Bitcoin ETF Boom: Over $5 Billion Poured In – What's Driving The Surge?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Boom: Over $5 Billion Poured In – What's Driving the Surge?

The world of finance is buzzing. Over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) in a remarkably short period, marking a monumental shift in investor sentiment towards the leading cryptocurrency. This unprecedented influx raises a crucial question: what's fueling this explosive growth? Is this a fleeting trend, or a sign of Bitcoin's increasing mainstream acceptance?

The Catalyst: Regulatory Approvals and Institutional Interest

The primary driver behind this Bitcoin ETF boom is the recent approval of several Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC). This landmark decision, after years of deliberation and rejections, has opened the floodgates for institutional investors who were previously hesitant due to regulatory uncertainty. The availability of regulated Bitcoin investment vehicles provides a much-needed level of comfort and legitimacy.

-

Reduced Regulatory Risk: The SEC's approval significantly mitigates the regulatory risk associated with direct Bitcoin ownership. This is particularly attractive to institutional investors who are bound by stricter compliance regulations.

-

Increased Accessibility: ETFs offer a simpler and more accessible way to invest in Bitcoin compared to navigating the complexities of cryptocurrency exchanges. This streamlined access has attracted a broader range of investors, including those less familiar with the intricacies of digital assets.

-

Institutional Adoption: Major financial institutions are increasingly incorporating Bitcoin into their portfolios. The availability of ETFs facilitates this process, providing a familiar and manageable investment vehicle for large-scale investment strategies. This institutional adoption is a key indicator of Bitcoin's growing maturity as an asset class.

Beyond Regulatory Approvals: Other Contributing Factors

While regulatory approvals are the primary catalyst, other factors contribute to the current surge:

-

Growing Institutional Demand: As mentioned above, the institutional adoption of Bitcoin continues to grow, further driving up demand for ETF products.

-

Macroeconomic Uncertainty: The current global macroeconomic environment, characterized by inflation and uncertainty, has pushed investors to seek alternative assets. Bitcoin, often viewed as a hedge against inflation and traditional market volatility, has become an increasingly attractive option. Learn more about .

-

Technological Advancements: Ongoing advancements in Bitcoin's underlying technology, such as the Lightning Network, are improving scalability and transaction speeds, enhancing its practicality for everyday use.

Looking Ahead: Sustainability and Future Outlook

The question remains: is this Bitcoin ETF boom sustainable? While predicting the future of any market is inherently challenging, the current momentum suggests a significant shift in the perception and adoption of Bitcoin. The increased regulatory clarity, combined with growing institutional interest and macroeconomic factors, points towards continued growth in the Bitcoin ETF market. However, investors should remain cautious and conduct thorough research before investing in any asset, especially volatile ones like Bitcoin.

Call to Action: Stay informed about the evolving cryptocurrency landscape. Follow reputable financial news sources and consider consulting with a financial advisor before making any investment decisions. Understanding the risks and rewards is crucial for navigating the exciting but unpredictable world of digital assets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Boom: Over $5 Billion Poured In – What's Driving The Surge?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tariff Showdown Trump Tells Walmart To Absorb Increased Costs

