180 Life Sciences (ATNF): Biotech's Crypto Pivot And Stock Surge Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

180 Life Sciences (ATNF): Biotech's Crypto Pivot and Stock Surge Explained

180 Life Sciences (ATNF), a clinical-stage biotechnology company, has recently experienced a significant surge in its stock price, fueled by its unexpected pivot into the cryptocurrency sector. This move, while seemingly drastic, has captivated investors and sparked intense debate within the financial world. Understanding the reasons behind this dramatic shift and the subsequent stock surge requires a closer examination of the company's strategy and the current market dynamics.

The Unexpected Crypto Connection:

Traditionally focused on developing treatments for inflammatory diseases and certain cancers, 180 Life Sciences announced a strategic shift towards blockchain technology and cryptocurrency investments. This decision, initially met with skepticism from some analysts, has been attributed to several factors:

-

Diversification: The biotech industry is notoriously volatile. By diversifying its investments into the burgeoning cryptocurrency market, 180 Life Sciences aims to mitigate risk and potentially unlock new revenue streams. This strategy mirrors the diversification efforts of other companies looking to lessen dependence on a single market segment. [Link to article about diversification in biotech]

-

Capitalizing on Market Trends: The cryptocurrency market, despite its inherent volatility, has shown significant growth potential. By entering this sector, 180 Life Sciences is attempting to capitalize on this growth and potentially generate significant returns on its investments. [Link to article on cryptocurrency market trends]

-

Long-Term Vision: While the immediate impact is a stock price surge, the company likely views its crypto investments as a long-term strategy, possibly aiming to integrate blockchain technology into its future pharmaceutical development and data management systems. This forward-looking approach is gaining traction within the broader healthcare industry. [Link to article on blockchain in healthcare]

Analyzing the Stock Surge:

The recent surge in ATNF stock price isn't solely attributable to the crypto pivot. Several factors likely contributed to this increase:

-

Increased Investor Interest: The announcement of the crypto strategy has generated considerable interest from investors seeking exposure to both the biotech and cryptocurrency markets. This influx of new investment capital directly impacts stock prices.

-

Speculative Trading: The inherent volatility of the cryptocurrency market makes ATNF a potentially attractive target for speculative trading. Short-term traders are drawn to companies showing rapid price movements, exacerbating the stock surge.

-

Market Sentiment: Positive market sentiment, both for biotech and cryptocurrencies, has further fueled the price increase. Positive news and overall market optimism often contribute to stock valuations.

Risks and Considerations:

It's crucial to acknowledge the inherent risks associated with investing in ATNF following its crypto pivot:

-

Market Volatility: Both the biotech and cryptocurrency markets are highly volatile. This means the stock price could experience significant fluctuations in the future.

-

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain, posing potential challenges for 180 Life Sciences' investments in this sector.

-

Dilution of Focus: The shift into crypto could potentially dilute the company's focus on its core biotech research and development efforts.

Conclusion:

180 Life Sciences' (ATNF) decision to enter the cryptocurrency market represents a bold, high-risk, high-reward strategy. While the recent stock surge is exciting, investors should carefully assess the inherent risks associated with this move before making any investment decisions. Thorough due diligence and a long-term perspective are essential when considering investments in companies navigating such a significant strategic shift. Further research into the company's financials and crypto holdings is recommended before making any investment decisions. Remember to consult a financial advisor before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 180 Life Sciences (ATNF): Biotech's Crypto Pivot And Stock Surge Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

