Understanding The Trump Tax Plan: Avoiding Future Tax Avoidance Schemes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Trump Tax Plan: Avoiding Future Tax Avoidance Schemes

The 2017 Tax Cuts and Jobs Act, often referred to as the Trump tax plan, significantly reshaped the US tax code. While it delivered lower tax rates for many, it also inadvertently created loopholes and opportunities for sophisticated tax avoidance schemes. Understanding these potential pitfalls is crucial for individuals and businesses alike to ensure tax compliance and avoid future penalties. This article delves into key aspects of the Trump tax plan and highlights strategies to navigate its complexities legally and ethically.

Key Changes Introduced by the Trump Tax Plan:

The Trump tax plan brought several major changes, including:

- Reduced corporate tax rates: A dramatic reduction from 35% to 21% spurred significant economic activity but also raised concerns about potential tax avoidance through corporate structuring.

- Increased standard deduction: This simplified tax filing for many but also narrowed the benefits of itemized deductions, potentially impacting charitable giving and other tax-advantaged strategies.

- Changes to individual tax brackets: While lower rates were implemented, the changes also affected the tax liability of high-income earners and impacted the effectiveness of certain deductions.

- Pass-through business deductions: This provision offered a 20% deduction for qualified business income (QBI) from pass-through entities like S corporations and partnerships, but complex rules surrounding this deduction created opportunities for manipulation.

Potential Tax Avoidance Schemes and How to Avoid Them:

The complexity of the Trump tax plan opened doors for various tax avoidance strategies. Here are some key areas of concern and how to navigate them responsibly:

1. Misuse of the QBI Deduction: The QBI deduction, while intended to benefit small businesses, has been a target for aggressive tax planning. It's crucial to accurately determine qualified business income and ensure compliance with the intricate rules surrounding this deduction. Consult with a qualified tax professional to avoid potential penalties.

2. Exploiting International Tax Loopholes: The Trump tax plan's impact on international taxation created opportunities for multinational corporations to shift profits to low-tax jurisdictions. Understanding the implications of controlled foreign corporations (CFCs) and other international tax regulations is vital for businesses with global operations.

3. Improper Use of Tax Shelters: While legitimate tax planning strategies exist, many individuals and businesses fall prey to aggressive tax shelters promising unrealistic tax savings. These often involve complex financial instruments and transactions designed to mask taxable income. Always exercise caution and thoroughly investigate any proposed tax shelter before engaging.

4. Misrepresentation of Business Expenses: Inflating business expenses to reduce taxable income is a common tax avoidance scheme. Maintaining accurate and detailed records of all business expenses is crucial to avoid scrutiny from the IRS.

Best Practices for Tax Compliance:

- Maintain meticulous records: Keep detailed records of all income and expenses. Digital accounting software can greatly simplify this process.

- Seek professional advice: Consult with a qualified tax advisor or CPA to ensure compliance with all applicable tax laws and regulations.

- Stay informed: Tax laws are constantly evolving. Stay updated on changes and their impact on your tax situation. Resources like the IRS website and reputable financial news outlets can be helpful.

- Understand your tax obligations: Familiarize yourself with the specific tax rules and regulations relevant to your personal or business situation.

Conclusion:

The Trump tax plan presented both opportunities and challenges. While lower tax rates benefited many, it also created avenues for tax avoidance. By understanding the key changes, potential pitfalls, and best practices outlined above, individuals and businesses can navigate the complexities of the tax code and avoid future tax avoidance schemes. Proactive tax planning and expert advice are essential for ensuring compliance and peace of mind. Remember, ethical tax planning is crucial; avoiding aggressive tax avoidance strategies is not only legally sound but also morally responsible.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Trump Tax Plan: Avoiding Future Tax Avoidance Schemes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

