Billions Flowing Into Bitcoin ETFs: A Look At The Bold Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flowing into Bitcoin ETFs: A Look at the Bold Investment Strategy

Bitcoin ETFs are exploding in popularity, attracting billions in investment. But is this bold strategy a smart move, or a risky gamble? Let's delve into the details.

The cryptocurrency market has always been known for its volatility, but recent trends suggest a significant shift in how institutional investors view Bitcoin. The surge in investment into Bitcoin Exchange-Traded Funds (ETFs) is undeniable, with billions of dollars pouring into these funds in a relatively short period. This unprecedented inflow represents a major step towards the mainstream adoption of Bitcoin and presents both exciting opportunities and potential pitfalls for investors.

Why the Sudden Rush into Bitcoin ETFs?

Several factors contribute to this surge in investment:

-

Regulatory Clarity: The approval of several Bitcoin ETFs in key markets, such as the United States, has significantly boosted investor confidence. The regulatory framework, while still evolving, offers a degree of legitimacy and oversight previously absent. This increased regulatory clarity reduces perceived risk for many institutional investors.

-

Institutional Adoption: Large financial institutions, hedge funds, and pension funds are increasingly diversifying their portfolios to include Bitcoin. ETFs provide a regulated and accessible entry point for these large players, reducing the complexities associated with direct Bitcoin ownership.

-

Ease of Access and Diversification: Bitcoin ETFs offer a convenient way for investors to gain exposure to Bitcoin without the technical challenges of managing private keys or navigating cryptocurrency exchanges. They are easily bought and sold through traditional brokerage accounts, making them attractive to a wider range of investors.

-

Potential for High Returns (and High Risk): Bitcoin's historical price volatility, while a source of risk, also presents the potential for significant returns. Investors are betting on Bitcoin's long-term growth potential, viewing ETFs as a relatively safe way to participate in this growth.

The Risks Associated with Bitcoin ETF Investments

While the potential rewards are considerable, it's crucial to acknowledge the inherent risks:

-

Market Volatility: Bitcoin's price is notoriously volatile, susceptible to sharp fluctuations driven by market sentiment, regulatory changes, and technological developments. Even within the relative safety of an ETF, investors are still exposed to this price volatility.

-

Regulatory Uncertainty: While regulatory clarity has improved, the regulatory landscape for cryptocurrencies remains fluid. Future changes in regulations could significantly impact the performance of Bitcoin ETFs.

-

Underlying Asset Risk: The value of a Bitcoin ETF is directly tied to the price of Bitcoin. Any issues affecting the Bitcoin network or its underlying technology could negatively impact the ETF's value.

-

Expense Ratios: Like all investment funds, Bitcoin ETFs come with expense ratios, which can eat into returns over time. It's essential to compare expense ratios before investing.

A Look Ahead: The Future of Bitcoin ETFs

The influx of billions into Bitcoin ETFs signals a growing acceptance of Bitcoin as a legitimate asset class. However, it's essential for investors to proceed with caution. Thorough research, understanding the associated risks, and diversification within a broader investment portfolio are crucial. The future of Bitcoin ETFs remains uncertain, but their current popularity suggests a significant shift in the investment landscape.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in Bitcoin ETFs carries significant risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Further Reading:

- [Link to a reputable financial news source discussing Bitcoin ETFs]

- [Link to a website explaining the basics of ETFs]

Call to Action (subtle): Stay informed about the evolving cryptocurrency market by subscribing to our newsletter for regular updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flowing Into Bitcoin ETFs: A Look At The Bold Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Walmart Warns Of Higher Prices Amid Trump Tariff Dispute

