Impact Of Fed's Rate Cut Projection: Lower U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's Rate Cut Projection Sends U.S. Treasury Yields Lower: What it Means for Investors

The Federal Reserve's recent projection of potential interest rate cuts has sent ripples through the financial markets, leading to a significant decline in U.S. Treasury yields. This move, signaling a potential shift towards a more accommodative monetary policy, has major implications for investors and the broader economy. Understanding this shift is crucial for navigating the current market landscape.

Understanding the Connection: Fed Policy and Treasury Yields

U.S. Treasury yields are fundamentally linked to the Federal Reserve's monetary policy. When the Fed raises interest rates, it becomes more expensive for the government to borrow money, leading to higher yields on Treasury bonds. Conversely, when the Fed cuts rates or signals a potential for future cuts – as it recently did – investors anticipate lower borrowing costs, driving Treasury yields down. This inverse relationship is a cornerstone of fixed-income investing.

The Impact of Lower Yields

The decline in U.S. Treasury yields has several significant consequences:

- Increased Bond Prices: As yields fall, the price of existing Treasury bonds rises. This is because the fixed interest payments become more attractive relative to the lower yield environment. This benefits existing bondholders.

- Cheaper Borrowing Costs: Lower yields translate to lower borrowing costs for businesses and consumers. This could potentially stimulate economic activity, though the extent of this effect is subject to debate.

- Attractiveness of Riskier Assets: Lower yields on safe-haven assets like Treasuries can encourage investors to seek higher returns in riskier investments such as stocks and corporate bonds. This can lead to increased volatility in these markets.

- Potential for Inflation: While lower interest rates can stimulate the economy, they also carry the risk of increased inflation. The Fed's delicate balancing act between supporting economic growth and controlling inflation is a key factor driving its decisions.

Analyzing the Fed's Projection: A Cautious Optimism?

The Fed's projection isn't a guarantee of rate cuts. It’s a signal of the central bank's assessment of the current economic climate and its willingness to adjust its monetary policy to address potential headwinds. Factors like inflation data, employment figures, and overall economic growth will heavily influence the timing and magnitude of any future rate adjustments.

Several economic indicators are being closely monitored. These include:

- Inflation: Persistently high inflation could force the Fed to maintain or even raise interest rates, despite its current projection.

- Unemployment: Rising unemployment might signal a weakening economy, prompting the Fed to cut rates to stimulate growth.

- GDP Growth: Slowing GDP growth could also lead to rate cuts.

What Should Investors Do?

The shift in the market prompted by the Fed's projection requires a strategic approach for investors:

- Diversification: Maintaining a diversified portfolio across various asset classes is crucial to mitigate risk.

- Risk Assessment: Investors should carefully assess their risk tolerance before making any significant investment decisions.

- Professional Advice: Seeking advice from a qualified financial advisor can help tailor investment strategies to individual circumstances.

Conclusion: Navigating Uncertainty

The decline in U.S. Treasury yields following the Fed's rate cut projection underscores the interconnectedness of monetary policy and financial markets. While lower yields offer certain advantages, investors need to carefully consider the potential risks and adapt their strategies accordingly. The coming months will be crucial in observing how the economy responds and how the Fed adjusts its policy in response. Staying informed about key economic indicators and consulting with financial professionals will be essential for navigating this period of uncertainty. Learn more about [link to relevant resource on understanding interest rates].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's Rate Cut Projection: Lower U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Outpouring Of Love Ellen De Generes Social Media Return After Heartbreak

