Today's Stock Market: Analyzing The S&P 500 And Nasdaq Decline In Light Of Fed Policy And Iran Situation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Stock Market: S&P 500 and Nasdaq Decline Amidst Fed Policy and Iran Tensions

Wall Street experienced a downturn today, with the S&P 500 and Nasdaq Composite experiencing notable declines. This market movement is being attributed to a confluence of factors, primarily the ongoing uncertainty surrounding Federal Reserve policy and escalating geopolitical tensions in the Middle East, specifically concerning Iran. Understanding the interplay of these elements is crucial for investors navigating the current market climate.

The Federal Reserve's Influence: The Federal Reserve's recent pronouncements on interest rate hikes continue to weigh heavily on investor sentiment. While the Fed aims to combat inflation through these measures, the potential for aggressive rate increases raises concerns about slowing economic growth and potentially triggering a recession. This uncertainty is prompting investors to adopt a more cautious approach, leading to sell-offs across various sectors. Analysts are closely watching upcoming economic data releases for further clues about the Fed's future trajectory. [Link to relevant Fed statement/article]

<h3>S&P 500 and Nasdaq Specifics: A Deeper Dive</h3>

The S&P 500, a broad market index representing 500 large-cap U.S. companies, closed down [Insert percentage]% today, indicating widespread selling pressure. The tech-heavy Nasdaq Composite fared even worse, experiencing a [Insert percentage]% drop. This disparity highlights the sensitivity of the tech sector to rising interest rates, as higher borrowing costs can significantly impact growth-oriented companies relying on future earnings.

-

Sector-Specific Impacts: The energy sector showed some resilience amidst the overall decline, potentially benefiting from rising oil prices linked to the Iran situation. However, other sectors, including consumer discretionary and technology, experienced sharper losses.

-

Investor Behavior: The market volatility is encouraging investors to reassess their portfolios. Many are shifting towards more defensive investment strategies, favoring sectors perceived as less susceptible to economic downturns.

<h3>Geopolitical Uncertainty: Iran and its Market Impact</h3>

The escalating tensions surrounding Iran are adding another layer of complexity to the market's current state. Recent developments [briefly explain the recent news regarding Iran] have raised concerns about potential disruptions to global oil supplies. This uncertainty has led to increased oil prices, contributing to inflationary pressures and fueling investor anxiety. The situation's volatility makes it difficult to predict its long-term market impact. [Link to a reputable news source covering the Iran situation]

<h3>Navigating the Market Volatility: Tips for Investors</h3>

The current market conditions underscore the importance of a well-diversified investment portfolio and a long-term investment strategy. Here are some key considerations for investors:

- Risk Assessment: Re-evaluate your risk tolerance and adjust your portfolio accordingly. Consider consulting with a financial advisor to tailor your investment strategy to your specific circumstances.

- Diversification: Maintain a diversified portfolio across different asset classes to mitigate potential losses in any single sector.

- Long-Term Perspective: Avoid making impulsive decisions based on short-term market fluctuations. Focus on your long-term financial goals.

- Stay Informed: Stay updated on economic and geopolitical developments that could impact the market. Reliable financial news sources can provide valuable insights.

Conclusion: Today's market decline reflects a complex interplay of macroeconomic factors and geopolitical events. While the current situation presents challenges, it also presents opportunities for informed investors who can effectively navigate the volatility. Remember to conduct thorough research and consider seeking professional financial advice before making any investment decisions. The future remains uncertain, but by staying informed and adopting a prudent approach, investors can better position themselves for success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Stock Market: Analyzing The S&P 500 And Nasdaq Decline In Light Of Fed Policy And Iran Situation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stock Market Slump S And P 500 And Nasdaq Dive On Fed Rate Hike Fears And Iran Tensions

Jun 21, 2025

Stock Market Slump S And P 500 And Nasdaq Dive On Fed Rate Hike Fears And Iran Tensions

