Understanding The Volatility Of Hims & Hers (HIMS) Stock: A Prudent Investor's Guide.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Volatility of Hims & Hers (HIMS) Stock: A Prudent Investor's Guide

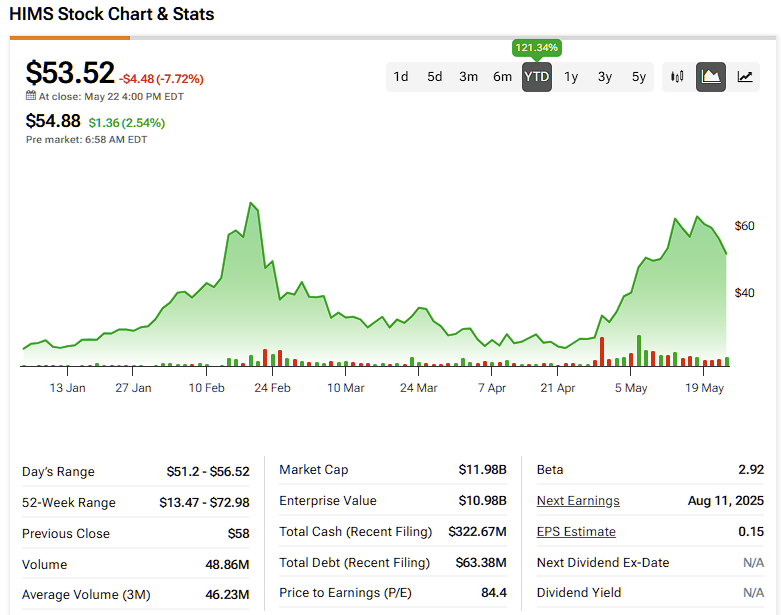

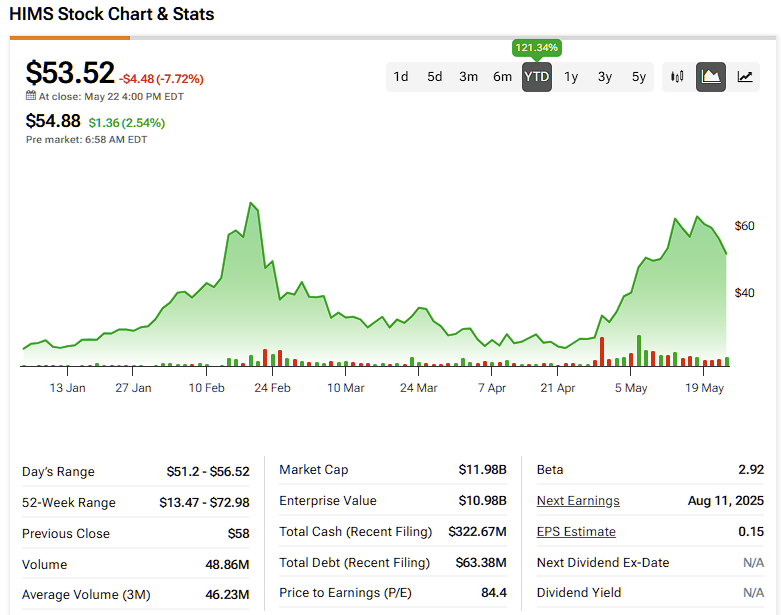

Hims & Hers Health, Inc. (HIMS) has captured the attention of investors with its telehealth platform offering personalized health and wellness solutions. However, the company's stock has also demonstrated significant volatility, making it crucial for potential investors to understand the factors contributing to its price fluctuations before making any investment decisions. This guide provides a prudent investor's perspective on navigating the complexities of HIMS stock.

What Drives HIMS Stock Volatility?

Several factors contribute to the fluctuating nature of HIMS stock:

-

Market Sentiment: Like many growth stocks, HIMS is heavily influenced by overall market sentiment. Periods of market uncertainty or corrections can disproportionately impact high-growth companies like HIMS, leading to increased volatility. Understanding broader market trends is crucial before investing.

-

Regulatory Changes: The telehealth industry is subject to evolving regulations. Changes in healthcare policy, particularly those impacting telehealth reimbursements or prescription drug regulations, can significantly impact HIMS's business model and, consequently, its stock price. Keeping abreast of regulatory developments is paramount.

-

Competition: The telehealth market is becoming increasingly competitive. The emergence of new players and the expansion of established healthcare providers into telehealth services puts pressure on HIMS to maintain its market share and innovate. Analyzing the competitive landscape is essential for assessing HIMS's long-term prospects.

-

Financial Performance: HIMS's quarterly and annual financial reports, including revenue growth, profitability, and cash flow, directly influence investor confidence. Unexpectedly poor financial results can trigger sharp declines in the stock price, while exceeding expectations can lead to significant gains. Diligent review of financial statements is non-negotiable.

-

Subscription Model Dependence: HIMS's business model relies heavily on its subscription services. Changes in customer acquisition costs, churn rates, and the average revenue per user (ARPU) directly impact the company's financial performance and therefore its stock price. Understanding the dynamics of this subscription model is key.

H2: Analyzing Risk and Reward:

Investing in HIMS stock presents both significant risks and potential rewards. The high growth potential of the telehealth sector is attractive, but the volatility requires a carefully considered approach.

H3: Mitigation Strategies for Prudent Investors:

-

Diversification: Don't put all your eggs in one basket. Diversifying your investment portfolio across different asset classes and sectors reduces the impact of any single stock's volatility.

-

Long-Term Perspective: HIMS is a growth stock, and growth stocks are inherently more volatile than established, dividend-paying companies. A long-term investment horizon allows you to ride out short-term fluctuations and potentially benefit from the company's long-term growth.

-

Thorough Due Diligence: Before investing, conduct thorough research, analyzing the company's financial statements, competitive landscape, and future growth prospects. Understanding the risks involved is crucial.

-

Consider Your Risk Tolerance: HIMS stock is not suitable for all investors. Only invest an amount you can afford to lose, and ensure your investment strategy aligns with your overall risk tolerance.

H2: Conclusion:

HIMS stock presents a compelling investment opportunity for those willing to accept a higher degree of risk. However, understanding the factors driving its volatility and employing prudent investment strategies is crucial for mitigating risk and maximizing potential returns. Remember to consult with a qualified financial advisor before making any investment decisions. Staying informed about the company’s performance and the broader telehealth market is essential for navigating the complexities of HIMS stock and making sound investment choices. This requires ongoing monitoring and a willingness to adapt your strategy as needed.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Volatility Of Hims & Hers (HIMS) Stock: A Prudent Investor's Guide.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nio Stock Q1 Earnings And The Potential For Investor Gain

Jun 03, 2025

Nio Stock Q1 Earnings And The Potential For Investor Gain

Jun 03, 2025 -

Community Rallies Around Actors Son After Devastating Tornado

Jun 03, 2025

Community Rallies Around Actors Son After Devastating Tornado

Jun 03, 2025 -

England Vs West Indies Roots 166 Leads England To Narrow Win In Cardiff

Jun 03, 2025

England Vs West Indies Roots 166 Leads England To Narrow Win In Cardiff

Jun 03, 2025 -

Are Federal Workers Union Rights Under Threat The Future Of Collective Bargaining

Jun 03, 2025

Are Federal Workers Union Rights Under Threat The Future Of Collective Bargaining

Jun 03, 2025 -

June 2 2025 Important Asian Economic Releases And Events

Jun 03, 2025

June 2 2025 Important Asian Economic Releases And Events

Jun 03, 2025