Trump Tax Cuts And Spending Bill: What It Means For SNAP Benefits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Tax Cuts and Spending Bill: A SNAPshot of the Impact on Food Assistance

The 2017 Tax Cuts and Jobs Act, a cornerstone of the Trump administration's economic policy, significantly altered the US tax code. While touted for its potential to boost economic growth, its impact on social programs like the Supplemental Nutrition Assistance Program (SNAP), often known as food stamps, remains a complex and controversial topic. This article delves into the intricate relationship between these tax cuts, subsequent spending bills, and the implications for SNAP benefits.

Understanding the Connection: Tax Cuts and Spending Caps

The 2017 tax cuts dramatically reduced corporate and individual income taxes. However, to offset the revenue loss, the legislation included significant spending cuts across various government programs. This created a budgetary squeeze, potentially impacting funding for programs like SNAP, which relies heavily on federal appropriations. While the tax cuts were permanent, the spending cuts were subject to future budgetary negotiations and appropriations processes. This dynamic created uncertainty regarding the long-term funding of SNAP.

The Impact on SNAP Funding and Eligibility

While the tax cuts didn't directly alter SNAP eligibility criteria or benefit levels, the resulting budgetary constraints created indirect pressures. Several factors played a role:

- Reduced Federal Discretionary Spending: The tax cuts led to a decrease in overall federal discretionary spending, limiting the funds available for a wide range of programs, including SNAP. This meant that increases to SNAP benefits, which were already subject to regular reviews and adjustments, faced increased scrutiny.

- Increased Demand for Social Services: The tax cuts, while benefiting some, may have inadvertently increased demand for social services, including SNAP. Economic uncertainty or stagnant wage growth could have led to a greater number of people needing assistance. This increased demand put further pressure on already constrained budgets.

- Political Climate and Budgetary Battles: The political climate surrounding the tax cuts and subsequent spending bills created an environment of uncertainty. Repeated budgetary battles and disagreements about funding levels added to the instability impacting SNAP funding and potential benefit adjustments.

Long-Term Consequences and Future Outlook

The long-term consequences of the Trump tax cuts on SNAP benefits remain a subject of ongoing debate and research. While no direct, immediate cuts to SNAP benefits resulted from the tax cuts themselves, the indirect effects through constrained budgets and increased demand for assistance are significant. Future analyses are needed to fully assess the long-term impacts on beneficiaries.

Beyond the Numbers: The Human Impact

It's crucial to remember that SNAP isn't just about numbers; it's about people. Millions of Americans rely on SNAP benefits to afford nutritious food, and any impact on funding directly affects their ability to put food on the table. Understanding the interplay between tax policy, budgetary decisions, and social programs like SNAP is essential for informed policymaking and advocacy.

Further Research and Resources:

For more detailed information, we recommend exploring resources from the following organizations:

- The United States Department of Agriculture (USDA): The USDA administers the SNAP program and provides comprehensive data and information on its operations. [Link to USDA SNAP webpage]

- The Congressional Budget Office (CBO): The CBO provides independent analyses of the budgetary impact of government policies, including the 2017 tax cuts. [Link to CBO webpage]

- The Center on Budget and Policy Priorities (CBPP): The CBPP offers research and analysis on the impact of government policies on low- and moderate-income families. [Link to CBPP webpage]

This article aims to provide a comprehensive overview of a complex issue. It's crucial to engage in informed discussions and advocate for policies that support vulnerable populations. Stay informed and get involved!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Tax Cuts And Spending Bill: What It Means For SNAP Benefits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cough Medicine New Hope For Slowing Parkinsons Dementia Progression

Jul 03, 2025

Cough Medicine New Hope For Slowing Parkinsons Dementia Progression

Jul 03, 2025 -

Sandman Season 2 Review A Pretentious Downfall

Jul 03, 2025

Sandman Season 2 Review A Pretentious Downfall

Jul 03, 2025 -

Netflix Cancels The Sandman After Two Seasons Why

Jul 03, 2025

Netflix Cancels The Sandman After Two Seasons Why

Jul 03, 2025 -

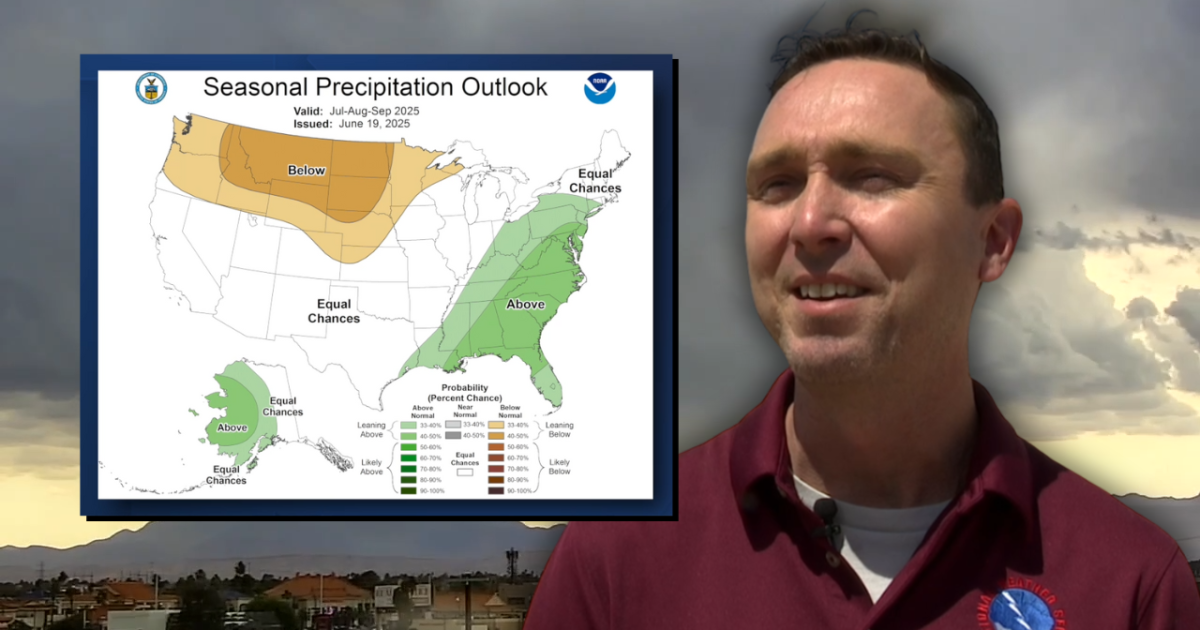

Experts Predict A Wet Or Dry Monsoon Season For Southern Nevada

Jul 03, 2025

Experts Predict A Wet Or Dry Monsoon Season For Southern Nevada

Jul 03, 2025 -

Bridging The Gap Mens Hardest Explanations And How To Improve Understanding

Jul 03, 2025

Bridging The Gap Mens Hardest Explanations And How To Improve Understanding

Jul 03, 2025

Latest Posts

-

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025 -

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025 -

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025 -

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025 -

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025