Slight Decrease In U.S. Treasury Yields Follows Fed's Indication Of Limited Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Decrease in U.S. Treasury Yields Follows Fed's Indication of Limited Rate Cuts

U.S. Treasury yields experienced a modest decline following the Federal Reserve's latest announcement hinting at a more cautious approach to future interest rate cuts. This shift, while subtle, signals a change in market sentiment regarding the pace of monetary policy easing. Investors are now grappling with the implications of a potentially slower-than-expected reduction in borrowing costs.

The Federal Open Market Committee (FOMC) meeting concluded with a statement emphasizing the need for a data-dependent approach to future rate adjustments. This cautious tone contrasts with earlier market expectations of more aggressive rate cuts throughout the remainder of the year. The subtle shift in language has had a measurable impact on Treasury yields, a key indicator of investor confidence and future economic growth.

What Drove the Yield Dip?

The primary driver behind the slight decrease in U.S. Treasury yields is the Fed's apparent reluctance to commit to further significant rate reductions. The market had previously priced in a more aggressive easing cycle, anticipating multiple rate cuts in the coming months. However, the FOMC's emphasis on assessing incoming economic data before making any decisions has led to a recalibration of these expectations.

This data-dependent approach suggests the Fed is closely monitoring inflation figures, employment data, and overall economic growth before making any further adjustments to interest rates. This cautious stance reduces the likelihood of a rapid decline in yields, as investors now anticipate a more gradual process.

Implications for Investors and the Economy

The change in market sentiment presents both opportunities and challenges for investors. The lower yields on Treasury bonds may be less attractive to some, potentially prompting a shift towards other investment vehicles. However, the increased certainty surrounding a more measured approach to monetary policy could offer a degree of stability, reducing the volatility associated with rapid interest rate changes.

For the broader economy, the slower pace of rate cuts could mean a more controlled cooling of inflation, preventing a potential economic downturn. This measured approach, while potentially slower in delivering immediate relief, aims to achieve a "soft landing" – a scenario where inflation is brought under control without triggering a significant recession.

Looking Ahead: Uncertainty Remains

While the slight decrease in Treasury yields reflects a shift in market expectations, considerable uncertainty remains. Future economic data will play a critical role in determining the Fed's next moves. Inflation remains a key concern, and any unexpected surges could prompt a reassessment of the current monetary policy stance.

Furthermore, global economic conditions and geopolitical events continue to add layers of complexity to the already challenging economic landscape. Investors need to stay informed and adapt their strategies to navigate these shifting dynamics. Consult with a financial advisor to understand the implications of these changes on your individual portfolio.

Keywords: U.S. Treasury yields, Federal Reserve, interest rates, rate cuts, FOMC, monetary policy, inflation, economic growth, investment, bonds, market sentiment, data-dependent, soft landing, economic outlook.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Decrease In U.S. Treasury Yields Follows Fed's Indication Of Limited Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bidens Cancer Diagnosis Political Figures Offer Messages Of Hope

