U.S. Treasury Yields Dip As Federal Reserve Hints At Cautious Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Federal Reserve Hints at Cautious Rate Cuts

U.S. Treasury yields experienced a decline following Federal Reserve Chair Jerome Powell's recent comments hinting at a more cautious approach to future interest rate cuts. This shift in the market reflects growing uncertainty about the pace and extent of monetary policy easing. The subtle change in the Fed's stance has sent ripples through the financial world, impacting everything from bond prices to the stock market.

This article will delve into the reasons behind the dip in Treasury yields, analyzing the implications for investors and the broader economy. We'll explore the Fed's evolving perspective on inflation, economic growth, and the potential risks associated with rapid interest rate adjustments.

The Fed's Shift in Stance: A Cautious Approach to Rate Cuts

The Federal Reserve has been aggressively raising interest rates throughout 2022 and early 2023 to combat stubbornly high inflation. However, recent economic data, including softening inflation figures and a slight slowdown in job growth, has prompted a reevaluation of its strategy.

Instead of signaling a swift series of rate cuts, Chair Powell indicated a more data-dependent approach. This means future decisions will be heavily influenced by incoming economic indicators, suggesting a potential for slower and more measured rate reductions than some market analysts had predicted. This cautious approach is designed to avoid triggering unintended consequences, such as reigniting inflation or destabilizing the financial markets.

- Key takeaways from Powell's comments:

- Emphasis on data dependency for future rate decisions.

- Acknowledgment of slowing inflation, but caution against premature easing.

- Focus on achieving a "soft landing" for the economy.

Impact on Treasury Yields and the Bond Market

The Fed's less hawkish tone directly impacted Treasury yields. Lower yields indicate higher bond prices, as investors are willing to accept lower returns for the perceived safety of government debt. This shift reflects a decreased expectation of aggressive rate hikes in the near future.

The decline in yields is not uniform across the maturity spectrum. Shorter-term yields have seen a more pronounced drop compared to longer-term yields, reflecting the market's anticipation of near-term rate cuts. This difference in yield curves can provide valuable insights into market expectations about future economic growth and inflation.

Implications for Investors and the Broader Economy

The dip in Treasury yields has significant implications for various market participants. For bond investors, this presents both opportunities and challenges. While higher bond prices are beneficial, the lower yields also mean reduced returns.

The broader economy will also feel the effects of this shift in monetary policy. Lower interest rates can stimulate economic growth by making borrowing cheaper for businesses and consumers. However, it's crucial to note that this easing needs to be carefully managed to avoid reigniting inflation.

The situation requires careful monitoring. Investors should remain vigilant and assess their portfolios accordingly. Consulting with a financial advisor is recommended for personalized guidance in navigating this evolving economic landscape.

Looking Ahead: Uncertainty and the Path Forward

The future trajectory of U.S. Treasury yields remains uncertain. Much depends on the upcoming economic data releases and the Federal Reserve's ongoing assessment of the economic situation. Inflation figures, employment data, and consumer spending will all play a significant role in shaping future monetary policy decisions.

The market will continue to closely scrutinize any communication from the Fed, searching for clues about the future direction of interest rates. This underscores the importance of staying informed and adapting investment strategies in response to evolving economic conditions.

Disclaimer: This article provides general information and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Dip As Federal Reserve Hints At Cautious Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

