Today's Stock Market: Iran Tensions And Fed Rate Expectations Weigh On S&P 500 And Nasdaq

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Stock Market: Iran Tensions and Fed Rate Expectations Weigh on S&P 500 and Nasdaq

Geopolitical uncertainty and looming interest rate hikes cast a shadow over Wall Street, sending major indices lower.

Today's stock market opened with a sense of unease, as escalating tensions in Iran and persistent concerns about Federal Reserve interest rate hikes weighed heavily on investor sentiment. The S&P 500 and Nasdaq Composite both experienced significant declines, reflecting a broader market retreat fueled by a confluence of factors impacting investor confidence.

The recent escalation of tensions between the U.S. and Iran following the drone strike on Iranian oil facilities has injected a dose of geopolitical risk into the market. Investors are wary of potential disruptions to global oil supplies and the broader implications for international relations, prompting a flight to safety and putting pressure on equities. This uncertainty, coupled with ongoing concerns about the war in Ukraine and its knock-on effects on the global economy, is creating a volatile trading environment.

<h3>Fed Rate Hikes: A Looming Threat to Market Growth?</h3>

Beyond geopolitical anxieties, the anticipation of further interest rate hikes by the Federal Reserve continues to exert significant pressure on the market. The Fed's aggressive monetary policy, aimed at curbing inflation, is dampening economic growth and impacting corporate earnings. Investors are increasingly concerned that aggressive rate hikes could trigger a recession, leading to a significant downturn in corporate profits and subsequently, stock valuations. This fear is particularly pronounced in growth-oriented sectors like technology, which are more sensitive to interest rate changes. The Nasdaq, heavily weighted with technology stocks, experienced a steeper decline than the broader S&P 500, reflecting this sensitivity.

<h3>Key Market Movers Today:</h3>

- Energy Sector: The energy sector saw some gains amidst the Iran-related uncertainty, reflecting investors’ concerns about potential oil supply disruptions.

- Technology Sector: The tech sector suffered significantly, mirroring the overall market trend and heightened sensitivity to interest rate increases.

- Treasury Yields: Treasury yields rose, further indicating investor flight to safety and reflecting concerns about future economic growth.

<h3>What to Watch For:</h3>

The coming days and weeks will be crucial in determining the market's trajectory. Investors will be closely monitoring several key factors:

- Further developments in the Iran situation: Any escalation or de-escalation of tensions will have a significant impact on market sentiment.

- Upcoming economic data: Key economic indicators, such as inflation data and employment figures, will offer further insights into the Fed's future monetary policy decisions.

- Corporate earnings reports: The upcoming earnings season will provide crucial information on the financial health of companies and their outlook for the future.

<h3>Expert Opinion: Navigating Market Volatility</h3>

Financial analysts suggest a cautious approach in the current market climate. Diversification remains crucial, and investors should consider reassessing their risk tolerance in light of the prevailing uncertainty. Long-term investment strategies, focused on fundamental analysis rather than short-term market fluctuations, are often recommended during periods of heightened volatility. Consult with a financial advisor to determine the best course of action for your individual circumstances.

Disclaimer: This article provides general market commentary and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial professional before making any investment decisions. For more in-depth market analysis, you can explore resources like [link to reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Stock Market: Iran Tensions And Fed Rate Expectations Weigh On S&P 500 And Nasdaq. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

