US Treasury Market Reacts: Fed's 2025 Rate Cut Outlook And Yield Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Market Reacts: Fed's 2025 Rate Cut Outlook and Yield Implications

The US Treasury market experienced significant shifts following the Federal Reserve's recent pronouncements hinting at potential interest rate cuts as early as 2025. This unexpected shift in the Fed's forward guidance has sent ripples through the bond market, prompting investors to reassess their strategies and sparking debate about the future trajectory of yields. Understanding these implications is crucial for anyone invested in the US Treasury market.

The Fed's Shift in Stance: A Surprise for Many

For months, the Federal Reserve maintained a hawkish stance, emphasizing its commitment to combatting inflation even if it meant maintaining higher interest rates for an extended period. However, recent economic data, including signs of cooling inflation and a slowing job market, has prompted a subtle but significant change in tone. The suggestion of rate cuts in 2025, while still tentative, marked a departure from previous projections and caught many market analysts off guard. This shift reflects a growing belief within the Fed that the current tightening cycle is nearing its end.

Impact on Treasury Yields: A Downward Trend?

The prospect of future rate cuts has naturally impacted Treasury yields. Yields, which move inversely to prices, have generally trended downward following the Fed's announcement. This is because investors anticipate a less aggressive monetary policy environment in the coming years, making longer-term Treasury bonds more attractive. The decrease in yields is particularly noticeable in longer-dated securities, reflecting the market's expectation of lower interest rates further out on the yield curve.

What This Means for Investors:

This shift presents both opportunities and challenges for investors:

- Lower Yields, Increased Prices: For those who already hold long-term Treasury bonds, the decreasing yields translate to an increase in the value of their holdings.

- Re-evaluation of Investment Strategies: Investors may need to reassess their portfolios, considering the implications of lower yields on their overall return expectations. Diversification remains key.

- Increased Uncertainty: The uncertainty surrounding the economic outlook and the Fed's future actions necessitates a cautious approach. Predicting the exact timing and magnitude of future rate cuts remains challenging.

Analyzing the Yield Curve:

The yield curve, which plots the yields of Treasury bonds of different maturities, is a crucial indicator of market sentiment. The flattening of the yield curve, observed after the Fed's announcement, reflects the market's belief that short-term rates will remain higher for longer than long-term rates. Analyzing the yield curve can provide valuable insights into investor expectations and potential future market movements. [Link to a reputable source explaining yield curves]

Looking Ahead: Uncertainty Remains

While the Fed's suggestion of rate cuts in 2025 has provided some clarity, significant uncertainty remains. The path of inflation, economic growth, and geopolitical events will all play a crucial role in shaping the future direction of interest rates and Treasury yields. Continuous monitoring of economic indicators and Fed pronouncements is crucial for informed investment decisions.

Call to Action: Consult with a financial advisor to discuss how these developments might affect your specific investment portfolio and risk tolerance. Thorough research and professional guidance are vital in navigating the complexities of the US Treasury market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Market Reacts: Fed's 2025 Rate Cut Outlook And Yield Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

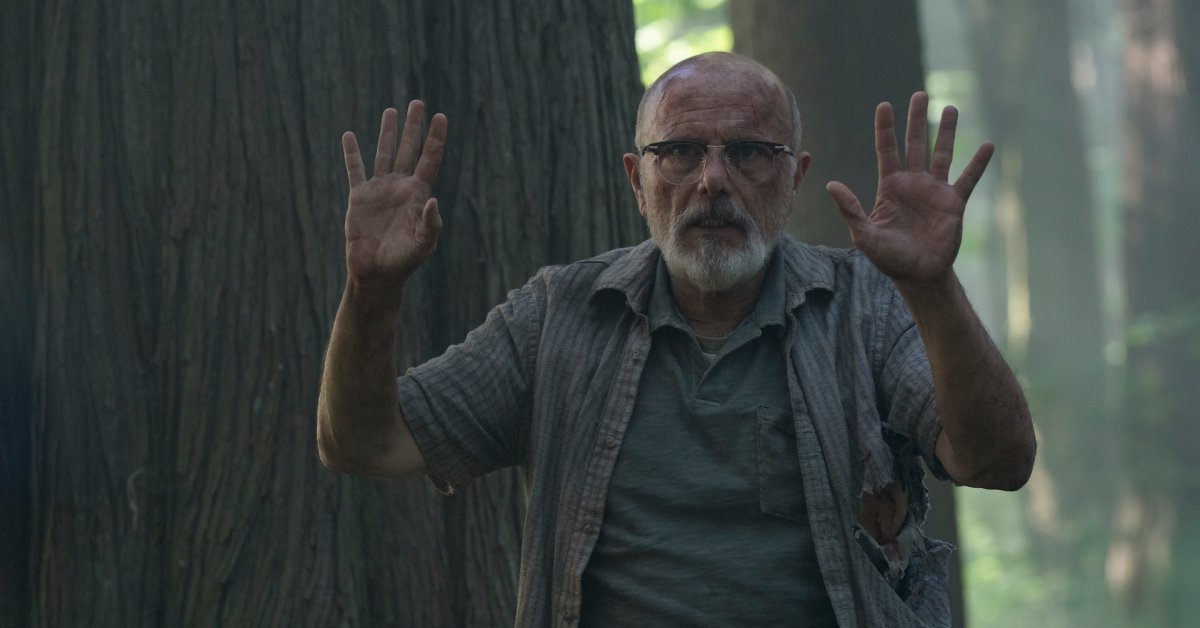

The Last Of Us Season 2 A Deeper Dive Into The Changes To Joel And Ellies Relationship