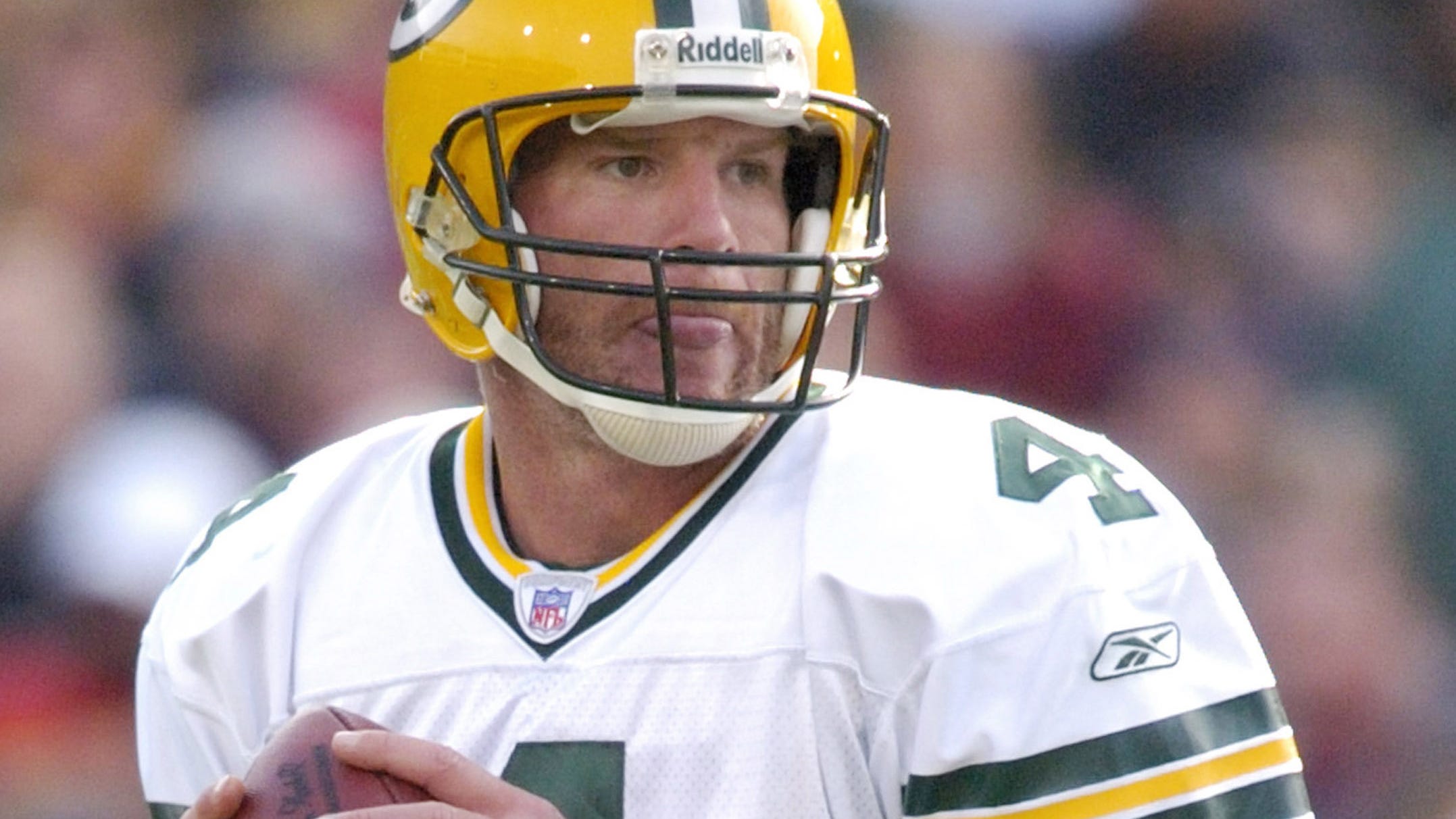

Brett Favres Legacy Under Scrutiny A Conversation With The Director Of Fall Of Favre

May 20, 2025

Brett Favres Legacy Under Scrutiny A Conversation With The Director Of Fall Of Favre

May 20, 2025 -

Live Score Updates Lsg Vs Srh Ipl 2025 Match Tensions Rise

May 20, 2025

Live Score Updates Lsg Vs Srh Ipl 2025 Match Tensions Rise

May 20, 2025 -

Limited Aid Reaches Gaza Israel Faces Mounting International Condemnation

May 20, 2025

Limited Aid Reaches Gaza Israel Faces Mounting International Condemnation

May 20, 2025 -

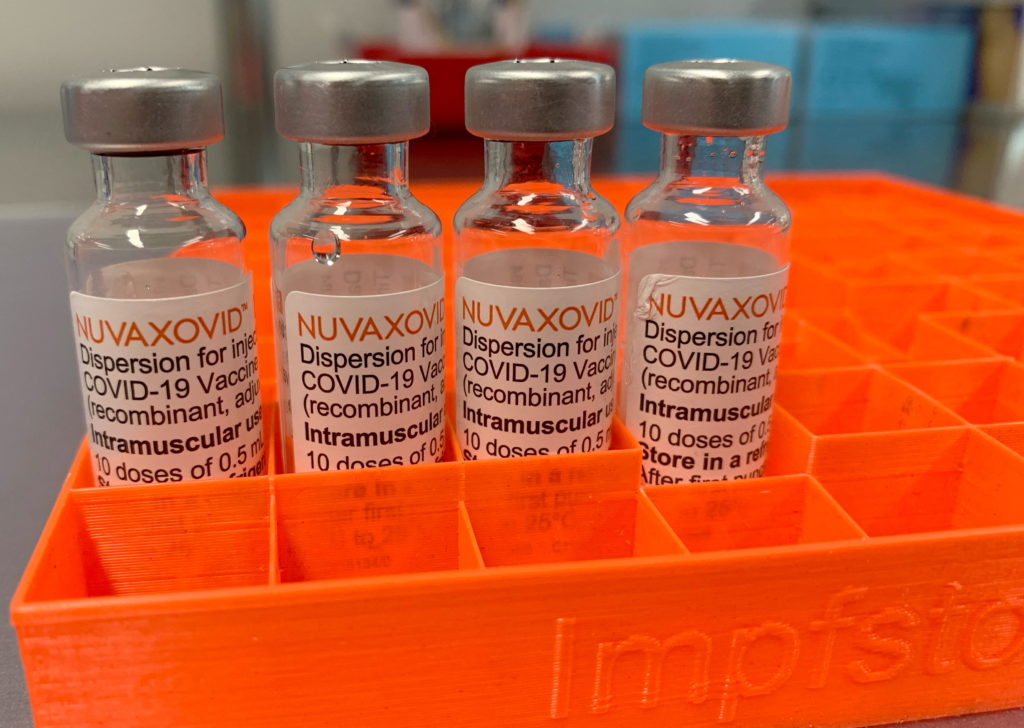

Limited Fda Approval Understanding The Novavax Covid 19 Vaccine Restrictions

May 20, 2025

Limited Fda Approval Understanding The Novavax Covid 19 Vaccine Restrictions

May 20, 2025 -

Supreme Court Ruling Ends Protected Status For Venezuelan Migrants

May 20, 2025

Supreme Court Ruling Ends Protected Status For Venezuelan Migrants

May 20, 2025