How Clean Energy Tax Policy Will Reshape The US Economic Landscape

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How Clean Energy Tax Policy Will Reshape the US Economic Landscape

The US is undergoing a significant energy transition, spurred largely by ambitious clean energy tax policies embedded within landmark legislation like the Inflation Reduction Act (IRA). These policies are poised to dramatically reshape the American economic landscape, impacting everything from job creation and technological innovation to regional development and international competitiveness. But what exactly does this transformation entail, and what are the potential pitfalls and triumphs along the way?

A Wave of Investment and Job Creation:

The IRA's generous tax credits for renewable energy sources like solar, wind, and geothermal power are already attracting massive investment. This influx of capital is translating into tangible job growth across the country. From manufacturing solar panels in Georgia to installing wind turbines in Iowa, the clean energy sector is creating high-paying jobs in both blue-collar and white-collar fields. A recent report by the Department of Energy estimates the potential for millions of new jobs in the clean energy sector over the next decade, significantly boosting employment numbers nationwide. This isn't just about construction; it encompasses research and development, engineering, project management, and more.

Boosting Domestic Manufacturing and Reducing Reliance on Foreign Energy:

One of the key goals of the clean energy tax policy is to reduce America's dependence on foreign energy sources. By incentivizing domestic manufacturing of renewable energy components, the IRA aims to strengthen national energy security and lessen vulnerability to global supply chain disruptions. This “Made in America” approach isn't just about patriotism; it's a strategic move to foster economic resilience and create a more stable energy future. This includes incentives for battery production, critical mineral extraction and processing, and the development of advanced energy storage technologies.

Regional Economic Diversification:

The geographic distribution of clean energy resources is diverse. While some states excel in wind power, others are better suited for solar. This uneven distribution presents an opportunity for economic diversification in regions traditionally reliant on fossil fuels. By providing targeted incentives, the government hopes to revitalize struggling communities and create new economic opportunities in areas that need them most. This requires careful planning and investment in infrastructure to support the growth of these new industries.

Challenges and Considerations:

While the potential benefits are substantial, the transition to a clean energy economy also presents challenges. The rapid deployment of renewable energy technologies requires a significant upgrade to the nation’s grid infrastructure. Furthermore, ensuring a just transition for workers in the fossil fuel industry is crucial to avoid social and economic disruption. Retraining programs and support for affected communities are essential to mitigate the negative consequences of this shift.

The International Stage:

The US's ambitious clean energy policy has implications beyond its borders. It positions the country as a global leader in the fight against climate change and could attract foreign investment in the US clean energy sector. However, it also raises questions about international trade and competitiveness.

Looking Ahead:

The success of the clean energy tax policy hinges on effective implementation, robust infrastructure investment, and a commitment to a just transition. While challenges remain, the potential for economic transformation is undeniable. The coming years will be crucial in assessing the long-term impact of these policies on the US economic landscape, and continued monitoring and adaptation will be necessary to ensure a successful and equitable transition.

Call to Action: Stay informed about the evolving landscape of clean energy policy and its impact on your community. Learn more about available resources and incentives at [link to relevant government website, e.g., Department of Energy].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How Clean Energy Tax Policy Will Reshape The US Economic Landscape. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jon Jones Controversial Aspinall Take Should The Ufc Heavyweight Be Stripped