May 20, 2025

Bidens Cancer Diagnosis Political Figures Offer Messages Of Hope

May 20, 2025 -

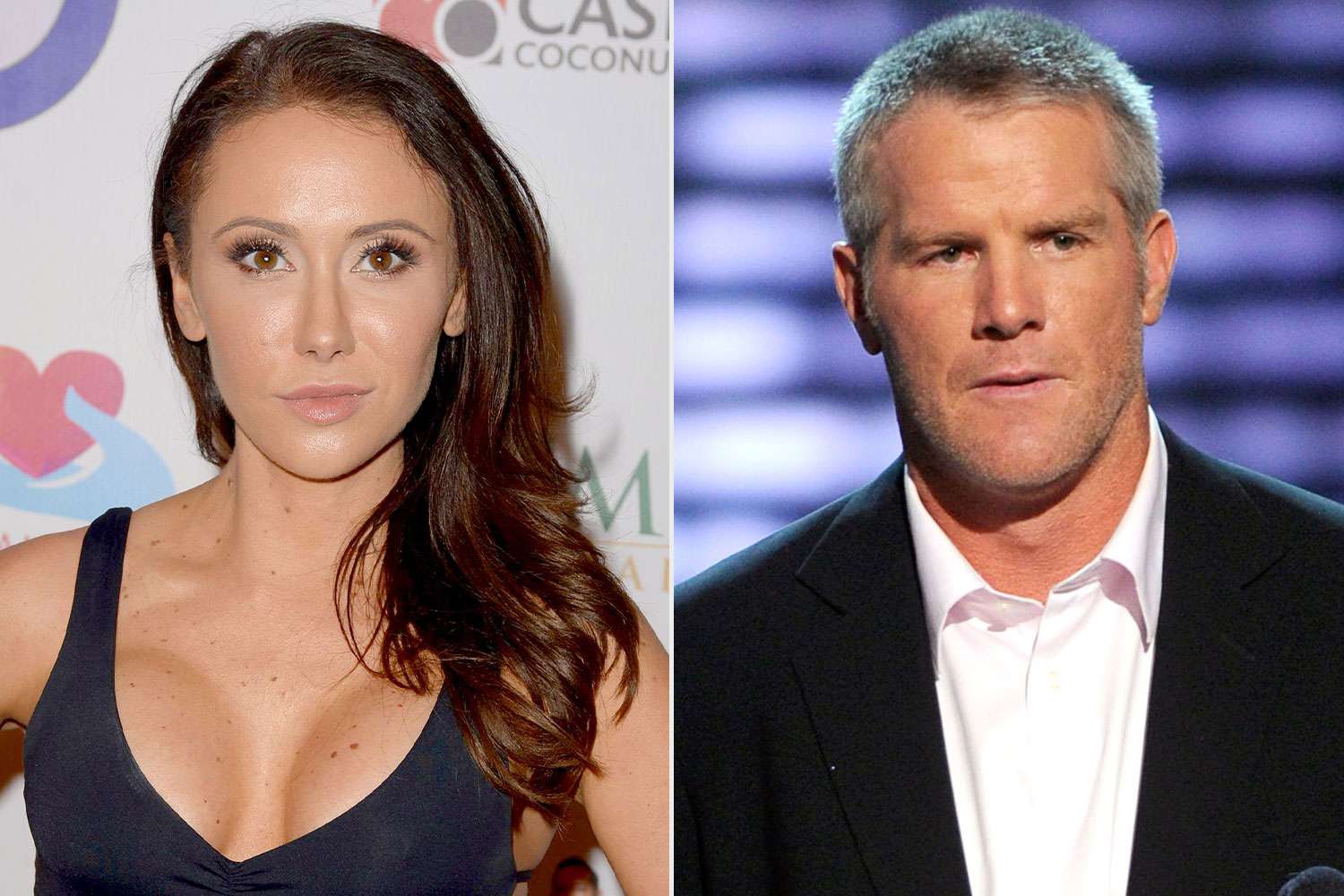

Jenn Sterger Recounts Emotional Toll Of Brett Favre Sext Scandal A Story Of Neglect

May 20, 2025

Jenn Sterger Recounts Emotional Toll Of Brett Favre Sext Scandal A Story Of Neglect

May 20, 2025 -

S And P 500 Extends Winning Streak Market Rally Continues Despite Moodys Downgrade

May 20, 2025

S And P 500 Extends Winning Streak Market Rally Continues Despite Moodys Downgrade

May 20, 2025 -

Russia Ukraine Conflict Trump Intervenes Peace Talks To Start Now

May 20, 2025

Russia Ukraine Conflict Trump Intervenes Peace Talks To Start Now

May 20, 2025 -

New Regulations Target Bad Tourist Behavior In Bali What You Need To Know

May 20, 2025

New Regulations Target Bad Tourist Behavior In Bali What You Need To Know

May 20, 2025