May 20, 2025

Tariff Showdown Trump Tells Walmart To Absorb Increased Costs

May 20, 2025 -

Trumps Venezuela Tps Victory Supreme Court Clears Path For Deportations

May 20, 2025

Trumps Venezuela Tps Victory Supreme Court Clears Path For Deportations

May 20, 2025 -

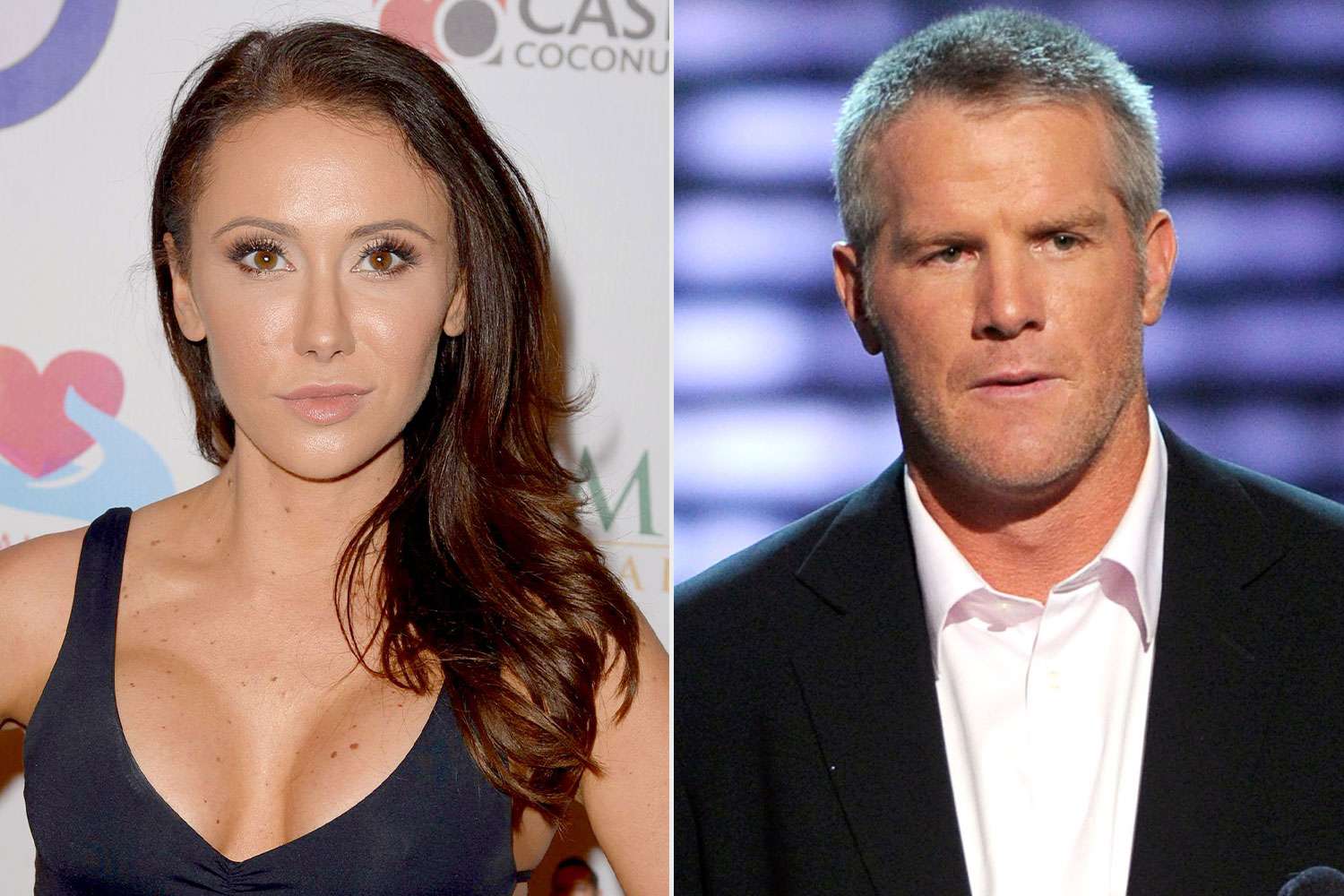

Jenn Sterger Recounts Emotional Toll Of Brett Favre Sexting Scandal

May 20, 2025

Jenn Sterger Recounts Emotional Toll Of Brett Favre Sexting Scandal

May 20, 2025 -

Market Update S And P 500 Dow And Nasdaq Rise Amidst Moodys Negative Outlook

May 20, 2025

Market Update S And P 500 Dow And Nasdaq Rise Amidst Moodys Negative Outlook

May 20, 2025 -

Jon Jones Ufc Kept Aspinalls Injury A Secret From Fight Fans

May 20, 2025

Jon Jones Ufc Kept Aspinalls Injury A Secret From Fight Fans

May 20, 2025