US Treasury Yields Slip On Fed's Prediction Of Sole 2025 Rate Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Slip as Fed Hints at Single 2025 Rate Cut

US Treasury yields experienced a decline following the Federal Reserve's latest projections, which anticipate only one interest rate reduction in 2025. This move surprised some market analysts who had predicted a more aggressive easing of monetary policy. The shift reflects a nuanced view from the Fed, balancing concerns about inflation with the ongoing strength of the US economy.

The subtle adjustment in the Fed's outlook sent ripples through the bond market, causing yields on benchmark Treasury notes to fall. This signifies a shift in investor sentiment, reflecting a decreased expectation of future interest rate hikes and a tempered outlook on the pace of potential future rate cuts. Understanding this shift is crucial for anyone navigating the current economic landscape and making informed investment decisions.

What Drove the Yield Dip?

The primary catalyst for the Treasury yield slip was the Fed's revised "dot plot," a chart illustrating individual policymakers' interest rate projections. The updated dot plot showed a significant majority of Fed officials anticipating a single rate cut in 2025, a more conservative approach compared to previous forecasts. This suggests a belief that inflation, while still above the Fed's target, is gradually cooling and doesn't warrant a more aggressive series of rate cuts.

This more cautious stance stems from several factors:

- Persistent Inflation: Although inflation has shown signs of easing, it remains above the Fed's 2% target. The Fed is committed to bringing inflation down sustainably, even if it means maintaining higher interest rates for longer.

- Robust Labor Market: The US labor market continues to show strength, with low unemployment and robust wage growth. This suggests a resilient economy that can withstand higher interest rates without significant negative consequences.

- Geopolitical Uncertainty: Ongoing global uncertainties, including the war in Ukraine and geopolitical tensions, contribute to economic volatility and influence the Fed's decision-making process.

Implications for Investors

The decrease in Treasury yields presents both opportunities and challenges for investors. Lower yields can be attractive for those seeking fixed-income investments, particularly in the context of potentially higher inflation. However, the relatively low yields also reflect a conservative outlook on future economic growth.

Investors should carefully consider their risk tolerance and investment goals when making decisions in this shifting market environment. Diversification across asset classes remains a key strategy to mitigate risk.

Looking Ahead

The Fed's projection of a single rate cut in 2025 doesn't signal the end of its tightening cycle, but rather a cautious recalibration. The central bank's future actions will heavily depend on incoming economic data, particularly inflation figures and labor market conditions. Closely monitoring these indicators will be crucial for navigating the evolving market landscape. Staying informed about economic news and analysis from reputable sources like the will help investors make informed decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Slip On Fed's Prediction Of Sole 2025 Rate Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraine War Trumps Planned Monday Conversation With Putin

May 20, 2025

Ukraine War Trumps Planned Monday Conversation With Putin

May 20, 2025 -

Exclusive Interview The Making Of Netflixs Fall Of Favre Documentary

May 20, 2025

Exclusive Interview The Making Of Netflixs Fall Of Favre Documentary

May 20, 2025 -

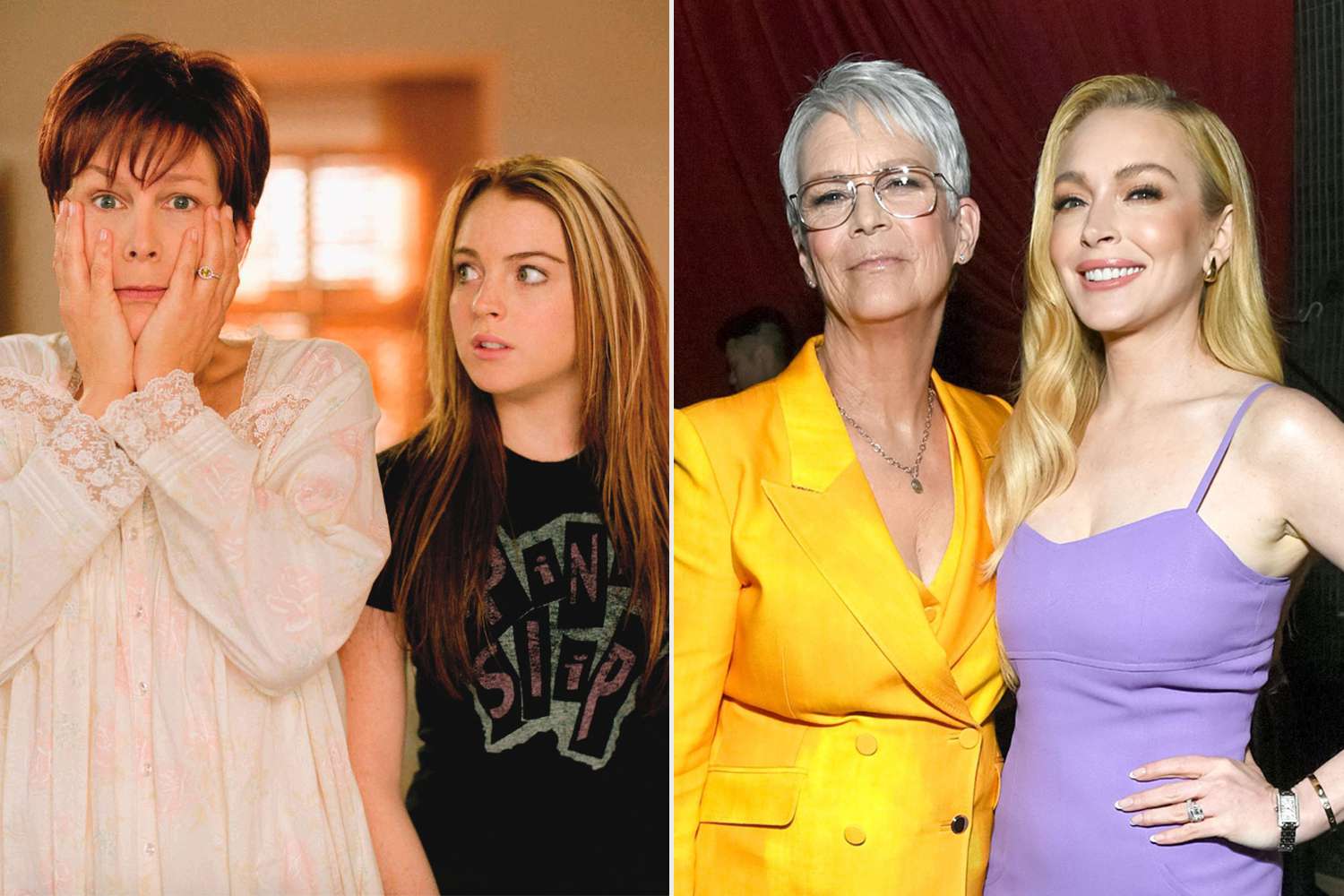

Jamie Lee Curtis Gives An Exclusive Update On Her Friendship With Lindsay Lohan After Freaky Friday

May 20, 2025

Jamie Lee Curtis Gives An Exclusive Update On Her Friendship With Lindsay Lohan After Freaky Friday

May 20, 2025 -

Bitcoin Etf Investments Surpass 5 Billion Analyzing The Market Trend

May 20, 2025

Bitcoin Etf Investments Surpass 5 Billion Analyzing The Market Trend

May 20, 2025 -

Geomagnetic Storm Causes Major Communications Outage Across Five Continents

May 20, 2025

Geomagnetic Storm Causes Major Communications Outage Across Five Continents

May 20, 2025