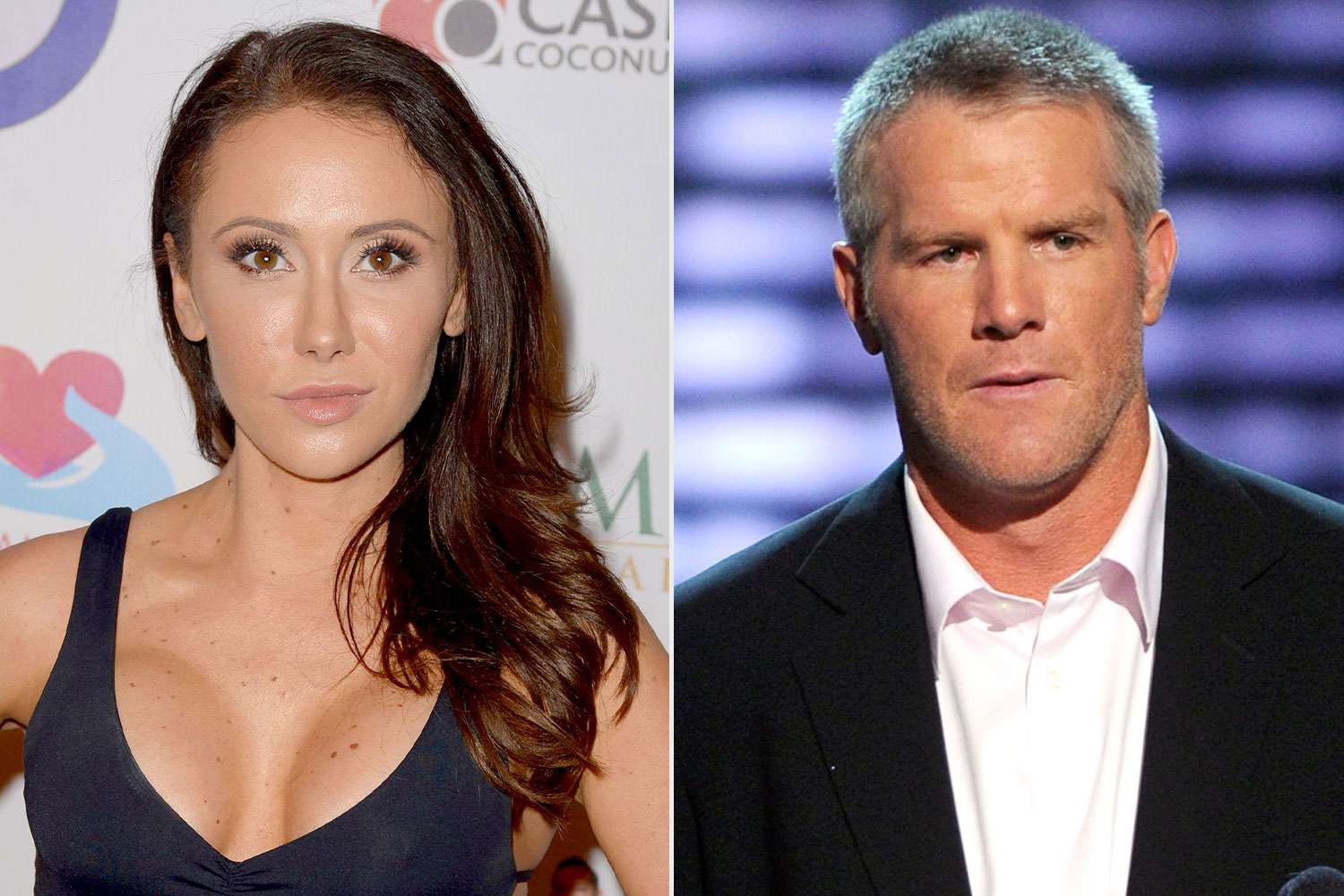

Jenn Sterger Speaks Out The Lasting Impact Of The Brett Favre Sexting Scandal

May 20, 2025

Jenn Sterger Speaks Out The Lasting Impact Of The Brett Favre Sexting Scandal

May 20, 2025 -

Reimagining The Relationship How The Last Of Us Season 2 Diverges From The Games Narrative For Joel And Ellie

May 20, 2025

Reimagining The Relationship How The Last Of Us Season 2 Diverges From The Games Narrative For Joel And Ellie

May 20, 2025