U.S. Treasury Yields Dip As Fed Hints At Limited Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Fed Hints at Limited Rate Cuts

U.S. Treasury yields experienced a decline on [Date] following Federal Reserve Chair Jerome Powell's comments suggesting a more cautious approach to future interest rate cuts. This shift in market sentiment reflects a growing uncertainty about the pace and extent of monetary policy easing in the coming months. The implications for investors and the broader economy are significant, prompting a closer look at the Fed's evolving strategy.

The recent dip in Treasury yields follows a period of heightened volatility in the bond market. Yields, which move inversely to prices, had been rising in anticipation of further aggressive rate cuts to combat potential economic slowdown. However, Powell's remarks, delivered during [Event where comments were made, e.g., a press conference or congressional testimony], painted a more nuanced picture.

<h3>Powell's Cautious Tone Shifts Market Expectations</h3>

Powell emphasized the need for a data-dependent approach, indicating that future rate adjustments will hinge on incoming economic data and inflation indicators. He downplayed the likelihood of significant rate cuts in the near term, citing persistent inflationary pressures despite recent easing. This cautious stance contrasts with earlier expectations of more substantial and rapid rate reductions.

This shift in narrative has led to a reassessment of the economic outlook by market analysts. Many now predict a less aggressive easing cycle than previously anticipated, leading to lower demand for Treasuries and subsequently, a dip in yields.

<h3>What Does This Mean for Investors?</h3>

The decline in Treasury yields presents a mixed bag for investors. While lower yields may initially appear less attractive for fixed-income investments, they also signal a potential shift in the overall market landscape. This could influence investment strategies across various asset classes.

-

Bond Investors: Those holding longer-term Treasuries might experience some capital gains due to the price increase associated with lower yields. However, future returns may be more modest compared to expectations based on previous projections of more aggressive rate cuts.

-

Stock Investors: The cautious Fed stance could impact stock valuations, particularly for growth stocks that are more sensitive to interest rate changes. Lower yields could reduce the attractiveness of bonds as an alternative investment, potentially leading to increased demand for equities.

-

Overall Economic Impact: The tempered expectations surrounding rate cuts could influence economic growth. While lower rates typically stimulate economic activity, a more measured approach could lead to a slower pace of recovery or even exacerbate existing economic challenges.

<h3>Looking Ahead: Uncertainty Remains</h3>

The future trajectory of Treasury yields remains uncertain. The upcoming release of key economic indicators, such as inflation data and employment figures, will play a crucial role in shaping the Fed's future decisions. Furthermore, geopolitical events and global economic conditions could also influence market sentiment and subsequently impact yields.

It's important for investors to stay informed about these developments and adjust their investment strategies accordingly. Consulting with a financial advisor can provide personalized guidance based on individual risk tolerance and investment goals. Staying abreast of economic news and analysis through reputable sources is crucial for navigating this evolving market environment.

Keywords: U.S. Treasury Yields, Federal Reserve, Interest Rate Cuts, Jerome Powell, Bond Market, Inflation, Economic Outlook, Investment Strategy, Monetary Policy, Economic Data.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Dip As Fed Hints At Limited Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Health Concerns Emerge Vance Questions Bidens Ability To Lead

May 21, 2025

Health Concerns Emerge Vance Questions Bidens Ability To Lead

May 21, 2025 -

New Wwi Epic Starring Daniel Craig Cillian Murphy And Tom Hardy Now Available

May 21, 2025

New Wwi Epic Starring Daniel Craig Cillian Murphy And Tom Hardy Now Available

May 21, 2025 -

Trump To Intervene Talks With Putin And Zelensky For Ukraine Cease Fire As Russia Escalates Attacks

May 21, 2025

Trump To Intervene Talks With Putin And Zelensky For Ukraine Cease Fire As Russia Escalates Attacks

