Find The Best Mortgage Refinance Rates: May 19, 2025 Update

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Find the Best Mortgage Refinance Rates: May 19, 2025 Update

Are you considering refinancing your mortgage? With interest rates constantly fluctuating, finding the best refinance rate can feel like navigating a maze. This May 19, 2025 update provides crucial insights into the current mortgage refinance landscape, helping you make informed decisions and potentially save thousands of dollars.

The Current Mortgage Refinance Rate Environment (May 19, 2025)

As of today, the mortgage refinance market reflects a complex interplay of economic factors. While we can't provide specific rates (as these change daily and vary drastically by lender and borrower profile), we can analyze the trends influencing them. Several key factors are impacting refinance rates in May 2025:

- Inflation and the Federal Reserve: The Federal Reserve's actions regarding inflation heavily influence interest rates. Recent decisions – whether to raise or lower rates – directly impact what lenders offer. Keep a close eye on economic news for updates.

- Bond Yields: Movement in the bond market, particularly Treasury yields, significantly impacts mortgage rates. Higher bond yields generally lead to higher mortgage rates.

- Competition Among Lenders: A competitive lending environment can drive down rates, offering borrowers more favorable options. However, a less competitive market might result in higher rates.

- Your Credit Score and Loan-to-Value Ratio (LTV): Your personal financial health remains paramount. A higher credit score and a lower LTV (the ratio of your mortgage to your home's value) will typically secure you a better rate.

How to Find the Best Mortgage Refinance Rate for You

Finding the best rate involves more than just checking a few websites. A strategic approach is essential:

-

Check Your Credit Score: Before you even start shopping, obtain your credit report and score. Knowing your score empowers you to understand what rates you're likely to qualify for. Sites like [link to reputable credit score website] can help.

-

Shop Around: Don't settle for the first offer. Compare rates from multiple lenders, including banks, credit unions, and online lenders. Utilize online comparison tools, but remember to verify information directly with the lenders.

-

Consider Different Loan Types: Explore various refinance options, such as:

- Rate-and-Term Refinance: Lower your interest rate and/or shorten your loan term.

- Cash-Out Refinance: Borrow additional funds against your home's equity.

- ARM Refinance: Consider an adjustable-rate mortgage (ARM) if you anticipate lower rates in the future. (However, be aware of the risks involved.)

-

Understand All Fees: Don't focus solely on the interest rate. Pay close attention to closing costs, origination fees, and other associated charges. Compare the total cost of the refinance, not just the interest rate.

-

Negotiate: Once you've identified a lender offering a competitive rate, don't hesitate to negotiate. Lenders often have some flexibility, especially in a competitive market.

Is Refinancing Right for You?

Refinancing isn't always the best option. Carefully weigh the benefits against the costs, considering:

- Closing Costs: These can offset any savings from a lower interest rate if you plan to stay in your home for a short period.

- Your Current Interest Rate: A significantly lower interest rate is needed to justify the cost of refinancing.

- Your Financial Goals: Consider your long-term financial plans and whether refinancing aligns with them.

Conclusion:

Finding the best mortgage refinance rates in May 2025 requires diligence and research. By understanding the current market trends, shopping around, and carefully comparing offers, you can significantly reduce your monthly mortgage payments and save money over the life of your loan. Remember, consulting with a financial advisor can provide valuable personalized guidance. Stay informed about market fluctuations and don't hesitate to seek professional help to make the best decision for your individual circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Find The Best Mortgage Refinance Rates: May 19, 2025 Update. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