May 20, 2025

Walmart Warns Of Higher Prices Amid Trump Tariff Dispute

May 20, 2025 -

Putin Undermines Trump A New Era Of Geopolitical Dynamics

May 20, 2025

Putin Undermines Trump A New Era Of Geopolitical Dynamics

May 20, 2025 -

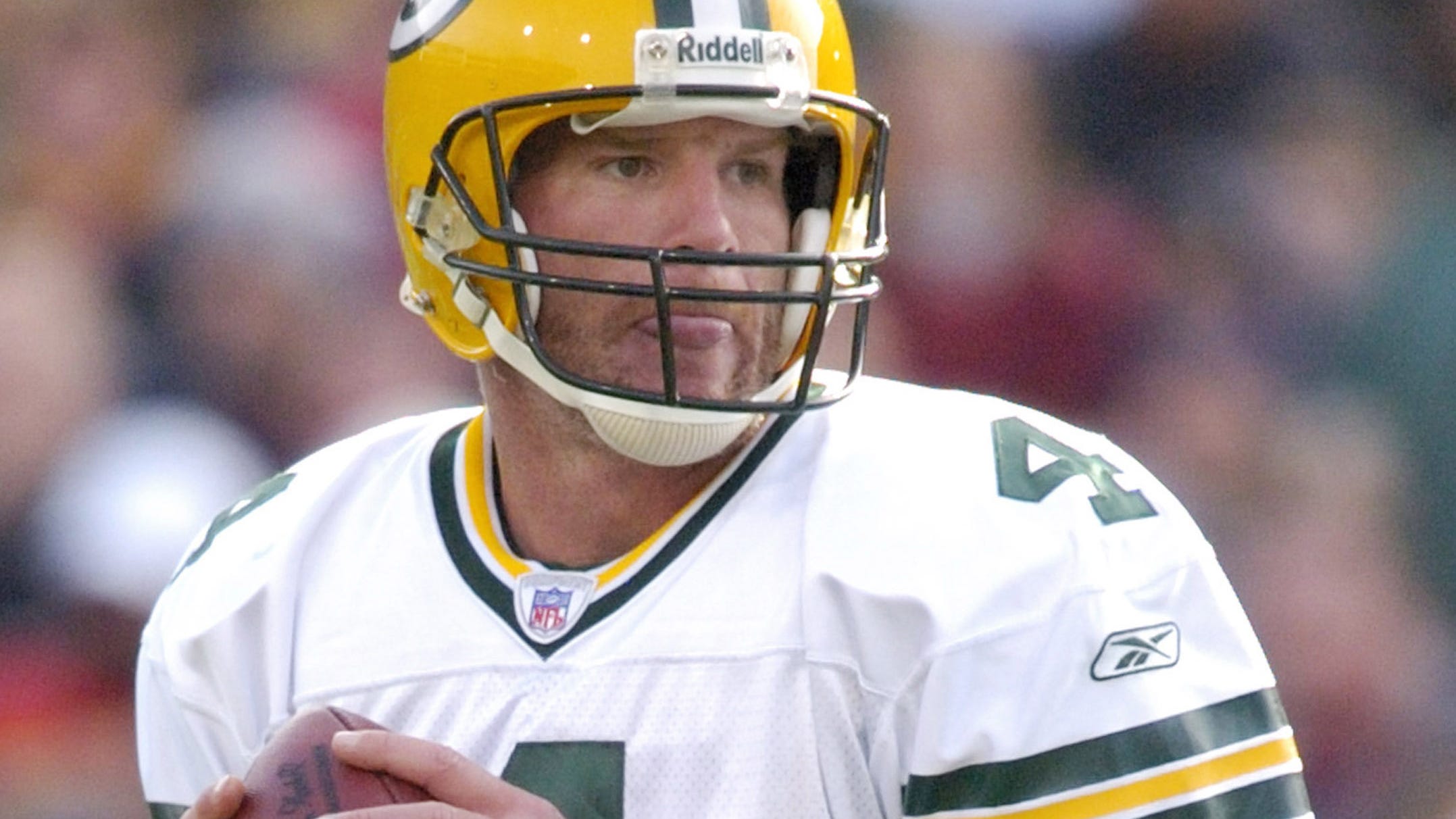

Brett Favres Legacy Under Scrutiny A Conversation With The Director Of Fall Of Favre

May 20, 2025

Brett Favres Legacy Under Scrutiny A Conversation With The Director Of Fall Of Favre

