U.S. Treasury Yields Fall As Federal Reserve Hints At One 2025 Rate Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Fed Signals Potential 2025 Rate Cut

U.S. Treasury yields experienced a noticeable decline following Federal Reserve Chair Jerome Powell's recent comments hinting at a potential interest rate reduction in 2025. This shift reflects a growing market expectation that the aggressive interest rate hiking cycle implemented to combat inflation might soon be nearing its end. The implications are far-reaching, impacting everything from borrowing costs for businesses to the performance of the broader stock market.

This unexpected development marks a significant change in narrative from earlier this year when the Fed projected multiple rate hikes throughout 2024. The market's reaction underscores the delicate balancing act the central bank faces between controlling inflation and avoiding a potential economic recession.

What Drove the Yield Decline?

The primary catalyst for the fall in Treasury yields was Powell's suggestion of a possible rate cut in 2025 during his testimony before Congress. While he emphasized the Fed's commitment to bringing inflation down to its 2% target, the acknowledgment of a potential future rate decrease signaled a less hawkish stance than previously anticipated. This softened sentiment among investors, leading them to reduce their demand for higher-yielding assets and driving down yields on U.S. Treasuries.

This shift is particularly interesting given the recent resilience of the U.S. economy, which has shown surprising strength despite aggressive interest rate increases. However, lingering uncertainties surrounding inflation and the potential for a future economic slowdown continue to fuel speculation within the market.

Understanding the Implications

The decrease in Treasury yields has several significant implications:

- Lower Borrowing Costs: Falling yields generally translate to lower borrowing costs for businesses and consumers. This could potentially stimulate economic activity, but also risks reigniting inflationary pressures if demand increases too rapidly.

- Impact on the Stock Market: Lower yields can be positive for the stock market, as investors may shift their allocations towards equities in search of higher returns. However, the overall effect on the stock market is complex and depends on various other factors.

- Increased Demand for Bonds: Lower yields make bonds more attractive to investors seeking a safe and stable investment, potentially leading to increased demand for U.S. Treasuries.

Looking Ahead: Uncertainty Remains

While the recent dip in Treasury yields suggests a potential shift in the Fed's monetary policy outlook, significant uncertainty remains. Inflation remains a key concern, and the Fed's future actions will heavily depend on incoming economic data. Factors like employment figures, consumer spending, and inflation reports will continue to shape market expectations and influence Treasury yields in the coming months. Analysts are closely monitoring these indicators to gauge the true trajectory of the U.S. economy and the Federal Reserve's future monetary policy decisions.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions. Investing in the bond market carries inherent risks, including interest rate risk and inflation risk.

Keywords: U.S. Treasury yields, Federal Reserve, interest rates, rate cut, inflation, economic outlook, bond market, monetary policy, Jerome Powell, investment, financial markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Fall As Federal Reserve Hints At One 2025 Rate Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ellen De Generes Comeback A Social Media Return After Heartbreaking News

May 21, 2025

Ellen De Generes Comeback A Social Media Return After Heartbreaking News

May 21, 2025 -

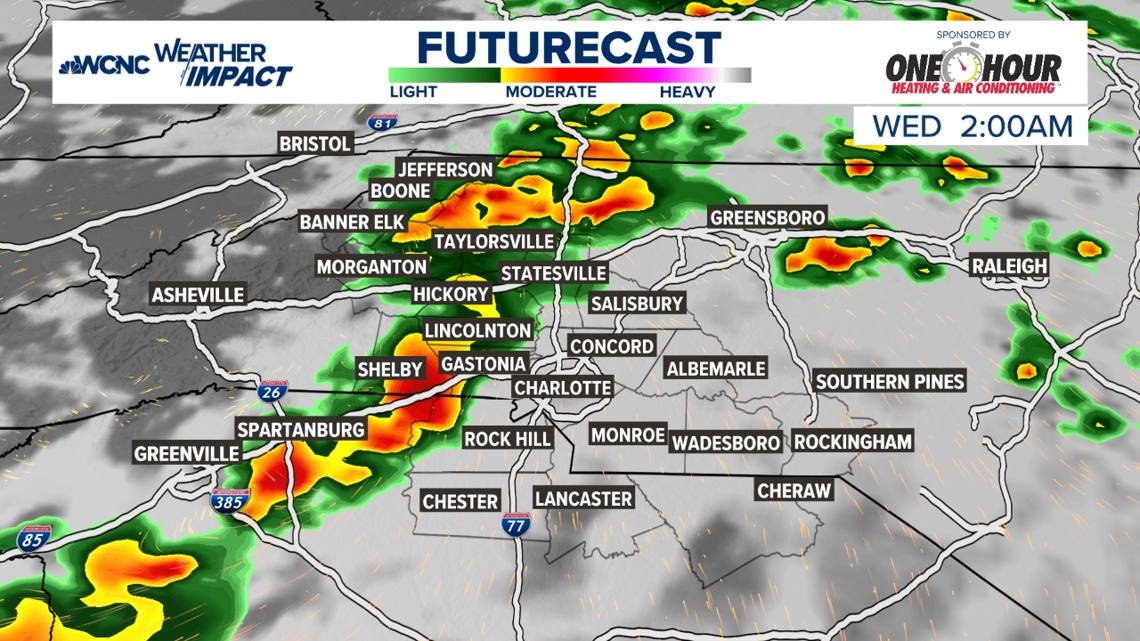

North Carolina Under Severe Weather Threat Heavy Rain And Storms Overnight

May 21, 2025

North Carolina Under Severe Weather Threat Heavy Rain And Storms Overnight

May 21, 2025 -

Weather Alert Very Isolated Risk Of Strong Storms Tuesday Night

May 21, 2025

Weather Alert Very Isolated Risk Of Strong Storms Tuesday Night

May 21, 2025 -

Severe Weather Threat North Carolina Faces Rain And Storms Overnight

May 21, 2025

Severe Weather Threat North Carolina Faces Rain And Storms Overnight

May 21, 2025 -

13 Industries 160 Companies A Japanese Drive For Corporate Value Via Environmental Stewardship

May 21, 2025

13 Industries 160 Companies A Japanese Drive For Corporate Value Via Environmental Stewardship

May 21, 2025