May 21, 2025 -

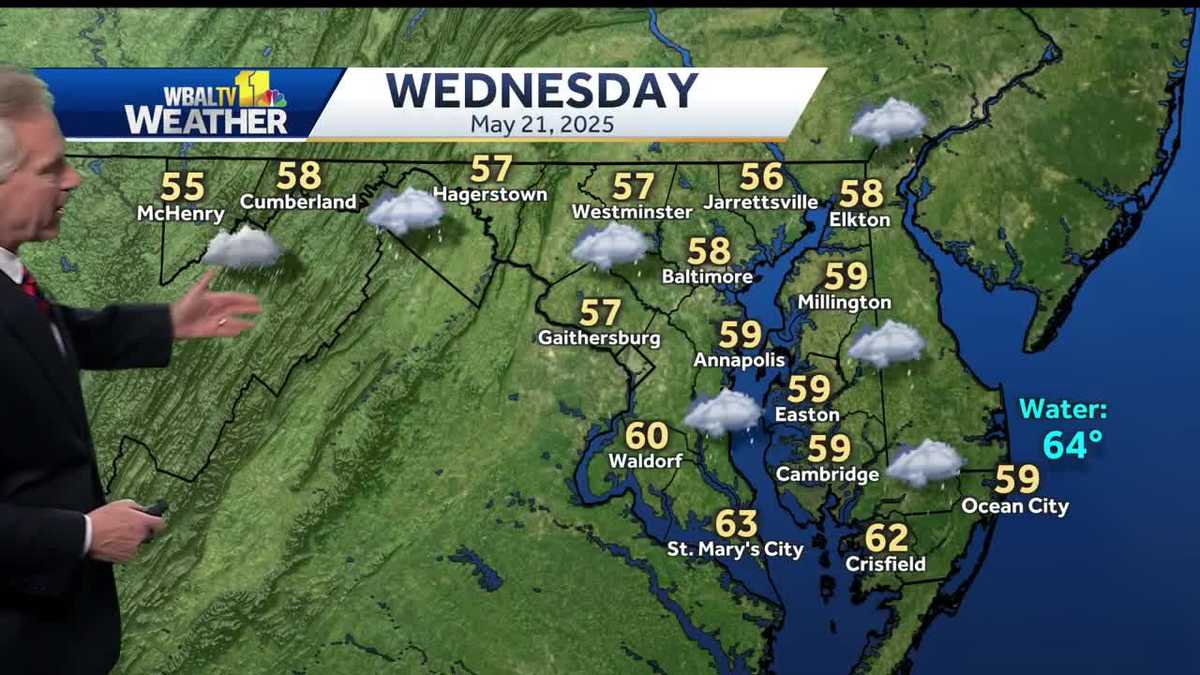

Cold Front Brings Rain And Chilly Temperatures Wednesday

May 21, 2025

Cold Front Brings Rain And Chilly Temperatures Wednesday

May 21, 2025 -

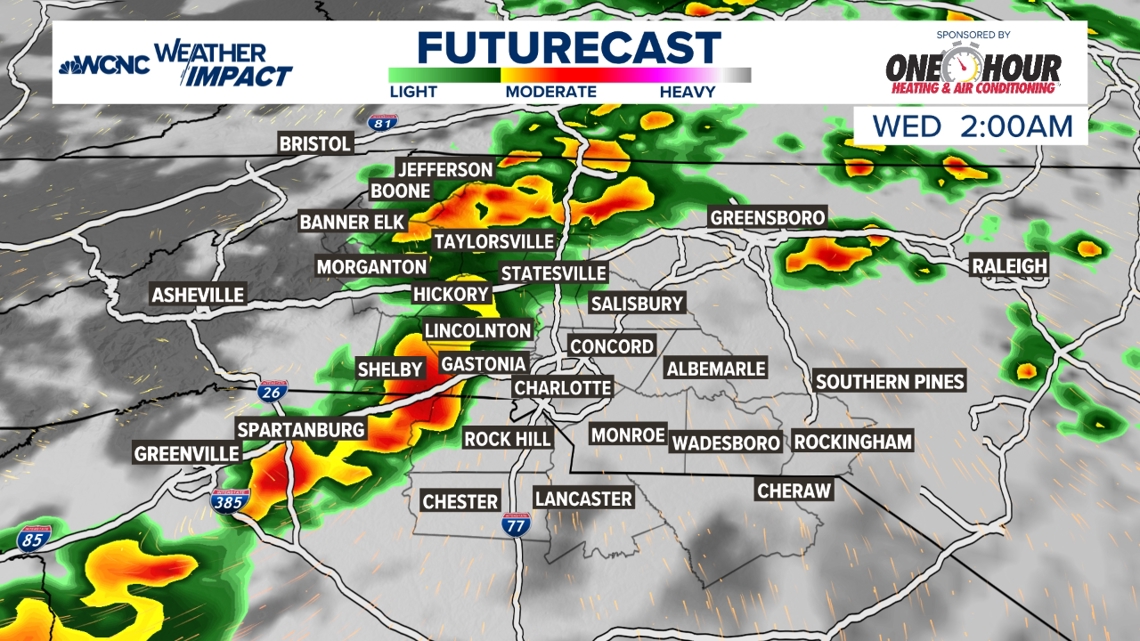

Isolated Strong Storms Possible Late Tuesday Night

May 21, 2025

Isolated Strong Storms Possible Late Tuesday Night

May 21, 2025