May 20, 2025

The Last Of Us Season 2 A Deeper Dive Into The Changes To Joel And Ellies Relationship

May 20, 2025 -

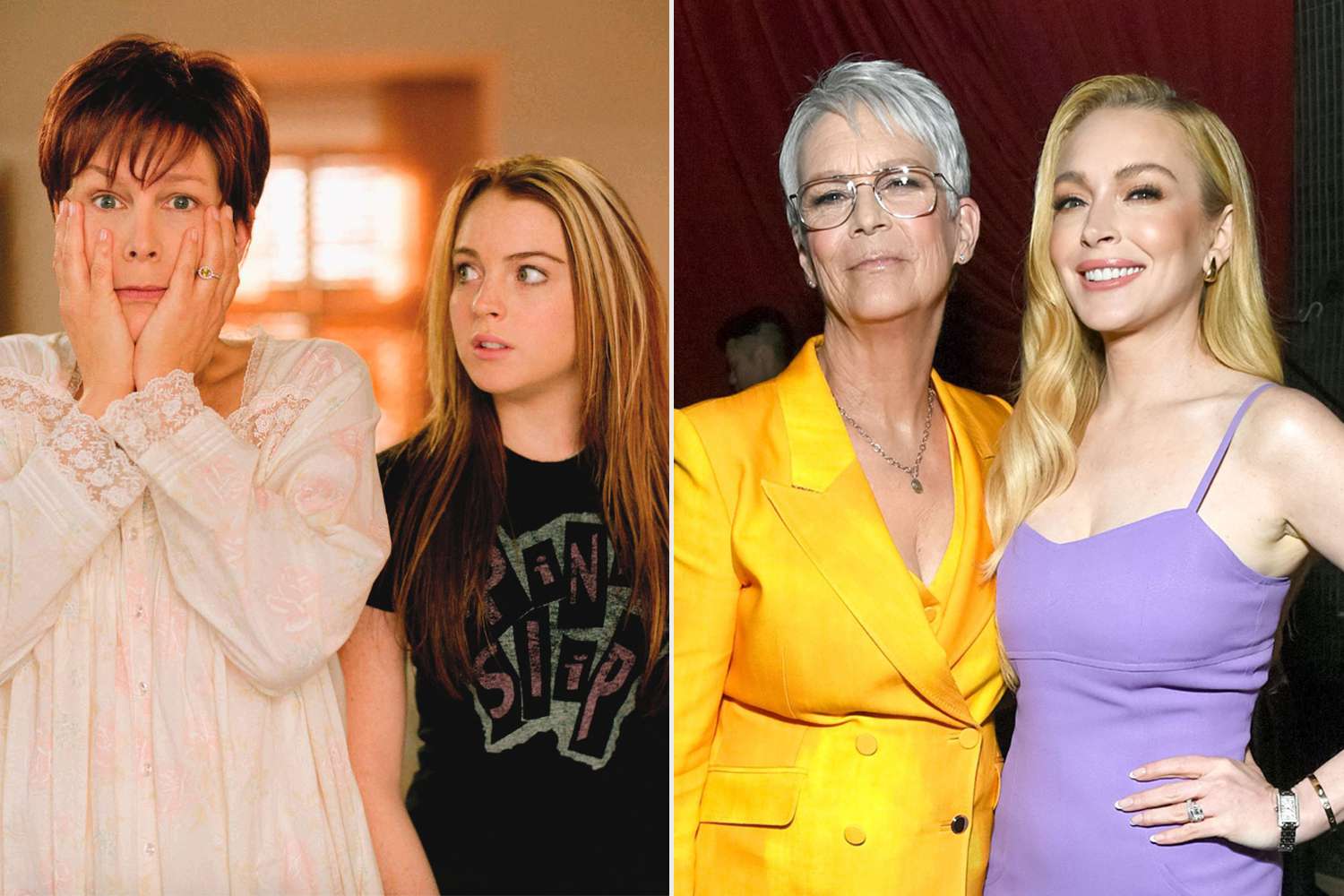

Jamie Lee Curtis Opens Up About Her Relationship With Lindsay Lohan Post Freaky Friday

May 20, 2025

Jamie Lee Curtis Opens Up About Her Relationship With Lindsay Lohan Post Freaky Friday

May 20, 2025 -

S And P 500 Dow Nasdaq Rise Market Defies Moodys And Continues Upward Trend

May 20, 2025

S And P 500 Dow Nasdaq Rise Market Defies Moodys And Continues Upward Trend

May 20, 2025 -

Severe Solar Storm Triggers Continent Wide Communications Blackouts

May 20, 2025

Severe Solar Storm Triggers Continent Wide Communications Blackouts

May 20, 2025 -

Upcoming Russia Ukraine Peace Talks Trumps Announcement

May 20, 2025

Upcoming Russia Ukraine Peace Talks Trumps Announcement

May 20, 2025