Wall Street Defies Moody's: S&P 500's Six-Day Rally Leads Market Gains

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Defies Moody's Downgrade: S&P 500's Six-Day Rally Ignites Market Gains

Wall Street shrugged off Moody's Investors Service downgrade of US government debt, staging a remarkable six-day rally that propelled the S&P 500 to significant gains. This unexpected surge defies the typical market reaction to credit rating cuts and raises questions about the current economic landscape and investor sentiment.

The market's resilience highlights the complex interplay of factors influencing investor decisions, beyond the immediate impact of credit rating agencies. While Moody's cited increasing fiscal challenges as the rationale behind its downgrade, investors appear to be focusing on other economic indicators and potential future growth.

A Six-Day Winning Streak: Unpacking the Rally

The S&P 500's impressive six-day winning streak, culminating in a [Insert Percentage]% gain (as of [Insert Date]), stands in stark contrast to the anticipated negative market response to Moody's action. This robust performance suggests a prevailing optimism amongst investors, potentially fueled by several factors:

-

Strong Corporate Earnings: Positive earnings reports from major corporations have boosted investor confidence, showcasing the resilience of the US economy despite macroeconomic headwinds. Several tech giants, in particular, have exceeded expectations. [Link to relevant financial news source about corporate earnings].

-

Resilient Consumer Spending: Despite inflation, consumer spending remains relatively strong, signaling continued economic activity and potential for future growth. [Link to relevant economic data source].

-

Federal Reserve's Policy Outlook: While the Federal Reserve continues its fight against inflation, some analysts interpret recent statements as suggesting a potential pause or slowdown in interest rate hikes. This speculation has eased concerns about aggressive monetary tightening. [Link to Federal Reserve website or relevant news article].

-

Geopolitical Factors: While geopolitical uncertainties persist, recent developments in [mention relevant geopolitical event, e.g., Ukraine conflict or other significant global event] may have had less impact on market sentiment than initially anticipated.

Moody's Downgrade: A Contextual Consideration

Moody's downgrade, while a significant event, needs to be considered within the broader economic context. The agency cited concerns about the US government's fiscal trajectory and increasing debt levels. However, the market's reaction suggests investors may be factoring in other long-term economic prospects that outweigh the immediate implications of the downgrade. This underscores the limitations of relying solely on credit rating agencies for investment decisions.

Looking Ahead: Market Volatility and Uncertainty Remain

While the current rally is encouraging, it's crucial to remember that market volatility is inherent. The future trajectory of the S&P 500 and broader market remains uncertain, subject to various economic and geopolitical influences. Factors such as inflation, interest rate changes, and global economic growth will continue to shape investor sentiment in the coming months.

Conclusion: A Cautious Optimism

Wall Street's defiant rally in the face of Moody's downgrade signals a complex and evolving economic landscape. While the six-day winning streak is impressive, investors should maintain a cautious optimism, acknowledging the persistent uncertainties and the need for a nuanced understanding of the interplay between macroeconomic factors and market dynamics. Staying informed about relevant economic news and consulting with financial advisors remains crucial for navigating the current market environment.

Keywords: S&P 500, Wall Street, Moody's, Downgrade, US Government Debt, Stock Market Rally, Market Gains, Economic Outlook, Investor Sentiment, Federal Reserve, Inflation, Corporate Earnings, Geopolitical Factors, Financial News, Investment Strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Defies Moody's: S&P 500's Six-Day Rally Leads Market Gains. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Real Estate Fraud Allegations Against Trump Ny Ag Jamess Dual Role In Legal Fight

May 21, 2025

Real Estate Fraud Allegations Against Trump Ny Ag Jamess Dual Role In Legal Fight

May 21, 2025 -

Two Youths Accused In Church Break In Defecation Reported

May 21, 2025

Two Youths Accused In Church Break In Defecation Reported

May 21, 2025 -

Impact Of Feds Rate Cut Projection Lower U S Treasury Yields

May 21, 2025

Impact Of Feds Rate Cut Projection Lower U S Treasury Yields

May 21, 2025 -

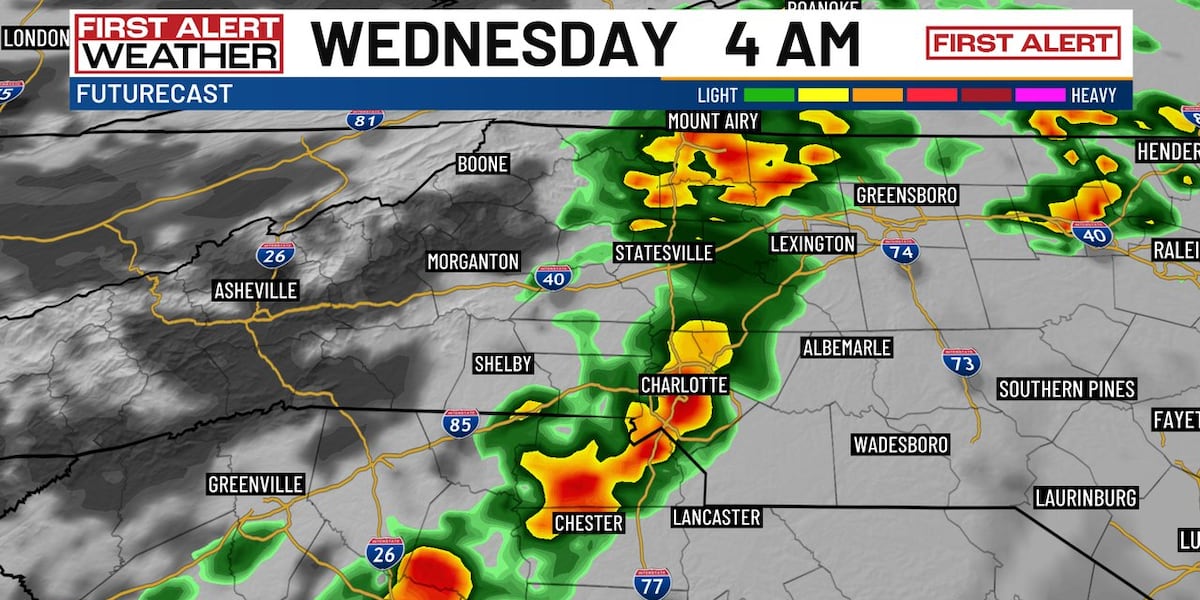

Charlotte Area Under Overnight Storm Watch Chilly Weather Ahead

May 21, 2025

Charlotte Area Under Overnight Storm Watch Chilly Weather Ahead

May 21, 2025 -

Letitia Jamess Divided Loyalties Trump Vs The Department Of Justice

May 21, 2025

Letitia Jamess Divided Loyalties Trump Vs The Department Of Justice

May 21, 2025