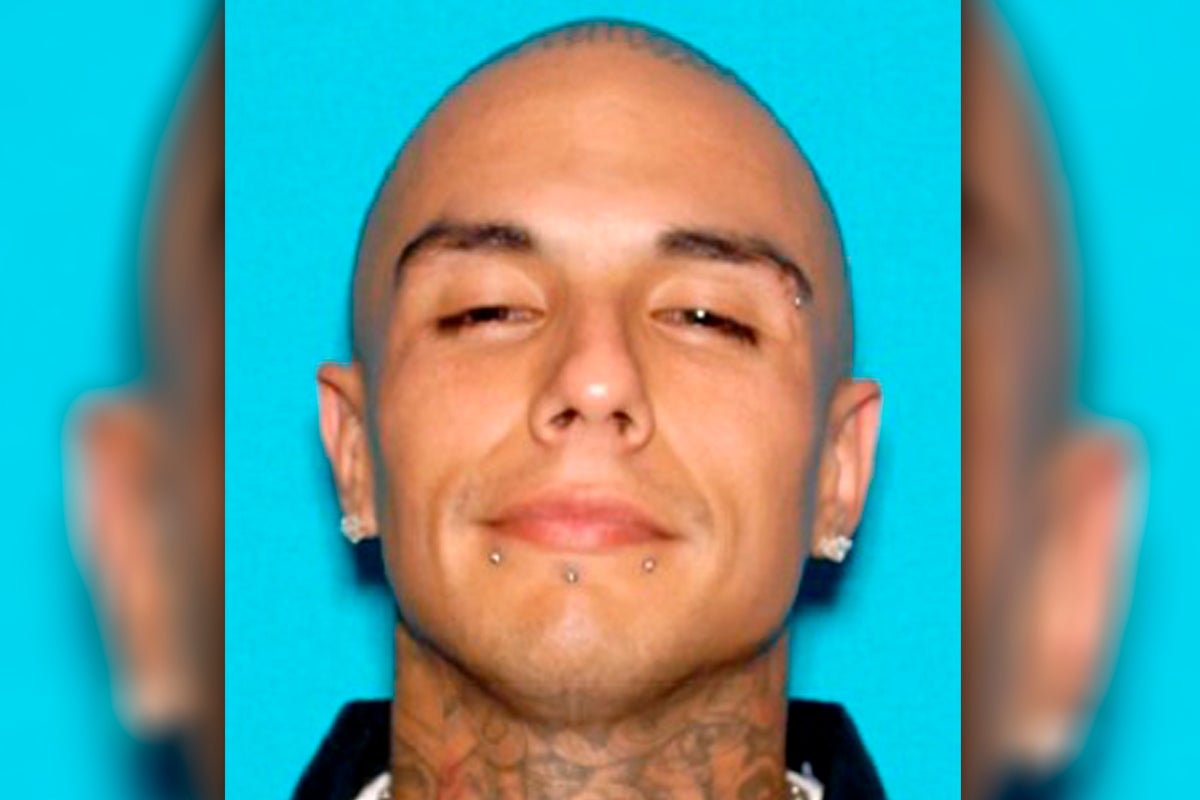

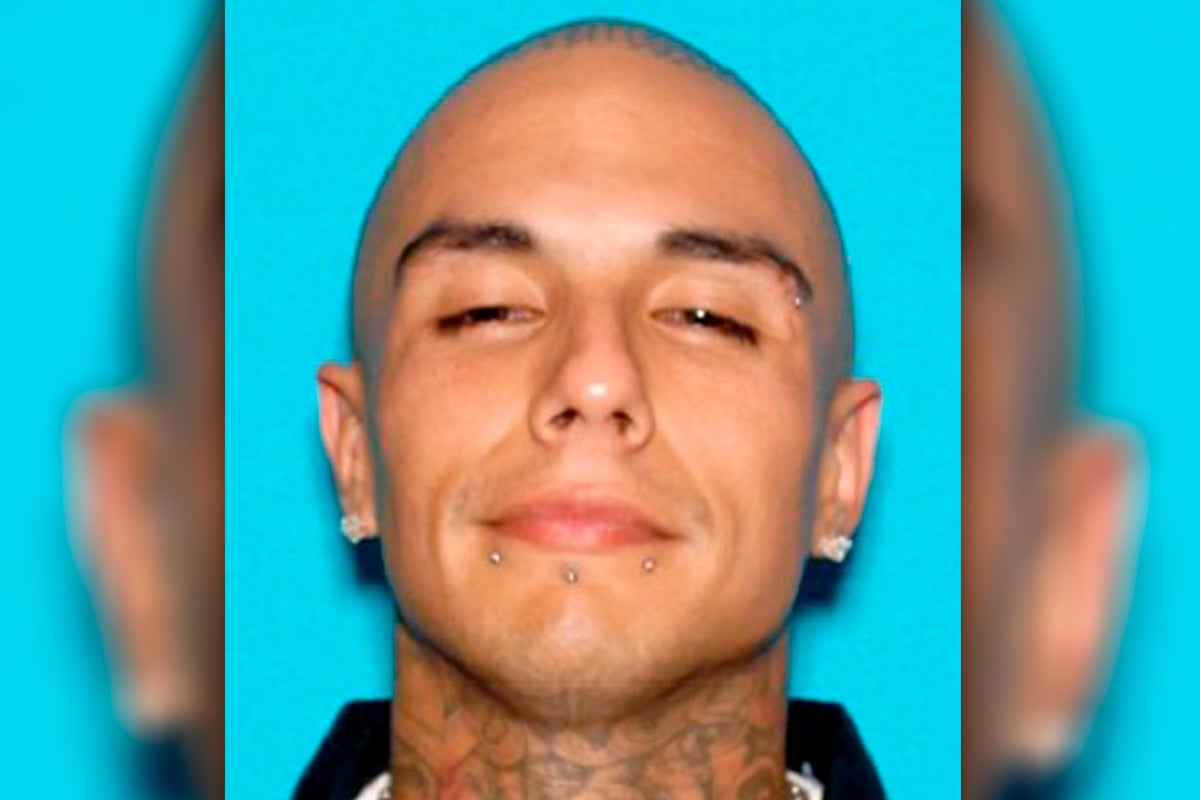

Rapper Targeted In Mexican Mafia Conspiracy 19 Charged

Jun 21, 2025

Rapper Targeted In Mexican Mafia Conspiracy 19 Charged

Jun 21, 2025 -

Red Sox Exploring Trade Options Is Kyle Tucker A Realistic Target

Jun 21, 2025

Red Sox Exploring Trade Options Is Kyle Tucker A Realistic Target

Jun 21, 2025 -

Major Gang Bust 19 Arrested In Plot To Assassinate Famous Rapper

Jun 21, 2025

Major Gang Bust 19 Arrested In Plot To Assassinate Famous Rapper

Jun 21, 2025 -

Todays Stock Market S And P 500 And Nasdaq Lower On Interest Rate Concerns And Iran Situation

Jun 21, 2025

Todays Stock Market S And P 500 And Nasdaq Lower On Interest Rate Concerns And Iran Situation

Jun 21, 2025 -

Red Sox Rumors Heat Up Trade Proposal For Astros Kyle Tucker Emerges

Jun 21, 2025

Red Sox Rumors Heat Up Trade Proposal For Astros Kyle Tucker Emerges

Jun 21, 2025