May 20, 2025

Jon Jones Controversial Aspinall Take Should The Ufc Heavyweight Be Stripped

May 20, 2025 -

Deconstructing Success The Taylor Jenkins Reid Publishing Model

May 20, 2025

Deconstructing Success The Taylor Jenkins Reid Publishing Model

May 20, 2025 -

U S Treasury Market Reacts Yields Fall On Feds Rate Cut Prediction

May 20, 2025

U S Treasury Market Reacts Yields Fall On Feds Rate Cut Prediction

May 20, 2025 -

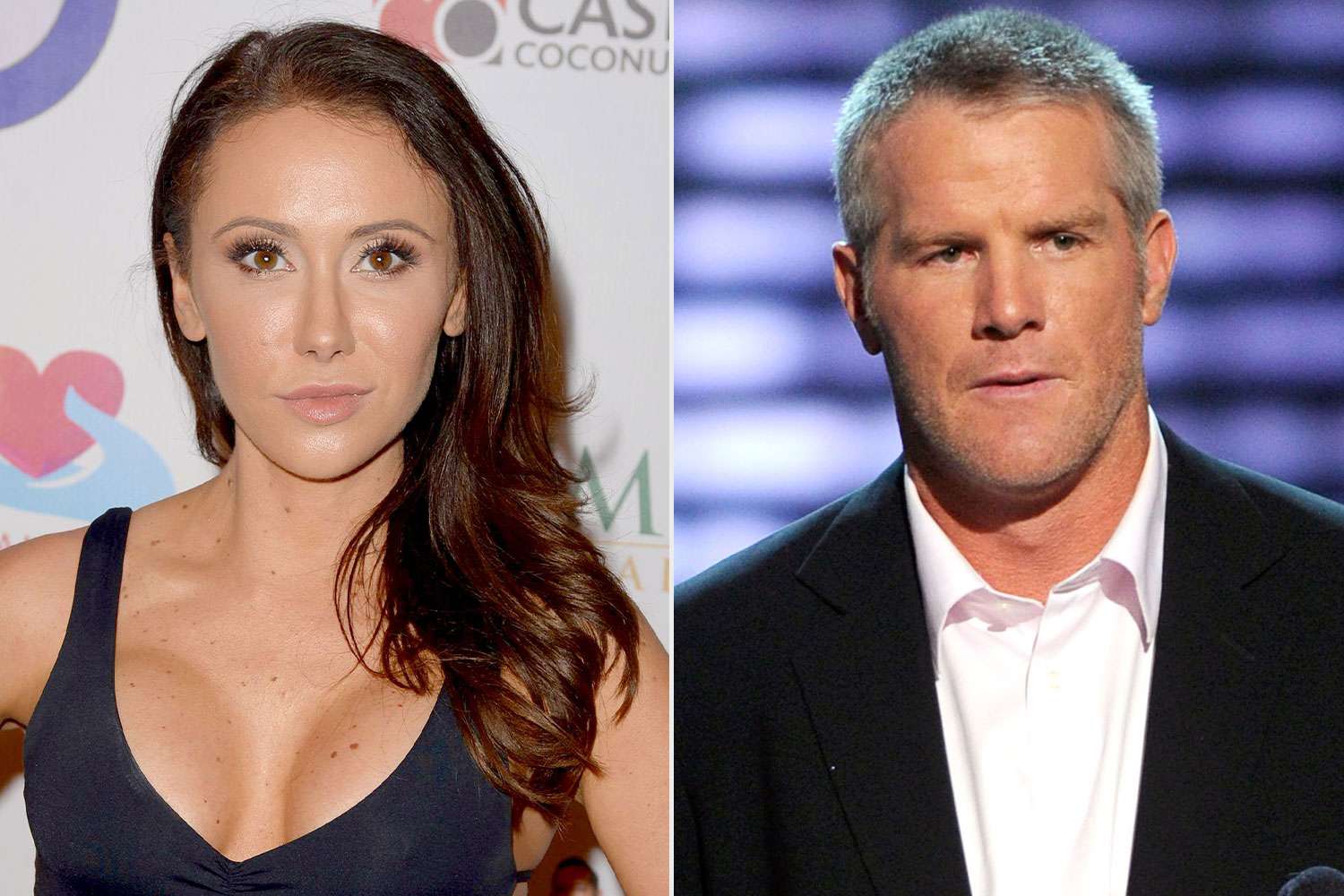

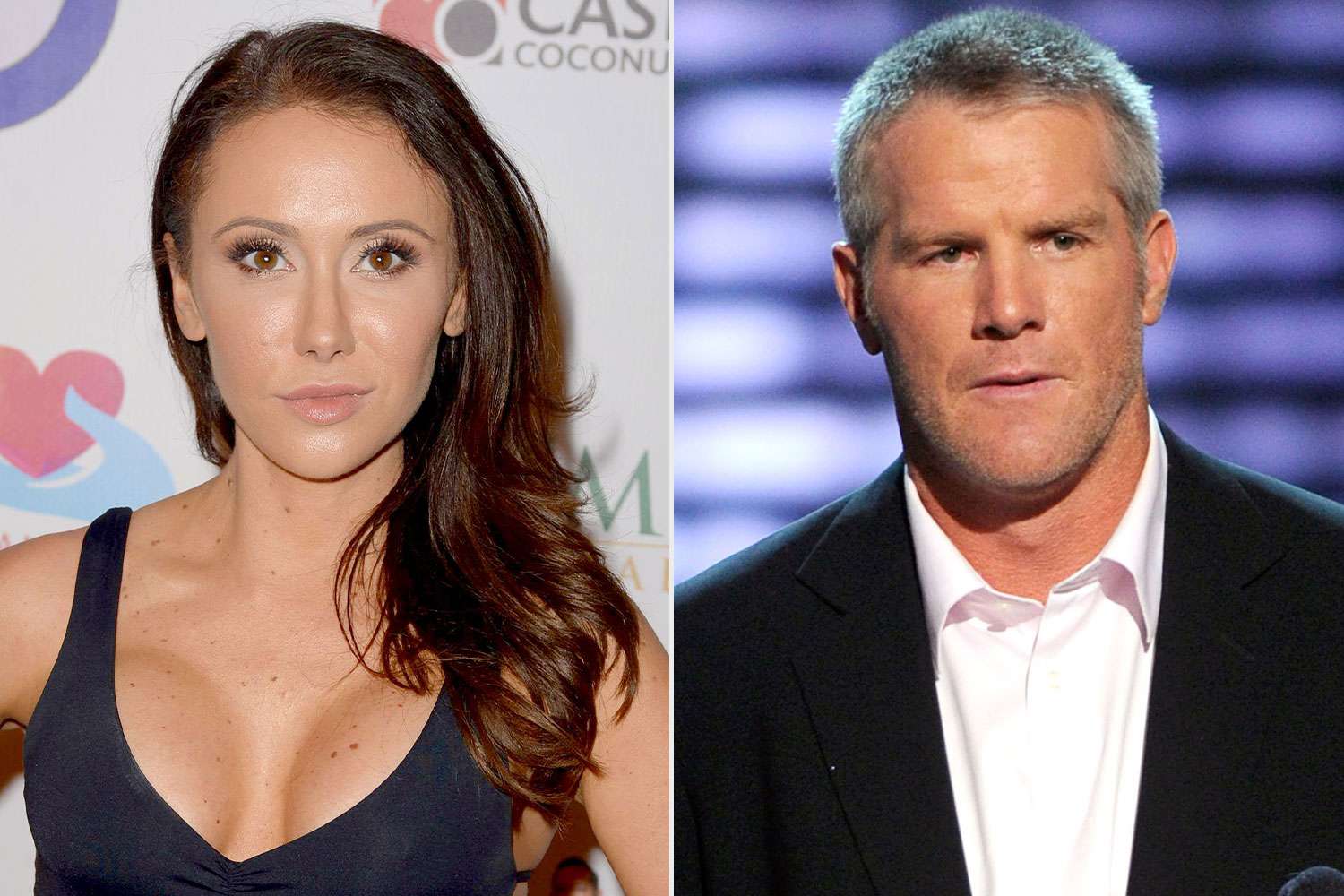

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Mistreatment

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Mistreatment

May 20, 2025 -

Brett Favre Sexting Scandal Jenn Sterger Details The Devastating Aftermath

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Details The Devastating Aftermath

May 20, 2025