US Treasury Yields Fall As Federal Reserve Hints At One 2025 Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Tumble as Fed Hints at 2025 Rate Cut: A Sign of Easing Inflation?

US Treasury yields experienced a significant drop following Federal Reserve Chair Jerome Powell's recent comments hinting at a potential interest rate cut in 2025. This unexpected shift in the market reflects growing optimism about cooling inflation and a potential slowdown in the Fed's aggressive monetary tightening policy. The development has significant implications for investors and the broader economy.

The 2-year Treasury yield, a highly sensitive barometer of interest rate expectations, fell sharply, indicating a decreased likelihood of further rate hikes in the near future. Similarly, longer-term yields, such as the 10-year Treasury yield, also declined, reflecting a shift in investor sentiment towards a more dovish Federal Reserve.

What Drove the Yield Decline?

Powell's testimony before Congress suggested a more cautious approach to future rate hikes. While acknowledging the ongoing fight against inflation, he hinted that the Fed might consider cutting rates in 2025 if inflation continues to decelerate as projected. This departure from the previously hawkish stance fueled speculation of a potential pivot, prompting investors to reduce their bets on higher interest rates.

This shift in perspective is largely attributed to recent economic data indicating a cooling inflation rate. While inflation remains above the Fed's target of 2%, the recent slowdown in price increases has given policymakers reason for cautious optimism. Factors like easing supply chain pressures and decreasing energy prices are contributing to this trend.

However, it's crucial to remember that the economic outlook remains uncertain. Geopolitical instability, ongoing supply chain challenges, and the potential for unexpected economic shocks could still influence the Fed's decisions.

Implications for Investors and the Economy

The fall in Treasury yields has immediate implications for various sectors. Lower yields generally translate to:

- Lower borrowing costs for businesses and consumers: This could stimulate economic activity and investment.

- Increased demand for riskier assets: As investors seek higher returns, they may shift their investments towards stocks and other assets considered riskier than government bonds.

- Potential impact on the US dollar: A decrease in yields might weaken the US dollar relative to other currencies.

However, a premature rate cut could also pose risks. If inflation proves more persistent than anticipated, a rate cut could fuel inflationary pressures, undermining the Fed's efforts to achieve price stability.

What's Next?

The coming months will be critical in gauging the effectiveness of the Fed's monetary policy and assessing the trajectory of inflation. Further economic data releases and upcoming Fed announcements will provide valuable insights into the future direction of interest rates. Investors should carefully monitor these developments and adjust their strategies accordingly. This situation underscores the importance of diversifying investments and consulting with financial advisors to navigate the complexities of the current economic landscape.

Stay informed about the latest developments in the financial markets by subscribing to our newsletter. [Link to newsletter signup] Understanding these shifts is crucial for making informed financial decisions. You can also learn more about [link to relevant article on understanding treasury yields].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Fall As Federal Reserve Hints At One 2025 Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

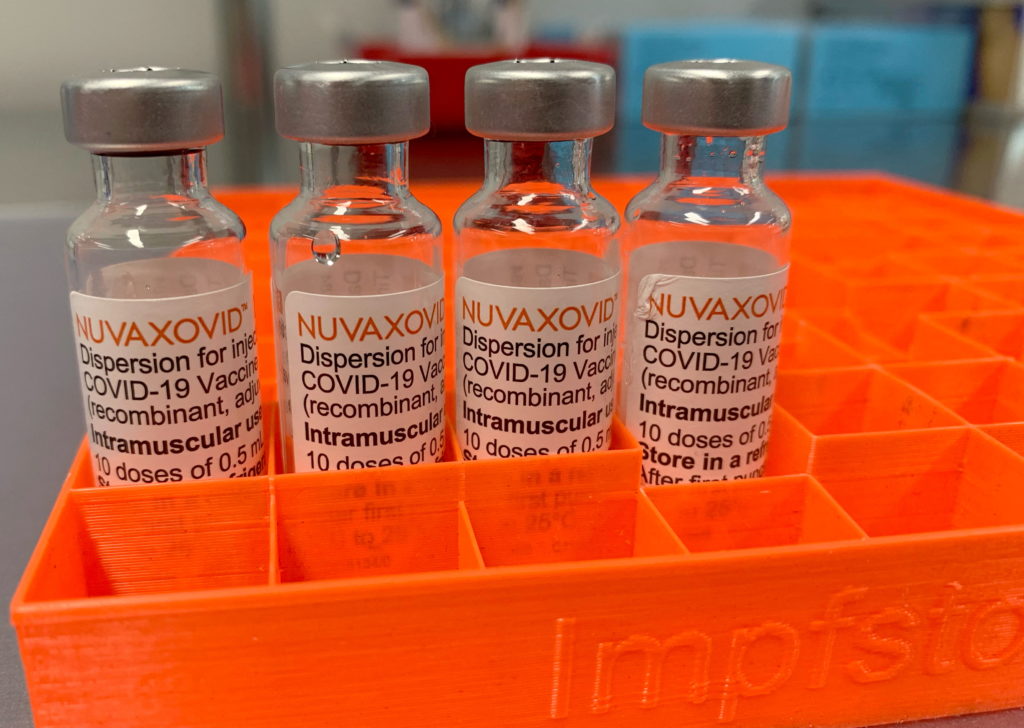

Fda Approval For Novavax Covid 19 Vaccine Understanding The Usage Restrictions

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Understanding The Usage Restrictions

May 20, 2025 -

Us Treasury Market Reacts Feds 2025 Rate Cut Outlook And Yield Impact

May 20, 2025

Us Treasury Market Reacts Feds 2025 Rate Cut Outlook And Yield Impact

May 20, 2025 -

Balis New Rules For Tourists Curbing Misconduct And Protecting The Island

May 20, 2025

Balis New Rules For Tourists Curbing Misconduct And Protecting The Island

May 20, 2025 -

New Wwi Movie Streaming Daniel Craig Cillian Murphy And Tom Hardy Deliver Gripping Performances

May 20, 2025

New Wwi Movie Streaming Daniel Craig Cillian Murphy And Tom Hardy Deliver Gripping Performances

May 20, 2025 -

Supreme Court Decision Venezuelan Migrants Lose Protected Status Under Trump Era Policy

May 20, 2025

Supreme Court Decision Venezuelan Migrants Lose Protected Status Under Trump Era Policy

May 20, 2025