Jun 21, 2025 -

Start Time Lineups And Team News Bayern Munich Vs Boca Juniors In Club World Cup

Jun 21, 2025

Start Time Lineups And Team News Bayern Munich Vs Boca Juniors In Club World Cup

Jun 21, 2025 -

Mlb Insider Reactions The Rafael Devers Trades Unforeseen Timing

Jun 21, 2025

Mlb Insider Reactions The Rafael Devers Trades Unforeseen Timing

Jun 21, 2025 -

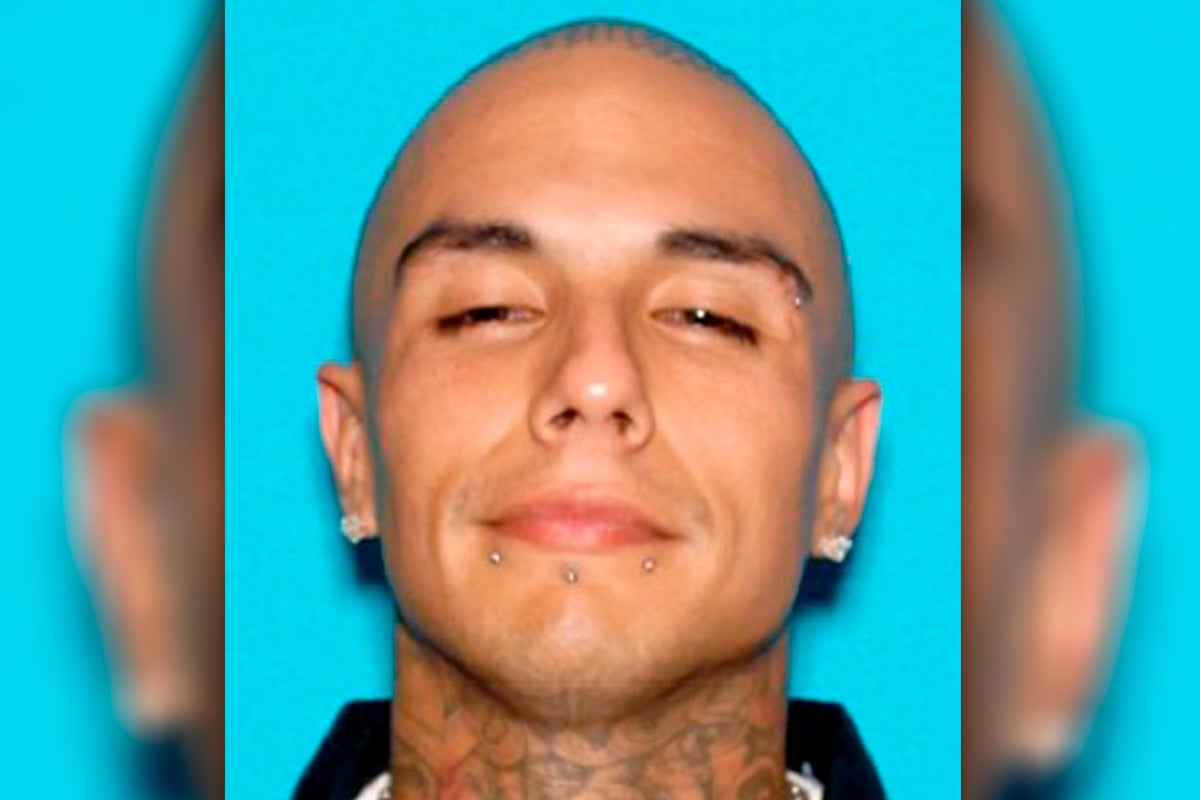

Major Gang Bust 19 Arrested In Plot To Assassinate Famous Rapper

Jun 21, 2025

Major Gang Bust 19 Arrested In Plot To Assassinate Famous Rapper

Jun 21, 2025 -

Todays Market S And P 500 And Nasdaq Fall Amidst Rising Interest Rates And Geopolitical Risks

Jun 21, 2025

Todays Market S And P 500 And Nasdaq Fall Amidst Rising Interest Rates And Geopolitical Risks

Jun 21, 2025