May 20, 2025 -

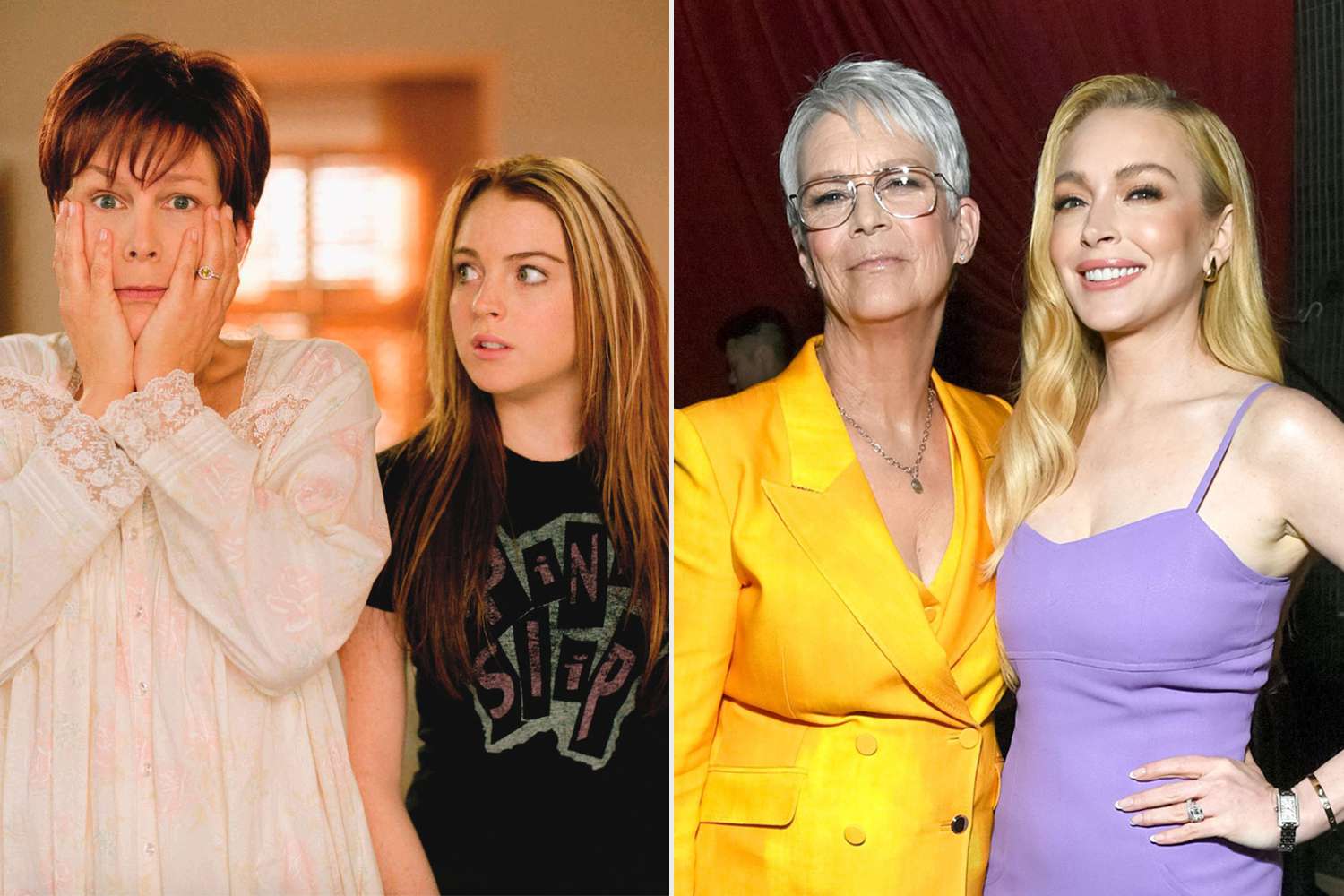

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Ongoing Bond With Lindsay Lohan

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Ongoing Bond With Lindsay Lohan

May 20, 2025 -

Review Overcompensating A Hilarious And Relatable Coming Out Story

May 20, 2025

Review Overcompensating A Hilarious And Relatable Coming Out Story

May 20, 2025