NIO Stock: Q1 Earnings And The Potential For Investor Gain

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock: Q1 Earnings and the Potential for Investor Gain

NIO, a leading Chinese electric vehicle (EV) manufacturer, recently released its Q1 2024 earnings report, sending ripples through the investment community. The results painted a mixed picture, prompting investors to reassess the company's potential for future growth and profitability. This article delves into the key takeaways from the report, analyzes the current market sentiment surrounding NIO stock, and explores the potential for investor gain.

Q1 2024 Earnings: A Closer Look

NIO's Q1 2024 earnings revealed a complex situation. While the company delivered strong vehicle deliveries, exceeding analyst expectations, its overall revenue fell slightly short of projections. This discrepancy can be attributed to several factors, including intensified competition within the burgeoning Chinese EV market and ongoing price wars. Furthermore, the company's gross profit margin experienced a contraction, primarily due to increased promotional activities and pricing pressures.

-

Positive Aspects: Record vehicle deliveries highlight growing consumer demand for NIO's vehicles. The company's expansion into new markets and its continued investment in research and development (R&D) also signal a long-term commitment to innovation and growth.

-

Challenges: The intense competition and pressure on profit margins pose significant challenges. Maintaining a competitive edge while ensuring profitability will be crucial for NIO's long-term success.

Market Sentiment and Stock Performance

Following the release of the Q1 earnings, NIO stock experienced a period of volatility. While some analysts expressed concern over the short-term financial performance, others remained optimistic about the company's long-term prospects. The overall market sentiment appears cautiously optimistic, with many investors focusing on the company’s potential for future growth rather than short-term financial results. This is particularly true given NIO's strong brand recognition and loyal customer base in China.

Potential for Investor Gain: A Long-Term Perspective

The potential for investor gain in NIO stock hinges on several key factors:

-

Continued Growth in EV Market: The global EV market is expected to experience significant growth in the coming years. NIO's ability to capitalize on this growth will be a major driver of its future success.

-

Innovation and Technological Advancement: NIO's commitment to R&D and its innovative battery swapping technology could give it a competitive edge in the market.

-

Expansion into New Markets: Successful expansion into international markets can significantly boost revenue and profitability.

-

Effective Cost Management: Addressing the challenges related to profit margins through effective cost management strategies will be crucial.

Is NIO Stock a Buy?

Whether or not NIO stock is a buy depends largely on individual investor risk tolerance and investment horizon. While the Q1 earnings report presented some challenges, the long-term prospects for the company remain promising, given the overall growth of the EV market and NIO's strategic positioning. Investors should conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Further Reading:

This article aims to provide a comprehensive overview of NIO's Q1 earnings and the potential for investor gain. Remember to always conduct your own research and consider seeking professional advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock: Q1 Earnings And The Potential For Investor Gain. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rising Energy Costs Fuel Resident Outrage Protests Against Dte Energy Rate Increases

Jun 03, 2025

Rising Energy Costs Fuel Resident Outrage Protests Against Dte Energy Rate Increases

Jun 03, 2025 -

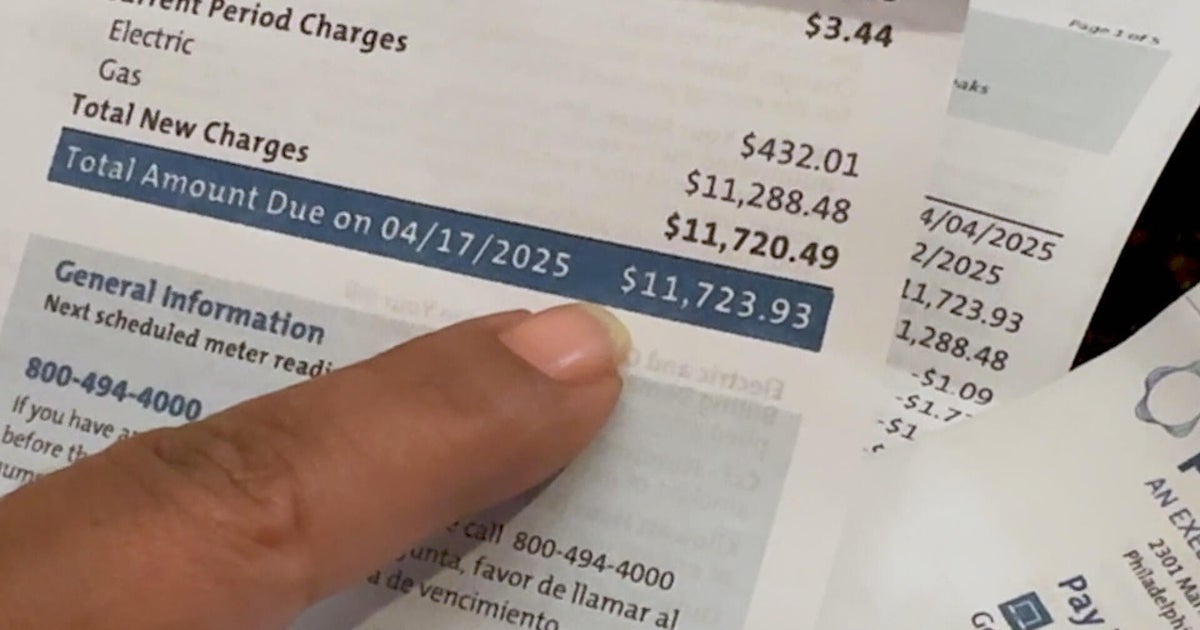

Peco Billing Problems One Customers 12 000 Bill And Months Of Delays For Others

Jun 03, 2025

Peco Billing Problems One Customers 12 000 Bill And Months Of Delays For Others

Jun 03, 2025 -

Sheinelle Jones Receives Outpouring Of Support Following Husbands Passing

Jun 03, 2025

Sheinelle Jones Receives Outpouring Of Support Following Husbands Passing

Jun 03, 2025 -

Economic Events In Asia Monday June 2nd 2025 Overview

Jun 03, 2025

Economic Events In Asia Monday June 2nd 2025 Overview

Jun 03, 2025 -

Hims Stock Price Increase 3 02 Gain On May 30

Jun 03, 2025

Hims Stock Price Increase 3 02 Gain On May 30

Jun 03, 2025