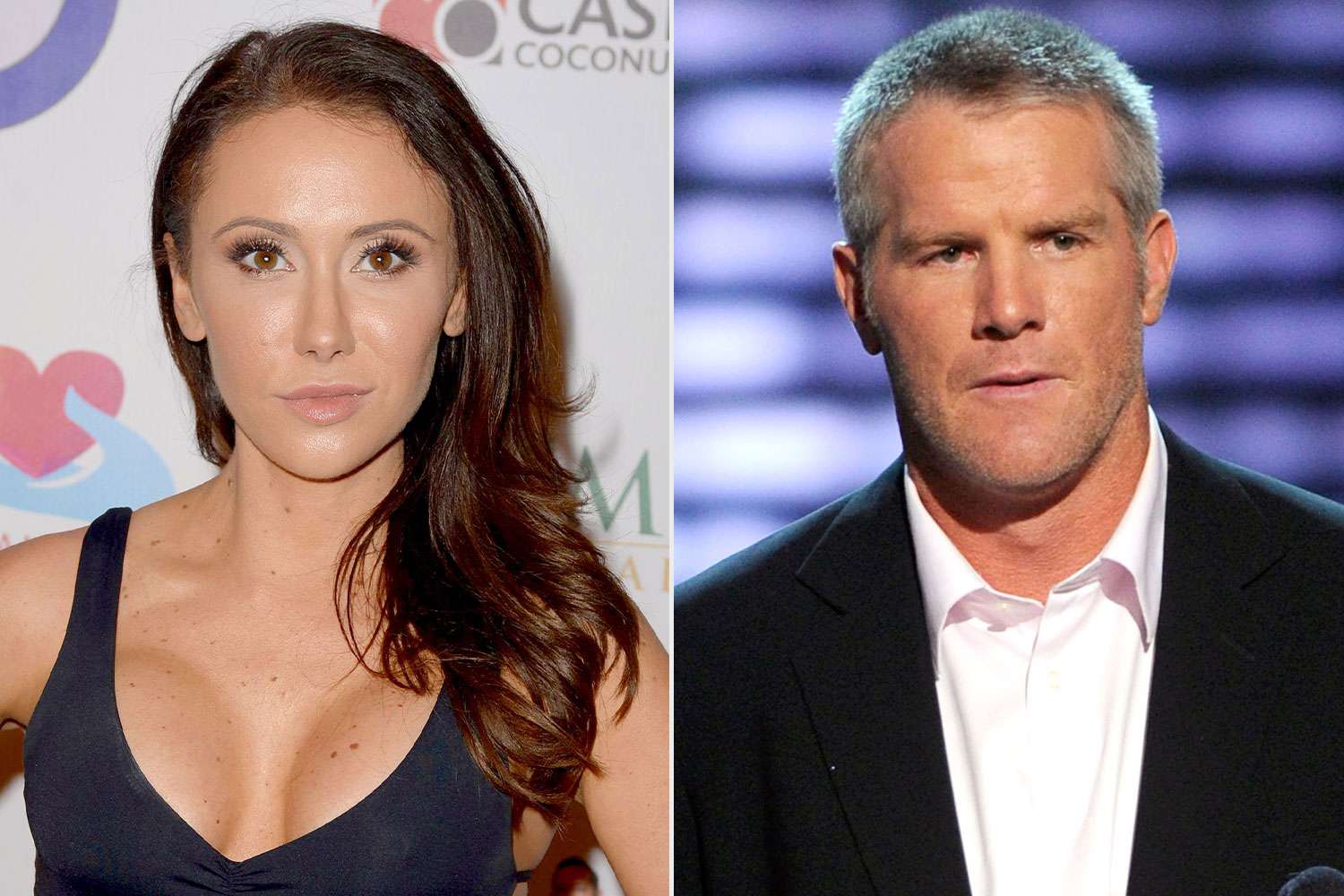

Years Later Jenn Sterger Reflects On The Emotional Toll Of The Brett Favre Scandal

May 20, 2025

Years Later Jenn Sterger Reflects On The Emotional Toll Of The Brett Favre Scandal

May 20, 2025 -

Overcompensating A Coming Out Comedy Thats Both Funny And Thought Provoking

May 20, 2025

Overcompensating A Coming Out Comedy Thats Both Funny And Thought Provoking

May 20, 2025 -

New Peaky Blinders Series Confirmed Creator Reveals Pivotal Change

May 20, 2025

New Peaky Blinders Series Confirmed Creator Reveals Pivotal Change

May 20, 2025 -

Espns A J Perez Recounts Threats From Brett Favres Camp

May 20, 2025

Espns A J Perez Recounts Threats From Brett Favres Camp

May 20, 2025 -

Widespread Tornado Threat Severe Weather Outbreak Impacts Plains Midwest And South

May 20, 2025

Widespread Tornado Threat Severe Weather Outbreak Impacts Plains Midwest And South

May 20, 2025