U.S. Treasury Yields Fall: One Fed Rate Cut Projected For 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Fall Amidst Expectations of a Single Fed Rate Cut in 2025

U.S. Treasury yields experienced a decline today, fueled by growing market expectations of a single Federal Reserve interest rate cut in 2025. This shift in the market sentiment reflects a nuanced view of the current economic landscape, balancing concerns about persistent inflation with the potential for a slowdown in economic growth. The movement underscores the ongoing debate amongst economists and investors regarding the future trajectory of monetary policy.

The benchmark 10-year Treasury yield fell to [insert current yield], while the 2-year yield dipped to [insert current yield]. This drop signifies a decrease in investor demand for higher-yielding, riskier assets, indicating a preference for the relative safety of government bonds. This is often interpreted as a sign of investors anticipating lower interest rates in the future.

Why the Shift? A Balancing Act of Inflation and Growth

Several factors are contributing to this market recalibration. While inflation remains stubbornly above the Federal Reserve's target rate of 2%, recent economic data points to a potential cooling of the economy. Softening consumer spending, a slowing housing market, and mixed employment figures are all contributing to this narrative.

The Federal Reserve itself has maintained a hawkish stance, emphasizing its commitment to bringing inflation down, even if it means slowing economic growth. However, the market seems to be pricing in a reduced likelihood of further aggressive rate hikes, and instead, anticipating a single rate cut towards the end of 2025.

What Does This Mean for Investors?

The fall in Treasury yields has significant implications for various sectors:

- Bond Markets: Lower yields mean higher bond prices, offering potentially attractive opportunities for income-seeking investors. However, it’s crucial to remember that bond prices are inversely related to yields, meaning that rising yields in the future could lead to capital losses.

- Mortgage Rates: While not directly correlated, lower Treasury yields often influence mortgage rates, potentially leading to more affordable borrowing costs for homebuyers. However, this effect can be indirect and influenced by other market factors.

- Stock Market: Lower yields can be viewed positively by the stock market, as they can reduce the cost of borrowing for companies and potentially stimulate investment. However, this is highly dependent on other economic indicators.

The Outlook: Uncertainty Remains

While the current market sentiment points towards a single rate cut in 2025, it’s crucial to acknowledge the considerable uncertainty surrounding the economic outlook. Geopolitical events, unforeseen economic shocks, and the ongoing battle against inflation could all significantly impact the Federal Reserve's decisions and, consequently, Treasury yields.

Investors should carefully consider their risk tolerance and investment horizon before making any decisions. Diversification remains a key strategy for navigating this period of economic uncertainty.

Further Reading:

- [Link to a relevant article on the Federal Reserve's recent statements]

- [Link to an article on current inflation data]

- [Link to a resource explaining the relationship between Treasury yields and mortgage rates]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Fall: One Fed Rate Cut Projected For 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Russia Ukraine Conflict Trump Intervenes Peace Talks Planned

May 20, 2025

Russia Ukraine Conflict Trump Intervenes Peace Talks Planned

May 20, 2025 -

Earth Faces Blackout Risk Nasas Alert On Intense Solar Activity

May 20, 2025

Earth Faces Blackout Risk Nasas Alert On Intense Solar Activity

May 20, 2025 -

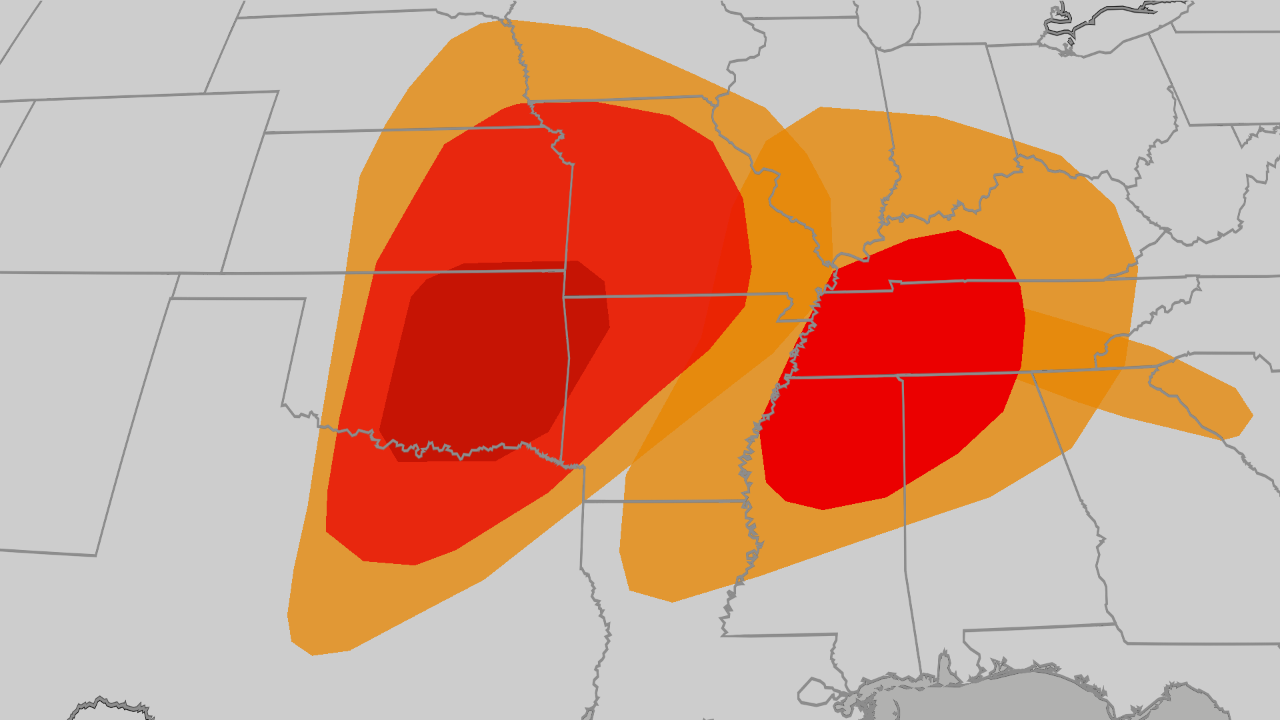

Tornado Threat Intensifies Severe Weather Outbreak Across Plains Midwest And South

May 20, 2025

Tornado Threat Intensifies Severe Weather Outbreak Across Plains Midwest And South

May 20, 2025 -

What A Gleason Score Of 9 Means Prostate Cancer Diagnosis Explained

May 20, 2025

What A Gleason Score Of 9 Means Prostate Cancer Diagnosis Explained

May 20, 2025 -

Claim Master Of Ceremony Warbonds In Helldivers 2 Starting May 15th

May 20, 2025

Claim Master Of Ceremony Warbonds In Helldivers 2 Starting May 15th

May 20, 2025