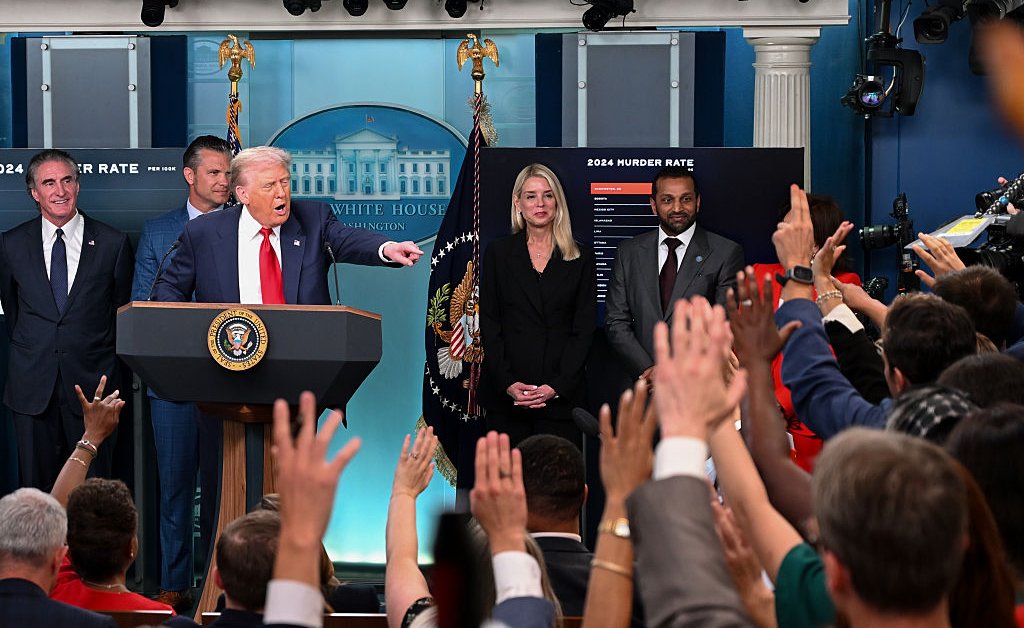

Is Trumps Approach To Dc In 2024 Mirroring His 2020 Playbook

Aug 13, 2025

Is Trumps Approach To Dc In 2024 Mirroring His 2020 Playbook

Aug 13, 2025 -

Farmers Almanac Issues Winter Storm Warning For Region Name

Aug 13, 2025

Farmers Almanac Issues Winter Storm Warning For Region Name

Aug 13, 2025 -

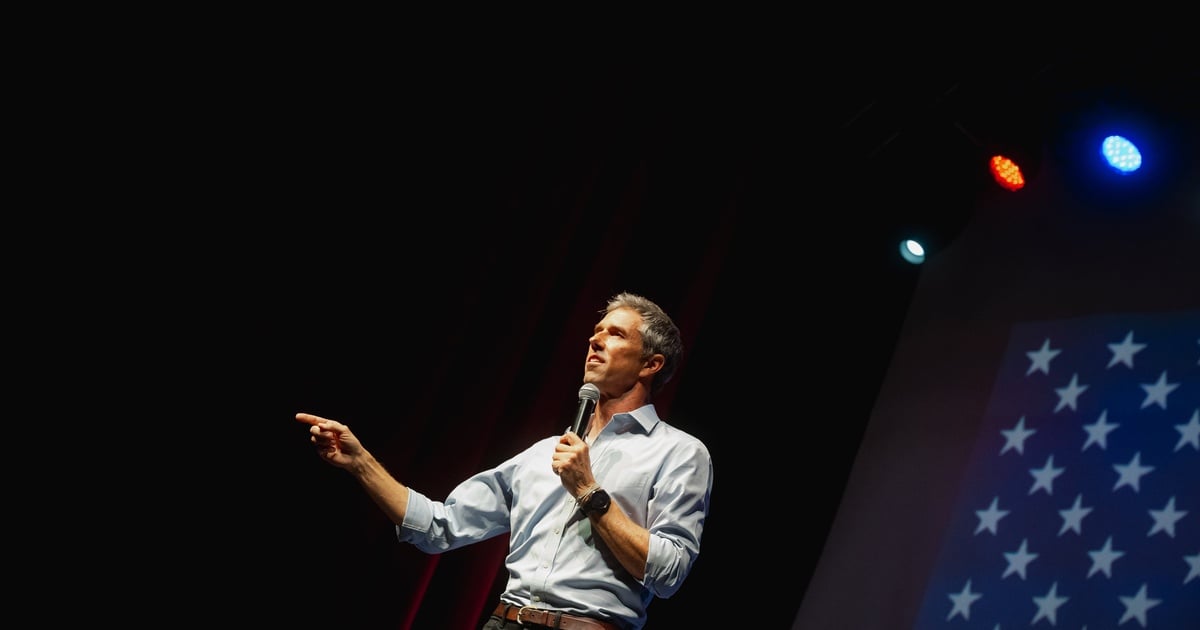

Ken Paxton Wants Beto O Rourke Jailed For Dem Walkout Fundraising

Aug 13, 2025

Ken Paxton Wants Beto O Rourke Jailed For Dem Walkout Fundraising

Aug 13, 2025 -

Metro Detroit Weather Alert Storms And Potential Severe Weather Tonight

Aug 13, 2025

Metro Detroit Weather Alert Storms And Potential Severe Weather Tonight

Aug 13, 2025 -

Atnf Stock Soars 180 Life Sciences Ethereum Bet Pays Off Big

Aug 13, 2025

Atnf Stock Soars 180 Life Sciences Ethereum Bet Pays Off Big

Aug 13, 2025

Latest Posts

-

The Trump Putin Summit A Behind The Scenes Look At The Key Backchannel Negotiations

Aug 13, 2025

The Trump Putin Summit A Behind The Scenes Look At The Key Backchannel Negotiations

Aug 13, 2025 -

180 Life Sciences Atnf Stock Surges 80 After 350 M Ethereum Investment

Aug 13, 2025

180 Life Sciences Atnf Stock Surges 80 After 350 M Ethereum Investment

Aug 13, 2025 -

Would A 10 000 Doge Investment In 2018 Be Profitable Now

Aug 13, 2025

Would A 10 000 Doge Investment In 2018 Be Profitable Now

Aug 13, 2025 -

180 Life Sciences Atnf Biotechs Crypto Pivot And Stock Surge Explained

Aug 13, 2025

180 Life Sciences Atnf Biotechs Crypto Pivot And Stock Surge Explained

Aug 13, 2025 -

Dogecoin At 0 25 Buy Or Sell Expert Analysis And Insights

Aug 13, 2025

Dogecoin At 0 25 Buy Or Sell Expert Analysis And Insights

Aug 13, 2025