Investing In Clean Energy: Analyzing The Economic Effects Of Tax Incentives

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Clean Energy: Analyzing the Economic Effects of Tax Incentives

The global shift towards clean energy is accelerating, driven by environmental concerns and the pursuit of energy independence. But the transition isn't solely a matter of environmental responsibility; it's a significant economic undertaking. Government tax incentives play a crucial role in stimulating investment and fostering the growth of this vital sector. This article delves into the economic effects of these incentives, examining both the benefits and potential drawbacks.

The Power of Tax Incentives in Driving Clean Energy Adoption

Tax incentives, such as investment tax credits (ITCs), production tax credits (PTCs), and accelerated depreciation, are powerful tools governments employ to encourage investment in clean energy technologies. These incentives reduce the upfront costs of projects, making them more financially attractive to investors. This has a cascading effect, leading to:

- Increased Investment: Lowered financial barriers directly translate to increased private sector investment in renewable energy sources like solar, wind, and geothermal power. This influx of capital fuels innovation, project development, and job creation.

- Job Creation: The clean energy sector is a significant job creator. Tax incentives accelerate this growth, leading to employment opportunities across the manufacturing, installation, maintenance, and research sectors. From solar panel installers to engineers developing advanced battery technologies, the ripple effect is substantial. [Link to Bureau of Labor Statistics data on clean energy jobs]

- Technological Advancement: Incentives stimulate competition and innovation. Companies are motivated to develop more efficient and cost-effective clean energy technologies to maximize returns, leading to advancements that benefit consumers and the environment.

- Reduced Energy Costs: Increased competition and technological advancements driven by tax incentives can contribute to lower energy prices in the long run, benefiting both households and businesses.

Analyzing the Economic Impact: A Balanced Perspective

While the benefits are substantial, a balanced analysis requires acknowledging potential drawbacks:

- Fiscal Costs: Governments incur costs associated with providing tax incentives. Careful consideration is needed to ensure that the economic benefits outweigh the fiscal burden. Effective targeting of incentives is crucial to optimize returns.

- Equity Concerns: The distribution of benefits from tax incentives needs careful scrutiny. Are the benefits reaching all segments of society equally? Policies should aim to ensure equitable access to clean energy opportunities and avoid exacerbating existing inequalities.

- Potential for Market Distortion: Overly generous incentives can distort the market, potentially leading to inefficient allocation of resources. A well-designed policy framework is essential to prevent such distortions.

The Future of Clean Energy Investment and Tax Incentives

The future of clean energy investment hinges on continued government support, particularly through well-designed tax incentives. However, these incentives must be adaptable to evolving technological landscapes and economic realities. Regular review and adjustments are crucial to ensure their effectiveness and long-term sustainability. Furthermore, integrating clean energy development with broader economic policies—like infrastructure investment and workforce development initiatives—can maximize the positive impact.

Conclusion:

Tax incentives are undeniably crucial for driving investment in clean energy. However, a holistic approach that considers both the economic benefits and potential challenges is essential. By carefully designing and implementing these incentives, governments can play a vital role in fostering a sustainable and prosperous future powered by clean energy. Further research into the long-term effects of specific incentive programs and their regional variations is necessary for continued improvement and optimization. What are your thoughts on the role of government incentives in the clean energy transition? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Clean Energy: Analyzing The Economic Effects Of Tax Incentives. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

430 Skin Fears Surround Riots 2025 League Of Legends Hall Of Fame Choice

May 21, 2025

430 Skin Fears Surround Riots 2025 League Of Legends Hall Of Fame Choice

May 21, 2025 -

Analysis Jon Jones Strip The Duck Statement And Its Implications For Aspinall

May 21, 2025

Analysis Jon Jones Strip The Duck Statement And Its Implications For Aspinall

May 21, 2025 -

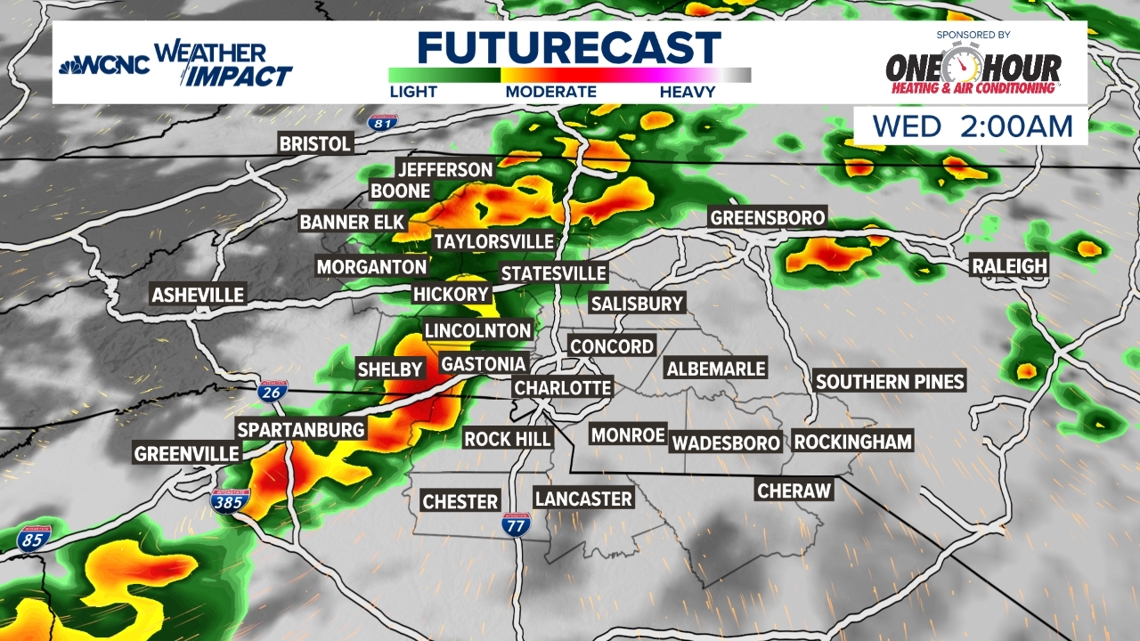

Weekly Forecast Rain And Falling Temperatures Predicted

May 21, 2025

Weekly Forecast Rain And Falling Temperatures Predicted

May 21, 2025 -

Trump Era Policy Supreme Court Backs Removal Of Venezuelan Migrant Protections

May 21, 2025

Trump Era Policy Supreme Court Backs Removal Of Venezuelan Migrant Protections

May 21, 2025 -

Few Strong Storms Predicted Late Tuesday Localized Risk Assessment

May 21, 2025

Few Strong Storms Predicted Late Tuesday Localized Risk Assessment

May 21, 2025