Institutional Investors Fuel Bitcoin ETF Growth: $5 Billion And Counting

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Fuel Bitcoin ETF Growth: $5 Billion and Counting

The cryptocurrency market is buzzing with excitement as institutional investment in Bitcoin exchange-traded funds (ETFs) surges past the $5 billion mark. This monumental milestone signifies a significant shift in the perception and adoption of Bitcoin as a legitimate asset class, attracting major players beyond individual investors. The influx of institutional money is not just boosting the ETF market; it's injecting a powerful dose of legitimacy and stability into the often-volatile world of crypto.

The $5 Billion Milestone: A Game Changer

Reaching $5 billion in assets under management (AUM) for Bitcoin ETFs represents a watershed moment. This figure underscores the growing confidence of sophisticated investors, including pension funds, hedge funds, and asset management firms, in Bitcoin's long-term potential. The sustained growth reflects a maturing market, moving beyond the speculative frenzy of its early days towards a more established and regulated investment landscape.

Driving Forces Behind the Surge

Several factors contribute to this dramatic increase in institutional investment:

-

Regulatory Clarity: The gradual increase in regulatory clarity surrounding Bitcoin and cryptocurrencies in key markets like the US and Canada has played a crucial role. The approval of the first Bitcoin futures ETF in the US paved the way for increased institutional participation, reducing regulatory uncertainty. Learn more about the evolving regulatory landscape for cryptocurrencies .

-

Inflation Hedge: With persistent inflation concerns globally, Bitcoin, often perceived as a hedge against inflation, has attracted significant attention from investors seeking to protect their portfolios from the erosion of purchasing power. This is especially true in a macroeconomic environment with rising interest rates.

-

Diversification: Institutional investors are increasingly recognizing the potential benefits of diversifying their portfolios with alternative assets, including Bitcoin. The low correlation between Bitcoin and traditional asset classes makes it an attractive addition to a well-diversified investment strategy.

-

Increased Institutional Infrastructure: The emergence of robust custodial solutions and trading platforms specifically designed for institutional investors has significantly lowered the barriers to entry for larger players. This has made it easier and safer for institutions to invest in and manage Bitcoin holdings.

What the Future Holds

The continued growth of Bitcoin ETFs suggests a bright future for the asset class. We can anticipate further institutional adoption as regulatory frameworks become more established and as investor understanding and confidence continue to grow. However, it's important to remember that the cryptocurrency market remains inherently volatile.

Beyond the Numbers: Implications for the Market

This surge in institutional investment isn't just about financial gains. It signifies a broader shift in the perception of Bitcoin. The participation of established financial institutions lends credibility to the asset, potentially driving wider mainstream adoption and integration into traditional financial systems. This could ultimately lead to increased liquidity, price stability, and further innovation within the cryptocurrency ecosystem.

Conclusion:

The $5 billion milestone for Bitcoin ETFs marks a pivotal moment. It showcases the growing maturity and legitimacy of the cryptocurrency market and highlights the increasing confidence of institutional investors in Bitcoin as a valuable asset. While risks remain, the ongoing institutional influx suggests that Bitcoin's long-term prospects are looking increasingly positive. Are you ready to explore the potential of Bitcoin ETFs? .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Fuel Bitcoin ETF Growth: $5 Billion And Counting. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jon Jones Aspinall Comments Spark Fury Fans React To Strip The Duck Remark

May 20, 2025

Jon Jones Aspinall Comments Spark Fury Fans React To Strip The Duck Remark

May 20, 2025 -

Wall Street Rebounds S And P 500 Dow And Nasdaq Rise Despite Moodys Credit Rating Cut

May 20, 2025

Wall Street Rebounds S And P 500 Dow And Nasdaq Rise Despite Moodys Credit Rating Cut

May 20, 2025 -

Tariff Tensions Escalate Trump Vs Walmart On Price Increases

May 20, 2025

Tariff Tensions Escalate Trump Vs Walmart On Price Increases

May 20, 2025 -

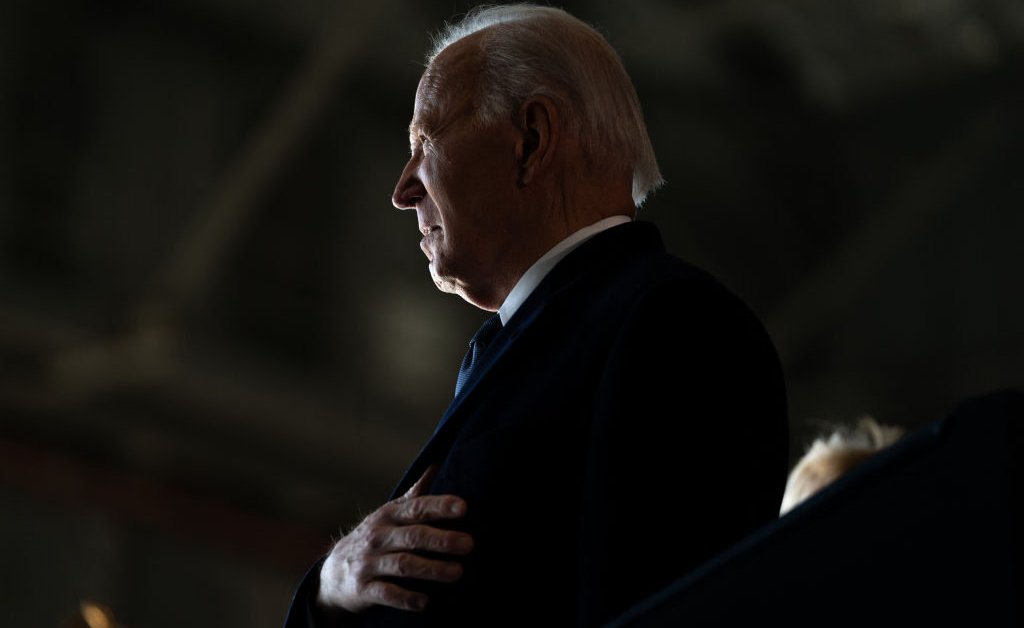

Bidens Cancer Diagnosis World Leaders Offer Encouragement And Solidarity

May 20, 2025

Bidens Cancer Diagnosis World Leaders Offer Encouragement And Solidarity

May 20, 2025 -

Star Wars Battlefronts Return What We Know So Far

May 20, 2025

Star Wars Battlefronts Return What We Know So Far

May 20, 2025