Wall Street Rebounds: S&P 500 Extends Winning Streak Despite Moody's Rating Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Rebounds: S&P 500 Extends Winning Streak Despite Moody's Downgrade

Wall Street defied expectations on Tuesday, with the S&P 500 extending its winning streak despite Moody's Investors Service downgrading the credit ratings of several U.S. banking giants. This unexpected resilience sparked debate among market analysts regarding the future trajectory of the market. The move highlights the complex interplay of factors currently shaping investor sentiment.

The S&P 500 closed up 0.7%, adding to its gains from Monday, while the Dow Jones Industrial Average rose 166 points. The Nasdaq Composite, heavily weighted with technology stocks, also saw a modest increase. This upward trend contradicts predictions of a significant market correction following Moody's decision to downgrade 10 midsize banks and place others under review for potential downgrades. The rating agency cited concerns about increasing credit risk and the potential for further deterioration in asset quality within the banking sector.

<h3>Moody's Downgrade: A Deeper Dive</h3>

Moody's cited rising loan losses and weakening profitability as key factors behind the downgrades. The agency highlighted the challenging economic environment, including persistent inflation and the potential for a recession, as contributing to increased pressure on the banking sector. This action shook investor confidence initially, but the market's rebound suggests that the impact might be less severe than initially feared. Several analysts believe the market had already priced in a degree of this risk.

This isn't the first time Moody's has issued warnings about the banking sector. Earlier this year, concerns around regional bank failures fueled market volatility. However, the current situation differs slightly, focusing primarily on smaller and mid-sized banks rather than the largest institutions. This nuanced difference may explain the market's relatively muted response.

<h3>Why Did the Market Rebound?</h3>

Several factors likely contributed to the market's resilience. Firstly, the Federal Reserve's recent pause in interest rate hikes might be offering some relief to investors. The pause suggests a potential easing of monetary tightening, which could support economic growth and reduce the strain on the banking sector.

Secondly, strong corporate earnings reports continue to bolster investor confidence. Despite economic uncertainty, many companies are demonstrating resilience, exceeding expectations and maintaining strong profit margins. This positive performance showcases a degree of economic strength that is counteracting negative sentiment.

Finally, the sheer volume of liquidity in the market might be playing a role. Despite concerns, many investors are still holding onto assets, believing that the long-term prospects remain positive. This belief is driving demand and counteracting the negative effects of the Moody's downgrade.

<h3>What Lies Ahead?</h3>

While the market's rebound is encouraging, it's too early to declare an end to the volatility. The impact of Moody's downgrade might still unfold in the coming weeks and months. Furthermore, the ongoing economic uncertainty and the potential for further interest rate hikes remain significant risks.

Investors should remain cautious and monitor key economic indicators closely. Diversification remains a crucial strategy for managing risk in this unpredictable environment. Staying informed about market developments and consulting with financial advisors is highly recommended.

Keywords: S&P 500, Wall Street, Moody's, credit rating downgrade, banking sector, stock market, market rebound, economic uncertainty, interest rates, Federal Reserve, investor confidence, corporate earnings, Nasdaq, Dow Jones Industrial Average

Call to Action (subtle): Stay informed about the latest market trends by subscribing to our newsletter or following us on social media.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Rebounds: S&P 500 Extends Winning Streak Despite Moody's Rating Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Siriannis Super Bowl Success Earns Him Eagles Contract Extension

May 20, 2025

Siriannis Super Bowl Success Earns Him Eagles Contract Extension

May 20, 2025 -

Medical And Scientific Research A Cornerstone Of American Strength And Global Leadership

May 20, 2025

Medical And Scientific Research A Cornerstone Of American Strength And Global Leadership

May 20, 2025 -

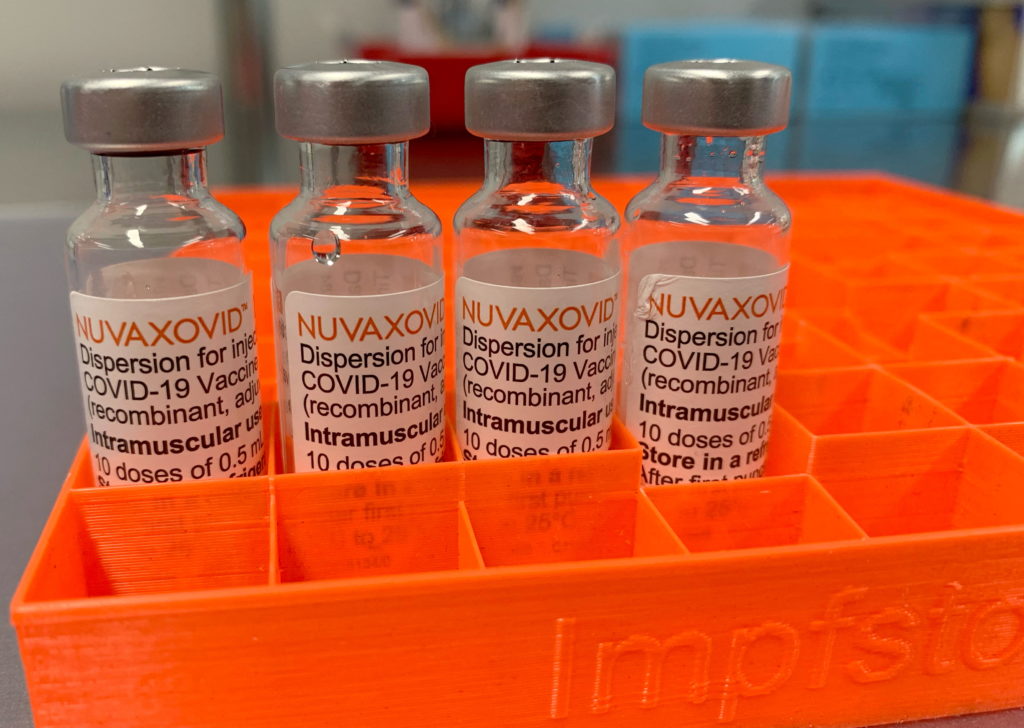

Fdas Approval Of Novavax Covid 19 Vaccine Includes Unusual Restrictions

May 20, 2025

Fdas Approval Of Novavax Covid 19 Vaccine Includes Unusual Restrictions

May 20, 2025 -

Did The Ufc Mislead Fans About Tom Aspinall Jon Jones Weighs In

May 20, 2025

Did The Ufc Mislead Fans About Tom Aspinall Jon Jones Weighs In

May 20, 2025 -

Potential Global Blackouts Nasas Forecast Of Intense Solar Activity

May 20, 2025

Potential Global Blackouts Nasas Forecast Of Intense Solar Activity

May 20, 2025