Today's Market: S&P 500 And Nasdaq Fall Amidst Rising Interest Rates And Geopolitical Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Market: S&P 500 and Nasdaq Fall Amidst Rising Interest Rates and Geopolitical Risks

Wall Street experienced a downturn today, with both the S&P 500 and Nasdaq posting significant losses. The decline comes amidst a confluence of factors, primarily the continued rise in interest rates and escalating geopolitical tensions. Investors are grappling with uncertainty, leading to a sell-off in several key sectors.

The S&P 500 closed down [Insert Percentage]% at [Insert Value], while the Nasdaq Composite dropped [Insert Percentage]% to [Insert Value]. This marks a significant reversal from recent gains and highlights the volatility currently characterizing the market.

Rising Interest Rates: A Major Headwind

The Federal Reserve's ongoing efforts to combat inflation through interest rate hikes remain a primary driver of market anxiety. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate profits. This concern is particularly acute for growth stocks, which are often more sensitive to changes in interest rates. The market is keenly anticipating the Fed's next move and any hints regarding the future trajectory of interest rates. [Link to a relevant article about the Fed's interest rate policy]

Geopolitical Uncertainty Adds to the Pressure

Adding to the pressure is the escalating geopolitical landscape. The ongoing conflict in Ukraine, coupled with rising tensions in other regions, is creating uncertainty and prompting investors to seek safer havens. This risk aversion is contributing to the sell-off, as investors shift their portfolios away from riskier assets. The impact of these geopolitical factors on global supply chains and energy markets is also a significant source of concern. [Link to a reputable news source covering geopolitical events]

Which Sectors Were Hit Hardest?

Several sectors experienced steeper declines than others. The technology sector, heavily represented in the Nasdaq, bore the brunt of the sell-off, reflecting its sensitivity to interest rate changes. [Mention specific examples of companies that experienced significant drops and why]. The energy sector also saw declines, likely influenced by concerns about the global economic outlook and potential demand slowdown.

What to Expect Next?

The market's future direction remains uncertain. Analysts are divided on the outlook, with some predicting further declines while others anticipate a rebound. Several factors will play a crucial role in shaping the market's trajectory in the coming weeks and months, including:

- Further interest rate hikes from the Federal Reserve: The Fed's next move will be closely scrutinized by investors.

- Resolution (or escalation) of geopolitical conflicts: Any significant developments in Ukraine or other global hotspots could significantly impact market sentiment.

- Corporate earnings reports: Upcoming earnings announcements from major companies will provide insights into the health of the corporate sector.

- Inflation data: Further signs of cooling inflation could provide some relief to the market.

Investor Sentiment Remains Cautious

Overall, investor sentiment remains cautious amidst the current market volatility. Many investors are adopting a wait-and-see approach, closely monitoring the unfolding economic and geopolitical developments before making significant investment decisions. It's crucial for investors to maintain a long-term perspective and carefully consider their risk tolerance before making any trading decisions. [Link to a resource on responsible investing]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Market: S&P 500 And Nasdaq Fall Amidst Rising Interest Rates And Geopolitical Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

