Trump Tax Bill: Millions Face Health Insurance Loss

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Tax Bill: Millions Face Health Insurance Loss – A Deeper Dive into the Impact

The 2017 Tax Cuts and Jobs Act, often referred to as the "Trump tax bill," significantly altered the American healthcare landscape. While touted for its economic benefits, a less discussed consequence was the potential loss of health insurance for millions of Americans. This article delves into the impact of the bill on healthcare coverage, examining the reasons behind the losses and the ongoing debate surrounding its legacy.

The Repeal of the Individual Mandate: A Key Driver of Insurance Loss

One of the most significant changes introduced by the Trump tax bill was the repeal of the Affordable Care Act (ACA)'s individual mandate. This mandate required most Americans to have health insurance or pay a penalty. The penalty's removal significantly impacted the insurance market, leading to several consequences:

- Increased Premiums: With fewer healthy individuals enrolling in insurance plans due to the lack of penalty, the risk pool shifted, leading to higher premiums for those who remained insured. This price hike made coverage unaffordable for many, resulting in decreased enrollment.

- Reduced Marketplace Competition: Insurance companies, facing higher risks and lower enrollment, began withdrawing from the ACA marketplaces in several states. This reduced competition, further impacting affordability and access to care.

- Increased Uninsured Population: The combined effect of higher premiums and reduced availability of plans directly resulted in a noticeable increase in the number of uninsured Americans, particularly those with lower incomes.

Beyond the Individual Mandate: Other Contributing Factors

While the repeal of the individual mandate was a major factor, other aspects of the Trump tax bill indirectly contributed to health insurance losses:

- Funding Cuts: The bill included various funding cuts that affected programs supporting healthcare access and affordability. While not directly impacting insurance coverage, these cuts indirectly weakened the safety net for vulnerable populations. This further exacerbated the problem for those already struggling to afford healthcare.

- State-Level Impacts: The changes at the federal level also triggered ripple effects at the state level, leading some states to further reduce their own healthcare subsidies or programs.

The Ongoing Debate and Future Implications

The impact of the Trump tax bill on healthcare access continues to be a subject of debate. Supporters argue the bill simplified the tax code and stimulated the economy, indirectly benefiting healthcare through job creation. Critics, however, point to the undeniable increase in the uninsured population and the widening gap in healthcare access as a direct result of the legislation.

Looking Ahead:

The long-term consequences of the Trump tax bill's impact on health insurance are still unfolding. Understanding this complex issue requires a nuanced approach, considering both the economic and social implications. Further research and policy discussions are crucial to finding solutions that ensure affordable and accessible healthcare for all Americans. Learning from this experience is vital in shaping future healthcare legislation.

Keywords: Trump tax bill, healthcare, ACA, Affordable Care Act, individual mandate, health insurance, premiums, uninsured, healthcare access, healthcare affordability, tax reform, 2017 Tax Cuts and Jobs Act

Call to Action (subtle): Stay informed about healthcare policy changes and advocate for accessible and affordable healthcare for all. Understanding these issues is crucial for ensuring a healthier future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Tax Bill: Millions Face Health Insurance Loss. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

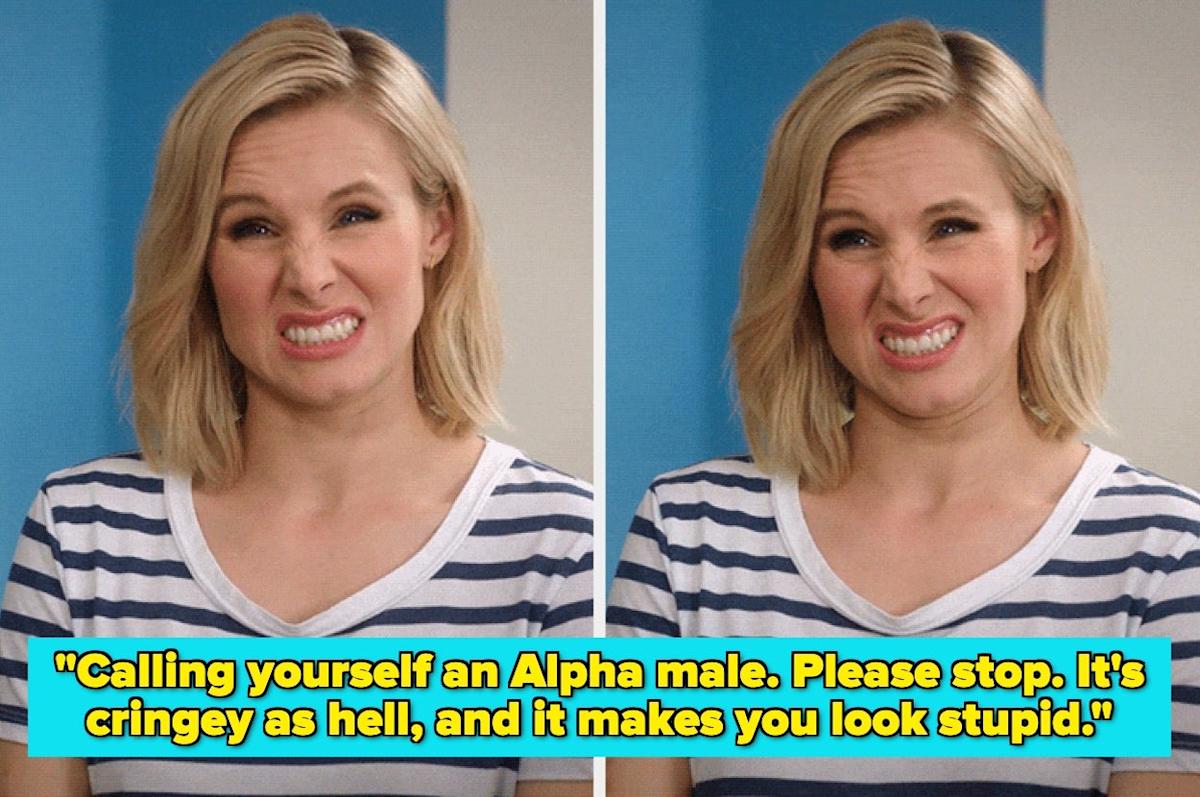

From Women Honest Truths About Actions That Kill Attraction

Jul 03, 2025

From Women Honest Truths About Actions That Kill Attraction

Jul 03, 2025 -

El Barca Y El Caso Nico Tebas Explica La Imposibilidad De Su Registro

Jul 03, 2025

El Barca Y El Caso Nico Tebas Explica La Imposibilidad De Su Registro

Jul 03, 2025 -

Trumps Tax Cuts The Potential Impact On Healthcare Access

Jul 03, 2025

Trumps Tax Cuts The Potential Impact On Healthcare Access

Jul 03, 2025 -

Where Will Chris Paul Go Free Agency Narrows To Two Previous Teams

Jul 03, 2025

Where Will Chris Paul Go Free Agency Narrows To Two Previous Teams

Jul 03, 2025 -

Unpacking The Us Connection To Israels Actions Against Iran

Jul 03, 2025

Unpacking The Us Connection To Israels Actions Against Iran

Jul 03, 2025

Latest Posts

-

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025 -

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025 -

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025 -

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025 -

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025