Today's Stock Market: S&P 500 And Nasdaq Lower On Interest Rate Concerns And Iran Situation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Stock Market Dip: S&P 500 and Nasdaq Fall on Interest Rate Jitters and Iran Tensions

Wall Street experienced a downturn today, with both the S&P 500 and Nasdaq Composite closing lower, fueled by growing concerns about persistent inflation and the escalating geopolitical situation in Iran. Investors are grappling with the implications of higher-for-longer interest rates and the potential for further global instability.

The S&P 500 shed [Insert Percentage]% today, settling at [Insert Closing Value], while the tech-heavy Nasdaq Composite fell by [Insert Percentage]%, closing at [Insert Closing Value]. This marks a significant reversal from recent gains and underscores the market's sensitivity to macroeconomic factors and geopolitical events.

Interest Rate Concerns Continue to Weigh on Markets

The Federal Reserve's recent commitment to maintaining a hawkish monetary policy continues to cast a long shadow over investor sentiment. While inflation has shown signs of cooling, the pace of deceleration remains a key concern. Analysts are closely monitoring upcoming economic data releases, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), for further clues about the Fed's future actions. The persistent threat of further interest rate hikes is prompting investors to reassess risk and adopt a more cautious approach. This uncertainty is impacting various sectors, particularly those sensitive to interest rate changes, like technology and real estate.

Iran Tensions Add to Market Volatility

Adding to the market's anxieties is the increasingly tense situation in Iran. Recent events, including [briefly mention specific recent events, citing reputable news sources], have heightened geopolitical uncertainty and raised concerns about potential disruptions to global oil supplies and broader economic consequences. This added layer of risk is contributing to the overall market volatility and prompting investors to seek safer havens. The potential for escalating conflict adds another layer of complexity for investors already grappling with economic headwinds.

Sector-Specific Performance

The decline wasn't uniform across all sectors. While technology stocks bore the brunt of the sell-off, [mention other sectors and their performance, e.g., energy stocks saw gains due to rising oil prices]. This divergence highlights the sector-specific factors impacting investment decisions.

What to Expect Tomorrow and Beyond

The market's direction in the coming days will largely depend on upcoming economic data and further developments in the geopolitical landscape. Analysts are divided on the market's short-term outlook, with some predicting further declines while others anticipate a rebound. However, the prevailing sentiment points towards continued volatility in the near term. Investors are urged to maintain a diversified portfolio and monitor economic indicators closely.

Key Takeaways:

- Interest Rate Hikes: The prospect of continued interest rate hikes remains a major market driver.

- Geopolitical Risks: The Iran situation is adding to market uncertainty and volatility.

- Sectoral Divergence: The market decline wasn't uniform across all sectors.

- Volatility Ahead: Expect continued market fluctuations in the short term.

For further analysis and market insights, consider exploring resources like [link to reputable financial news source] and [link to another reputable source]. Remember to consult with a financial advisor before making any investment decisions. This information is for educational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Stock Market: S&P 500 And Nasdaq Lower On Interest Rate Concerns And Iran Situation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rival Execs Bold Idea Kyle Tucker In A Red Sox Trade Deadline Deal

Jun 21, 2025

Rival Execs Bold Idea Kyle Tucker In A Red Sox Trade Deadline Deal

Jun 21, 2025 -

Unpacking Us Complicity Examining Americas Role In Israels Iranian Operation

Jun 21, 2025

Unpacking Us Complicity Examining Americas Role In Israels Iranian Operation

Jun 21, 2025 -

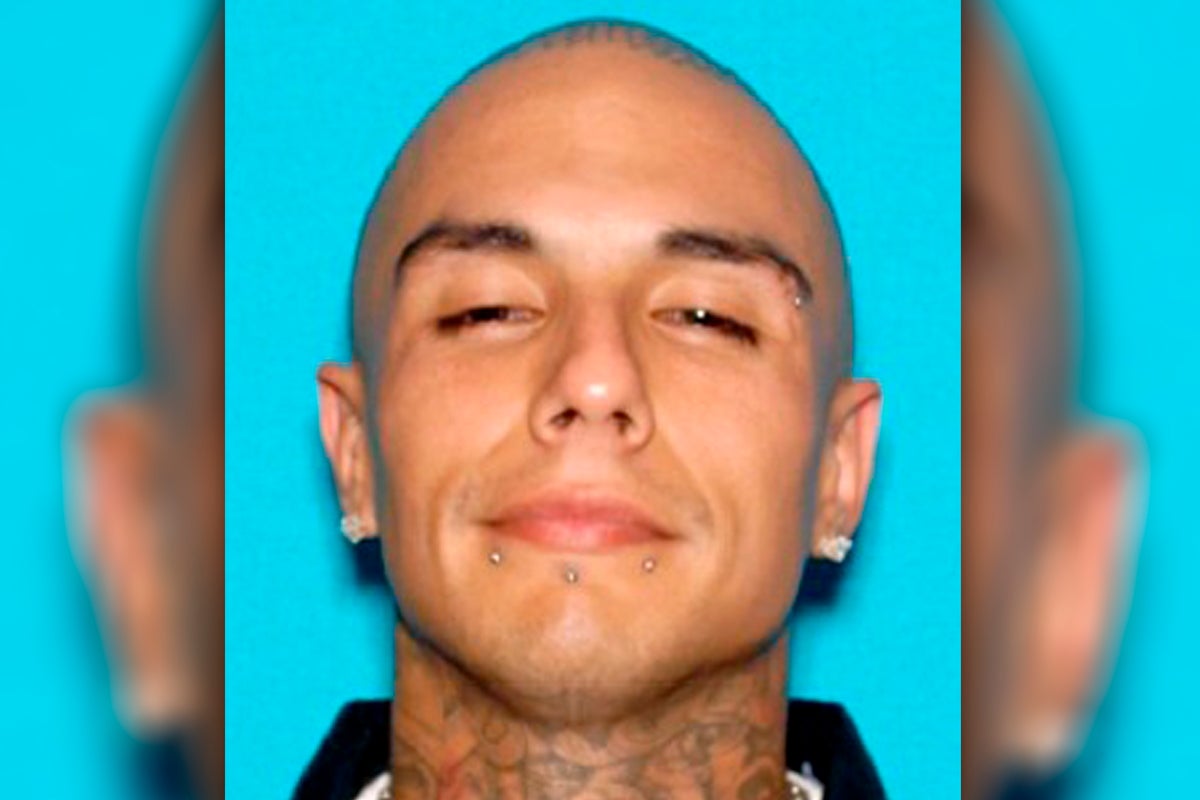

Rapper Targeted 19 Members Of Mexican Mafia Indicted In Murder Plot

Jun 21, 2025

Rapper Targeted 19 Members Of Mexican Mafia Indicted In Murder Plot

Jun 21, 2025 -

La Rapper Swifty Blue Mexican Mafia Conspiracy And 19 Arrests

Jun 21, 2025

La Rapper Swifty Blue Mexican Mafia Conspiracy And 19 Arrests

Jun 21, 2025 -

Red Sox Trade Rumors Could Kyle Tucker Be The Next Acquisition

Jun 21, 2025

Red Sox Trade Rumors Could Kyle Tucker Be The Next Acquisition

Jun 21, 2025