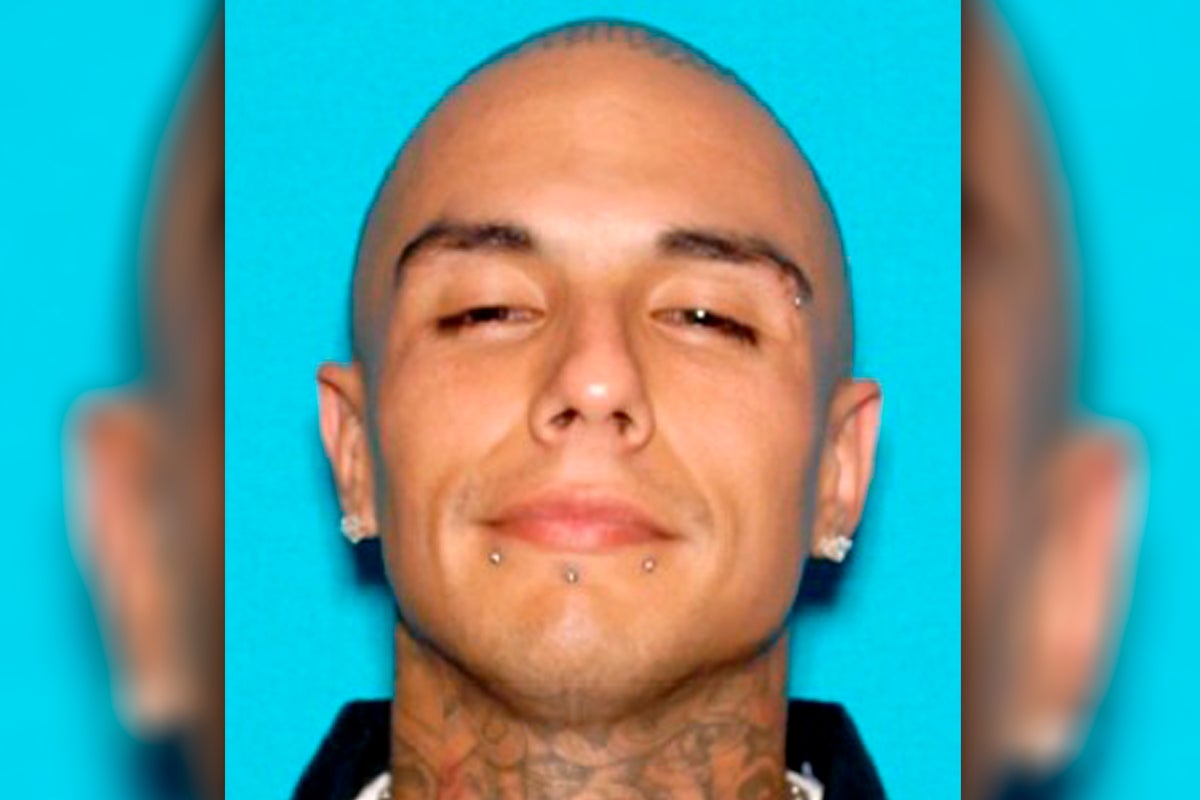

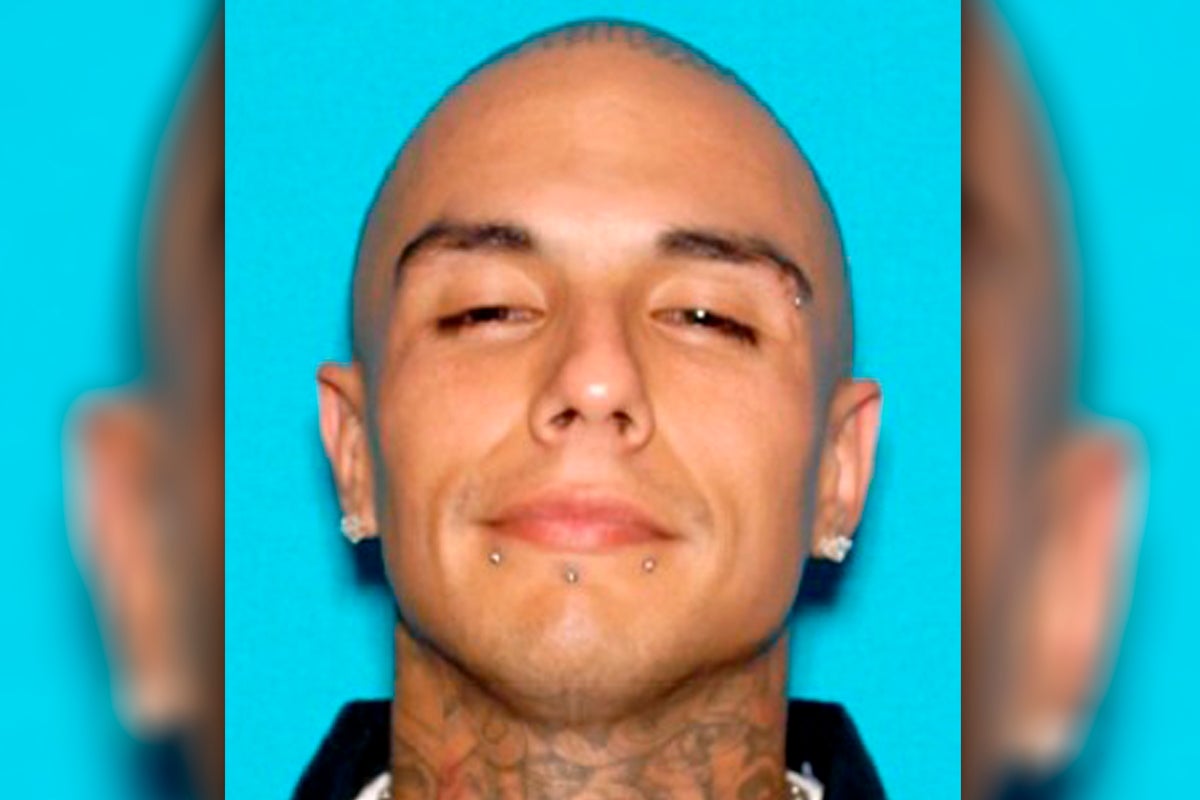

Rapper Targeted 19 Indicted In Mexican Mafia Murder Conspiracy

Jun 21, 2025

Rapper Targeted 19 Indicted In Mexican Mafia Murder Conspiracy

Jun 21, 2025 -

Devers Trades Sudden Timing Leaves Mlb In Disbelief

Jun 21, 2025

Devers Trades Sudden Timing Leaves Mlb In Disbelief

Jun 21, 2025 -

Mexican Mafia Hit Plot 19 Face Charges In Attempted Murder Of La Rapper

Jun 21, 2025

Mexican Mafia Hit Plot 19 Face Charges In Attempted Murder Of La Rapper

Jun 21, 2025 -

Jaws And The Legacy Of Fear Examining The Films Impact On Marine Conservation

Jun 21, 2025

Jaws And The Legacy Of Fear Examining The Films Impact On Marine Conservation

Jun 21, 2025 -

Gang Charges 19 Mexican Mafia Members Accused In Murder Plot Against Rapper

Jun 21, 2025

Gang Charges 19 Mexican Mafia Members Accused In Murder Plot Against Rapper

Jun 21, 2025