U.S. Treasury Market Reacts: Yields Fall On Fed's Rate Cut Prediction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Reacts: Yields Fall on Fed's Rate Cut Prediction

The U.S. Treasury market experienced a significant shift today, with yields falling sharply following the Federal Reserve's widely anticipated prediction of interest rate cuts later this year. This move reflects investor sentiment regarding the potential for easing monetary policy to combat slowing economic growth and address persistent inflation concerns. The market's reaction underscores the delicate balancing act the Fed faces in navigating the current economic landscape.

Yield Curve Inversion Deepens:

The yield curve, the difference between short-term and long-term Treasury yields, continues its inversion, a phenomenon often seen as a precursor to recession. Today's decline in yields further deepened this inversion, highlighting growing anxieties among investors about the future economic outlook. The 2-year/10-year Treasury yield spread, a key indicator, widened significantly, indicating a greater expectation of future rate cuts and potentially slower economic growth. [Link to relevant Treasury yield data source, e.g., TreasuryDirect.gov]

Impact on Investor Confidence:

The Fed's statement, hinting at potential rate cuts as early as the end of the year, suggests a less aggressive stance on inflation compared to previous months. While intended to stimulate economic activity, this shift also reveals a growing concern within the Federal Reserve about the potential for a significant economic slowdown. This uncertainty has led to increased volatility in the Treasury market and a flight to safety, driving demand for government bonds and consequently lowering their yields. Investors are clearly interpreting the Fed’s messaging as a sign that the central bank is prioritizing economic growth over further inflation control.

What's Next for the Treasury Market?

The future direction of Treasury yields remains uncertain. Several factors will influence the market’s trajectory in the coming weeks and months, including:

- Inflation Data: Upcoming inflation reports will be crucial in shaping market expectations and influencing the Fed's future decisions. High inflation could lead to a revision of the Fed's rate cut projections.

- Economic Growth: Signs of a weakening economy could further fuel demand for safe-haven assets like Treasuries, pushing yields lower. Conversely, stronger-than-expected economic data could lead to higher yields.

- Geopolitical Events: Global events, such as the ongoing war in Ukraine and geopolitical tensions, can significantly impact investor sentiment and Treasury market performance.

Analyzing the Fed's Strategic Shift:

The Fed's move highlights a shift in its priorities. While battling inflation remains paramount, the potential for a significant economic slowdown is now a major concern. This delicate balancing act requires careful navigation, and the Fed's actions will be closely scrutinized by investors and economists alike. The market reaction suggests that investors believe the Fed's predicted rate cuts are a necessary response to the evolving economic landscape.

Conclusion:

Today's fall in Treasury yields reflects a significant market reaction to the Federal Reserve's predicted rate cuts. The deepening yield curve inversion underscores growing concerns about economic growth, while the overall market sentiment suggests a cautious approach among investors navigating these uncertain times. The coming weeks will be critical in determining the lasting impact of the Fed's decision and the subsequent direction of the U.S. Treasury market. Stay tuned for further updates and analysis.

Keywords: U.S. Treasury Market, Treasury Yields, Federal Reserve, Interest Rate Cuts, Yield Curve Inversion, Inflation, Economic Growth, Recession, Investor Sentiment, Monetary Policy, Safe Haven Assets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Reacts: Yields Fall On Fed's Rate Cut Prediction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

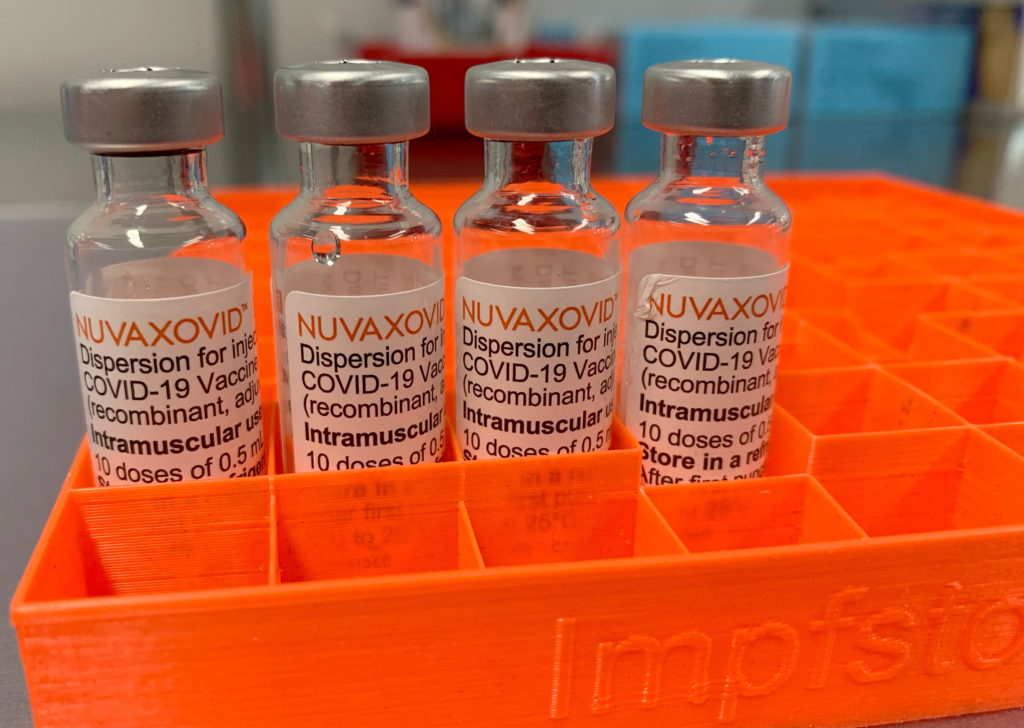

Novavax Covid 19 Vaccine Fda Approval And Key Restrictions Explained

May 20, 2025

Novavax Covid 19 Vaccine Fda Approval And Key Restrictions Explained

May 20, 2025 -

Get Masters Of Ceremony Skins In Helldivers 2s May 15th Warbond Event

May 20, 2025

Get Masters Of Ceremony Skins In Helldivers 2s May 15th Warbond Event

May 20, 2025 -

Jamie Lee Curtis On Lindsay Lohan A Candid Look At Their Unique Bond

May 20, 2025

Jamie Lee Curtis On Lindsay Lohan A Candid Look At Their Unique Bond

May 20, 2025 -

Investing In The Future The Importance Of Funding Medical And Scientific Research In The Us

May 20, 2025

Investing In The Future The Importance Of Funding Medical And Scientific Research In The Us

May 20, 2025 -

Jenn Sterger On Brett Favre Sexting Scandal I Was Never Treated Like A Person

May 20, 2025

Jenn Sterger On Brett Favre Sexting Scandal I Was Never Treated Like A Person

May 20, 2025