U.S. Treasury Market Reacts: Fed Predicts Only One Rate Cut By 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Reacts: Fed Predicts Only One Rate Cut by 2025

The U.S. Treasury market experienced a noticeable shift following the Federal Reserve's latest projection: a single interest rate cut by the end of 2025. This announcement, delivered amidst ongoing economic uncertainty, sent ripples through the bond market, impacting yields and investor sentiment. Understanding the implications of this forecast is crucial for anyone invested in or following the U.S. economy.

A Surprise for Many: Only One Rate Cut Projected

Many economists and market analysts had anticipated a more aggressive approach from the Federal Reserve, predicting multiple rate cuts to combat potential economic slowdowns. The Fed's projection of just one cut by 2025 surprised many, suggesting a more hawkish stance than previously assumed. This unexpected announcement highlights the ongoing debate regarding the effectiveness of monetary policy in navigating the current economic landscape. The persistence of inflation, albeit at a slower pace, is a key factor driving the Fed's cautious approach.

Impact on Treasury Yields and Bond Prices

The Fed's prediction immediately impacted Treasury yields. Longer-term yields, which are particularly sensitive to interest rate expectations, saw a noticeable increase. This reflects investors' reassessment of future returns on these bonds given the expectation of higher interest rates for longer. Conversely, bond prices generally moved inversely to yields, experiencing a decline. This dynamic underscores the interconnectedness of monetary policy decisions, interest rate expectations, and the performance of the Treasury market.

What Does This Mean for Investors?

The implications for investors are multifaceted. Those holding longer-term Treasury bonds may experience reduced returns compared to initial projections. Conversely, investors seeking higher yields might find opportunities in newly issued bonds. It's crucial to remember that the bond market is inherently complex, and various factors beyond Fed policy influence its performance. Geopolitical events, inflation rates, and global economic growth all contribute to the overall market dynamics.

Navigating Uncertainty: A Cautious Approach

The current economic climate necessitates a cautious approach to investment strategies. The Fed's projection, while offering some clarity, doesn't eliminate uncertainty. Investors should carefully consider their risk tolerance, investment horizon, and diversification strategies. Consulting with a financial advisor is recommended for personalized guidance, particularly given the unexpected shift in Fed projections.

Looking Ahead: Factors to Watch

Several key factors will continue to shape the trajectory of the Treasury market in the coming months:

- Inflation Data: Continued monitoring of inflation indicators is paramount. A resurgence in inflation could lead to further adjustments in Fed policy.

- Economic Growth: The pace of economic growth will significantly influence the Fed's decisions. A weaker-than-expected economy might prompt a re-evaluation of its rate cut projection.

- Geopolitical Events: Global events can significantly impact market sentiment and investor behavior. Unexpected geopolitical developments could further destabilize the market.

In Conclusion: The Fed's projection of only one rate cut by 2025 has created significant implications for the U.S. Treasury market. While the immediate impact has been a rise in yields and a decline in bond prices, the long-term consequences remain to be seen. Investors should approach the market with caution, closely monitoring economic indicators and seeking professional advice to navigate this period of uncertainty. Staying informed about economic news and policy changes is crucial for making informed investment decisions. Remember to consult with a financial professional before making any major investment changes.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Reacts: Fed Predicts Only One Rate Cut By 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Regulations Target Bad Tourist Behavior In Bali What You Need To Know

May 20, 2025

New Regulations Target Bad Tourist Behavior In Bali What You Need To Know

May 20, 2025 -

How Taylor Jenkins Reid Built A Successful Publishing Empire

May 20, 2025

How Taylor Jenkins Reid Built A Successful Publishing Empire

May 20, 2025 -

American Exceptionalism Examining The Impact Of Medical And Scientific Research

May 20, 2025

American Exceptionalism Examining The Impact Of Medical And Scientific Research

May 20, 2025 -

Climate Changes Effect On Pregnancy Understanding The Rising Health Concerns

May 20, 2025

Climate Changes Effect On Pregnancy Understanding The Rising Health Concerns

May 20, 2025 -

Trump Administration Wins Supreme Court Case End Of Protected Status For Venezuelans

May 20, 2025

Trump Administration Wins Supreme Court Case End Of Protected Status For Venezuelans

May 20, 2025

Latest Posts

-

Bitcoin Etf Boom Over 5 Billion Poured In Whats Driving The Surge

May 20, 2025

Bitcoin Etf Boom Over 5 Billion Poured In Whats Driving The Surge

May 20, 2025 -

Climate Changes Devastating Effect On Pregnancy Outcomes A Global Health Concern

May 20, 2025

Climate Changes Devastating Effect On Pregnancy Outcomes A Global Health Concern

May 20, 2025 -

Putins Snub Demonstrates Trumps Diminished Global Influence

May 20, 2025

Putins Snub Demonstrates Trumps Diminished Global Influence

May 20, 2025 -

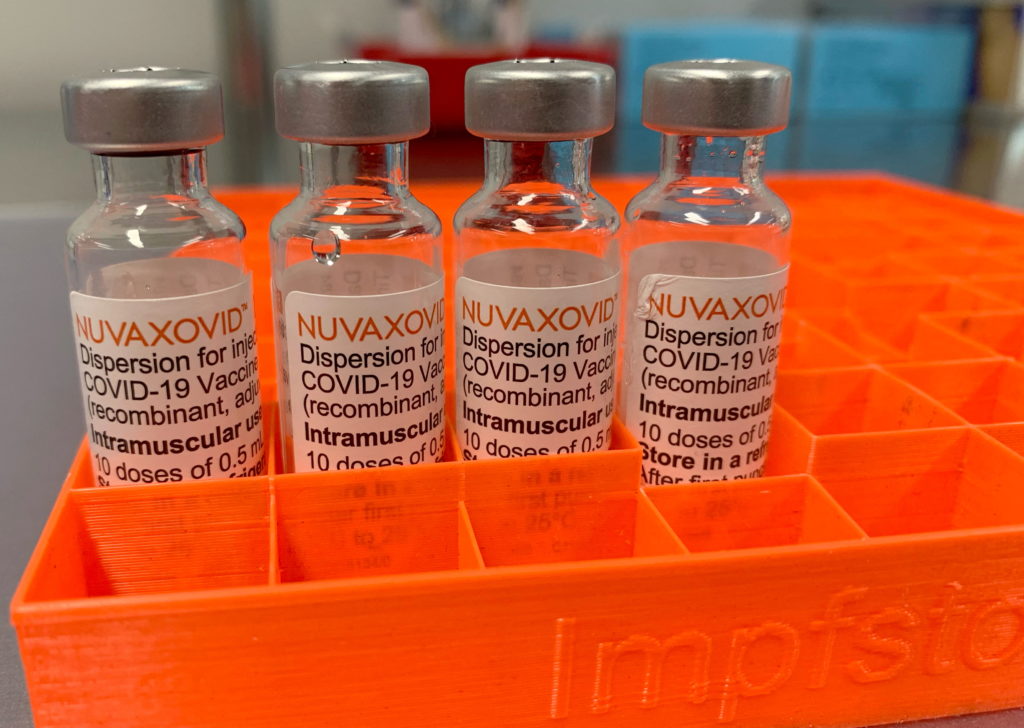

Fda Approval For Novavax Covid 19 Vaccine Use Restrictions Explained

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Use Restrictions Explained

May 20, 2025 -

Trumps Diminished Global Standing A Consequence Of Putins Actions

May 20, 2025

Trumps Diminished Global Standing A Consequence Of Putins Actions

May 20, 2025