US Treasury Yields Fall After Fed Hints At One 2025 Rate Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Dip as Fed Signals Potential 2025 Rate Cut

US Treasury yields experienced a noticeable decline following the Federal Reserve's latest policy statement, which hinted at a potential interest rate reduction in 2025. This shift in the market reflects a growing expectation that the aggressive interest rate hikes implemented to combat inflation may soon be reversed, at least partially. The implications for investors and the broader economy are significant and warrant close examination.

The Fed's recent comments, while still emphasizing the ongoing fight against inflation, acknowledged the possibility of easing monetary policy next year. This subtle shift in tone sent ripples through the financial markets, impacting everything from bond yields to stock prices. The market interpreted this as a sign that the current tightening cycle might be nearing its end, leading to a flight to safety and a subsequent decrease in Treasury yields.

Understanding the Impact of Falling Treasury Yields

Falling Treasury yields generally indicate a few key things:

- Increased investor demand for safer assets: When uncertainty looms, investors tend to flock to lower-risk investments like US Treasuries, driving up their prices and consequently lowering their yields.

- Lower borrowing costs: Decreased yields translate to lower borrowing costs for businesses and consumers, potentially stimulating economic growth. However, this also depends on other economic factors.

- Potential for inflation: While lower yields can be positive, they can also be a sign that inflation is still a concern, as lower yields sometimes reflect a lack of confidence in future economic growth.

What Drove the Yield Decline?

Several factors contributed to the recent fall in US Treasury yields beyond the Fed's hints:

- Easing inflation concerns: Although inflation remains above the Fed's target, recent data suggests a potential slowdown, bolstering the case for a rate cut in the future. This data includes the latest Consumer Price Index (CPI) and Producer Price Index (PPI) reports. [Link to relevant economic data source]

- Concerns about economic slowdown: Some analysts are expressing concerns about the possibility of a recession, further contributing to investor demand for safe-haven assets like Treasuries. This sentiment is fueled by ongoing global economic uncertainties.

- Geopolitical factors: Global instability and uncertainty can also influence investor behavior, driving demand for US Treasuries as a safe haven.

What This Means for Investors

The decline in Treasury yields presents both opportunities and challenges for investors. Those holding longer-term bonds might see their values increase, while investors looking for higher returns might need to consider alternative investments. It's crucial to consult with a financial advisor to tailor your investment strategy based on your individual risk tolerance and financial goals.

Looking Ahead: Uncertainty Remains

While the Fed's suggestion of a potential 2025 rate cut offers a glimmer of hope, considerable uncertainty remains. The actual timing and magnitude of any future rate reductions will depend heavily on evolving economic data and the Fed's assessment of inflation and growth prospects. Closely monitoring economic indicators and the Fed's pronouncements will be crucial for navigating the evolving landscape. This situation highlights the importance of diversification and a well-defined investment strategy.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Fall After Fed Hints At One 2025 Rate Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

La Freeways Shut Down High Speed Motorcycle Chase Ends In Arrest

May 20, 2025

La Freeways Shut Down High Speed Motorcycle Chase Ends In Arrest

May 20, 2025 -

The Last Of Us Season 2 Exploring The Impact Of Game Changes On Joel And Ellies Bond

May 20, 2025

The Last Of Us Season 2 Exploring The Impact Of Game Changes On Joel And Ellies Bond