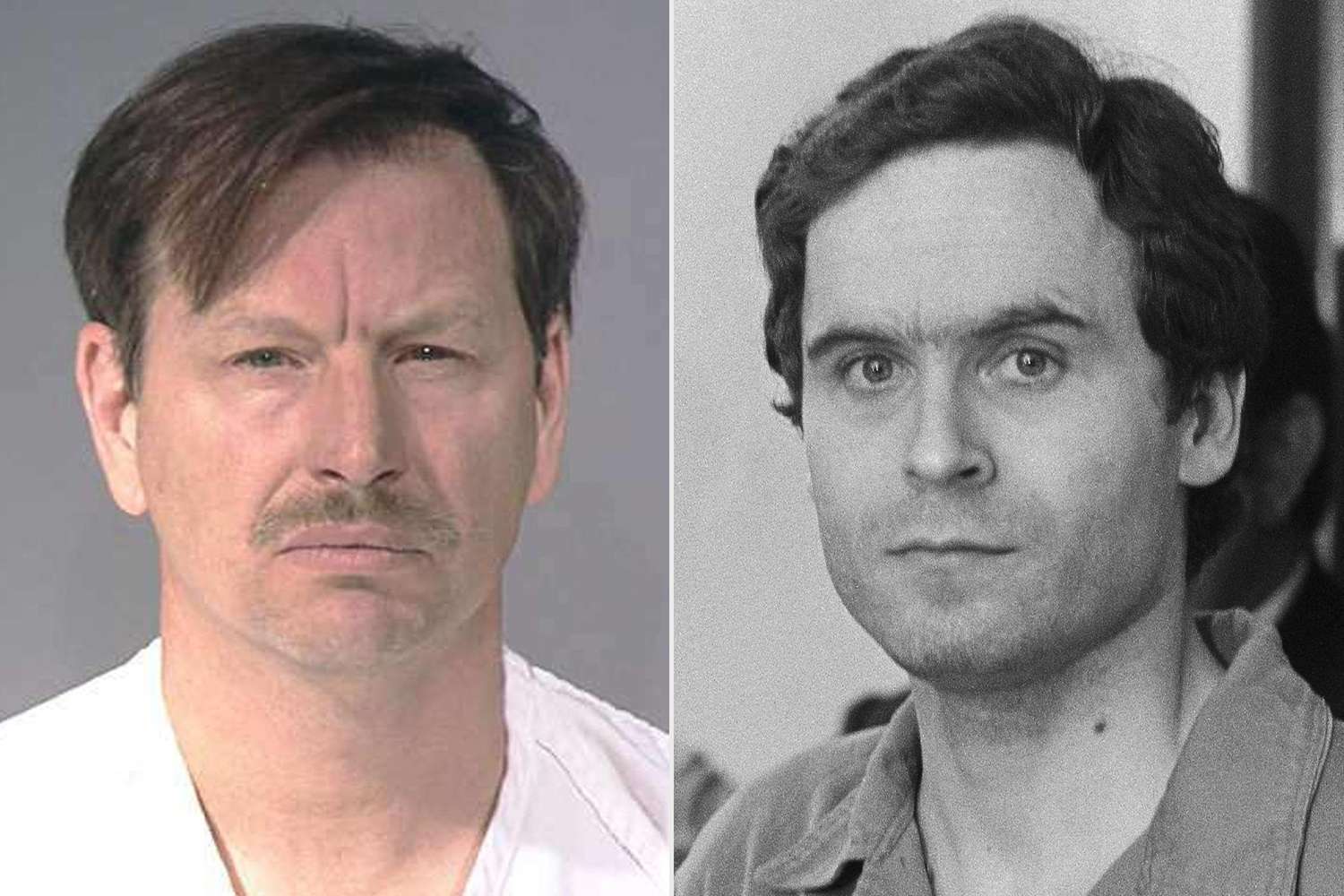

Understanding The Green River Killer Gary Ridgways Crimes

Aug 13, 2025

Understanding The Green River Killer Gary Ridgways Crimes

Aug 13, 2025 -

Peter Thiels Crypto Bet Pays Off Stock Jumps 182

Aug 13, 2025

Peter Thiels Crypto Bet Pays Off Stock Jumps 182

Aug 13, 2025 -

Farmers Almanac Issues Winter Storm Warning For Region Name

Aug 13, 2025

Farmers Almanac Issues Winter Storm Warning For Region Name

Aug 13, 2025 -

Unreal Engine 5s Impact A Case Study Of Hellblade 2s Easy Xbox To Ps 5 Port

Aug 13, 2025

Unreal Engine 5s Impact A Case Study Of Hellblade 2s Easy Xbox To Ps 5 Port

Aug 13, 2025 -

Its Cow Or Never A Critical Look At Peacemakers Season 1 Finale

Aug 13, 2025

Its Cow Or Never A Critical Look At Peacemakers Season 1 Finale

Aug 13, 2025