May 21, 2025

Outpouring Of Love Ellen De Generes Social Media Return After Heartbreak

May 21, 2025 -

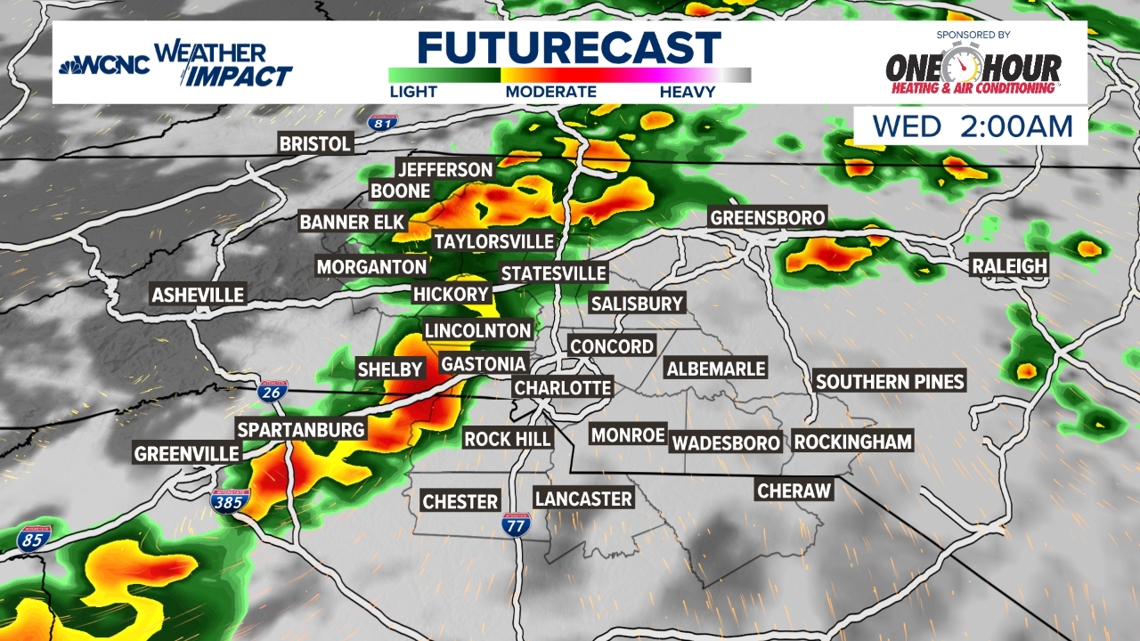

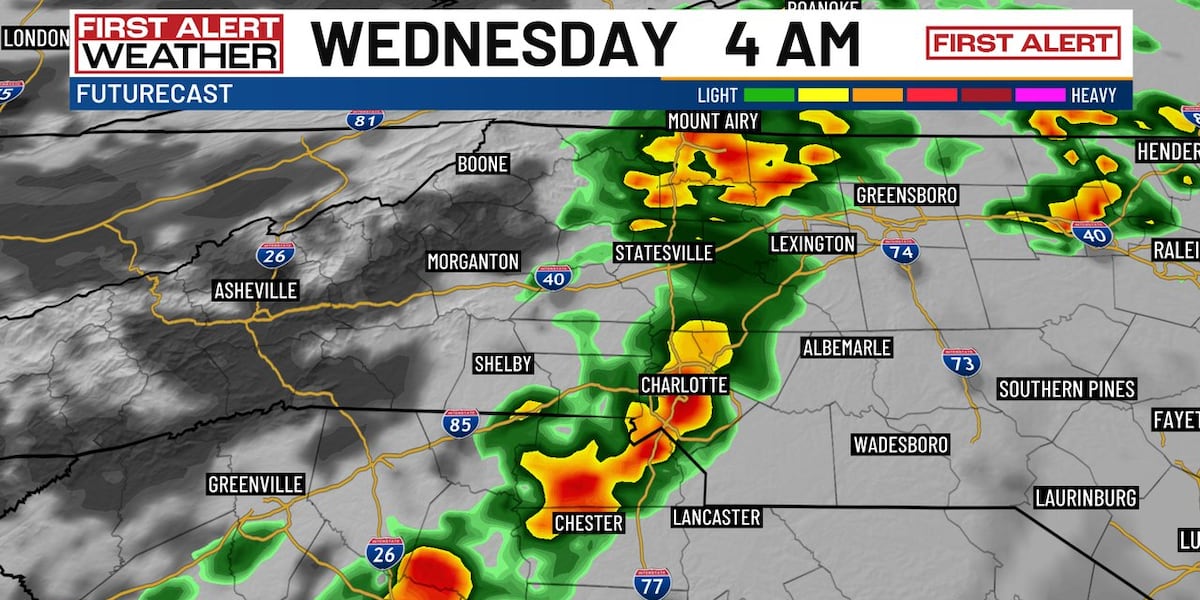

Limited Chance Of Severe Weather Tuesday Night Isolated Storms

May 21, 2025

Limited Chance Of Severe Weather Tuesday Night Isolated Storms

May 21, 2025 -

Espns Untold Brett Favre Journalist A J Perez Recounts Threats From Favres Camp

May 21, 2025

Espns Untold Brett Favre Journalist A J Perez Recounts Threats From Favres Camp

May 21, 2025 -

Charlotte Facing Overnight Storms Significant Cooldown Expected

May 21, 2025

Charlotte Facing Overnight Storms Significant Cooldown Expected

May 21, 2025 -

Fans React To Ellen De Generes Return To Social Media

May 21, 2025

Fans React To Ellen De Generes Return To Social Media

May 21, 2025