May 20, 2025 -

Espns Untold A J Perez Details Threats From Brett Favres Camp

May 20, 2025

Espns Untold A J Perez Details Threats From Brett Favres Camp

May 20, 2025 -

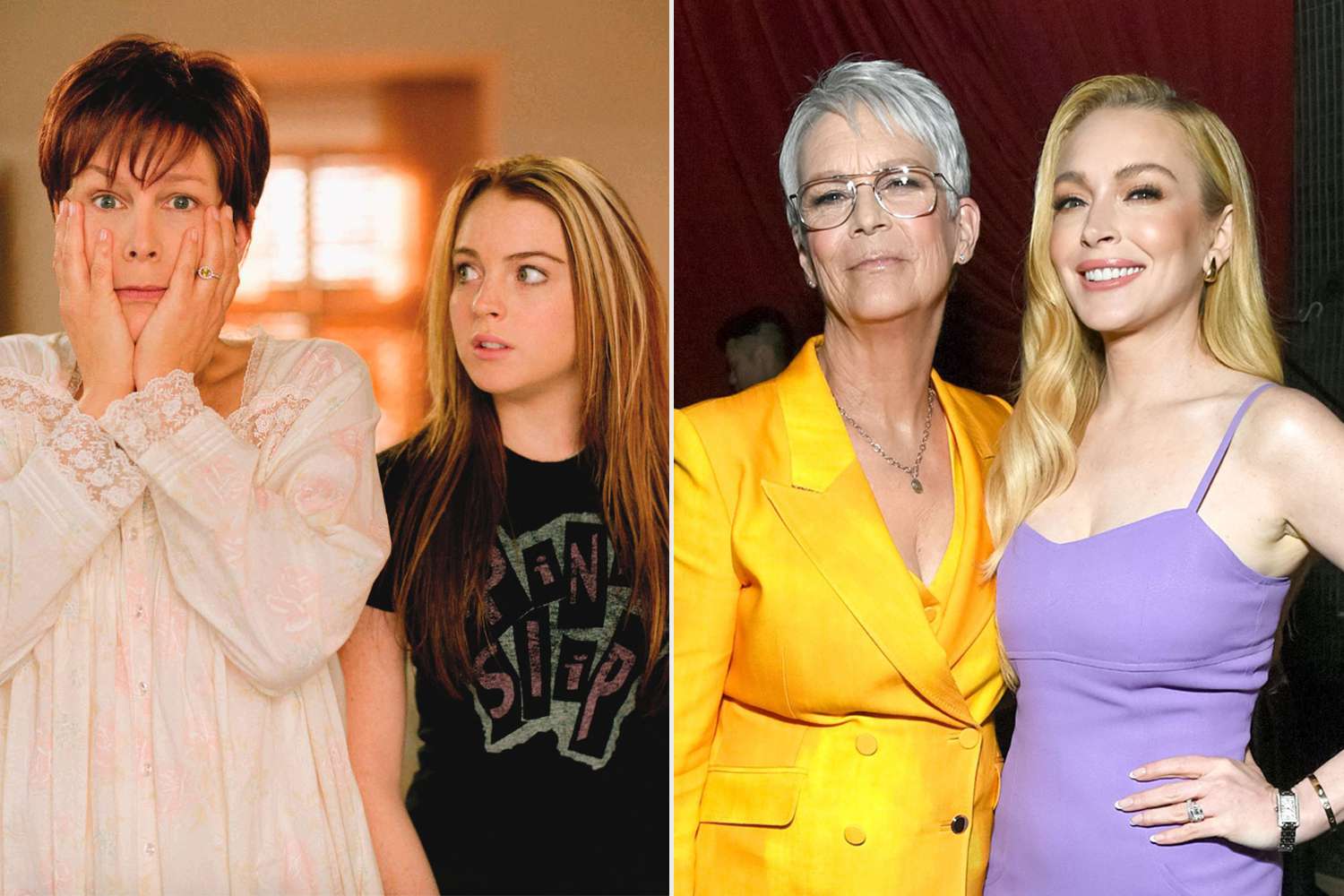

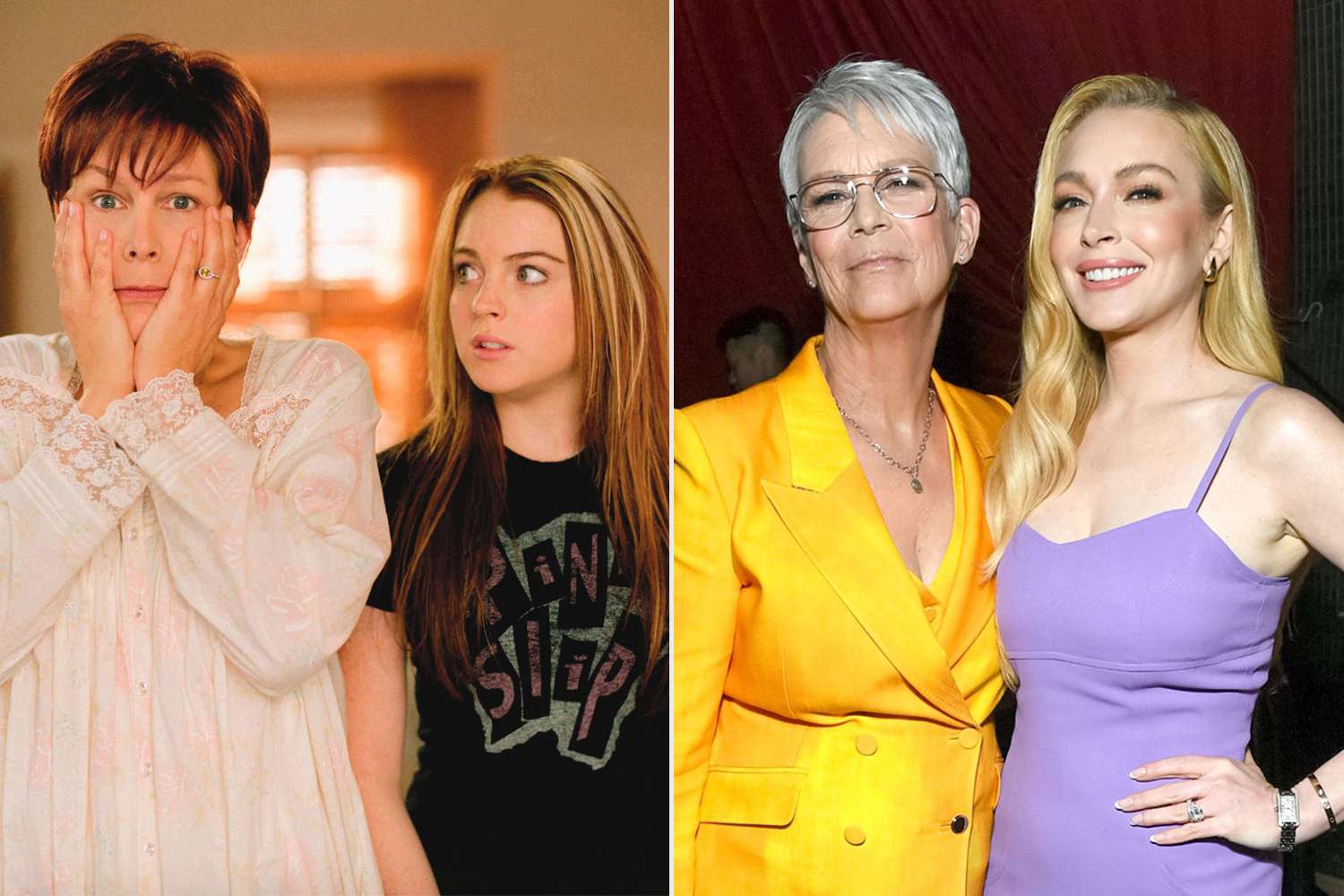

Jamie Lee Curtis On Her Lasting Friendship With Lindsay Lohan A Candid Conversation

May 20, 2025

Jamie Lee Curtis On Her Lasting Friendship With Lindsay Lohan A Candid Conversation

May 20, 2025 -

Balis Tourism Safety And Conduct A Collaborative Approach

May 20, 2025

Balis Tourism Safety And Conduct A Collaborative Approach

May 20, 2025

Latest Posts

-

Slight Decrease In U S Treasury Yields Follows Feds Indication Of Limited Rate Cuts

May 20, 2025

Slight Decrease In U S Treasury Yields Follows Feds Indication Of Limited Rate Cuts

May 20, 2025 -

Critically Acclaimed Wwi Drama Starring Daniel Craig Cillian Murphy And Tom Hardy Available To Stream

May 20, 2025

Critically Acclaimed Wwi Drama Starring Daniel Craig Cillian Murphy And Tom Hardy Available To Stream

May 20, 2025 -

Did The Ufc Mislead Fans Jon Jones Alleges Information Withholding Regarding Tom Aspinall

May 20, 2025

Did The Ufc Mislead Fans Jon Jones Alleges Information Withholding Regarding Tom Aspinall

May 20, 2025 -

Jones Vs Ufc Controversy Erupts Over Withheld Aspinall Injury Update

May 20, 2025

Jones Vs Ufc Controversy Erupts Over Withheld Aspinall Injury Update

May 20, 2025 -

Freaky Friday Reunion Jamie Lee Curtis Updates On Her Friendship With Lindsay Lohan

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Updates On Her Friendship With Lindsay Lohan

May 20, 2025